Probably Too Soon To Go Long TWTR, But Not To Generate Income Via Stock Options

An opportunity to generate income using options in Twitter (TWTR) shares may be brewing.

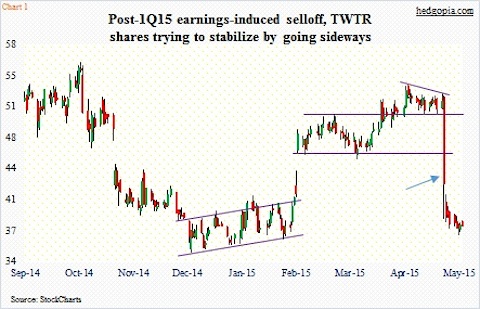

Twitter’s stock price has taken a 27-percent hit post-April 28th 1Q15 earnings, as several earnings metrics disappointed. Numbers were released in error an hour ahead of schedule – enough time for the stock to react negatively into the close. Twitter shares nosedived 18 percent that day.

Revenues were $436 million in the quarter, missing the company’s own guidance of $440 million to $450 million as well as consensus expectations of $456 million. Earnings per share of seven cents were three cents ahead of estimates. Adjusted EBITDA was $104 million, and was ahead of the guided range of $89 million to $94 million.

TWTR ended with 302 million monthly average users (MAUs), up 18 percent year-over-year. However, this was the fifth consecutive quarter of decelerating y/y growth. Advertising revenues were $388 million, up 72 percent y/y. Ad revenue per MAU has now slowed for three straight quarters.

Turns out management had saved more bad news for the conference call. They said they could not forecast MAUs. June quarter guidance was below expectations ($470 million to $485 million). CFO Anthony Noto said MAU trends are facing “headwinds” and “off to a slow start in April.”

The next day (April 29th), the stock dropped another nine percent.

It seems the law of large numbers is kicking in, but isn’t it rather too soon for that? TWTR’s premium valuation ($25 billion in market cap even after the sell-off) has been justified by higher growth.

Now, doubt is seeping in about the company’s ability to attract both new users and advertisers. It seems to be struggling – longs hope temporarily – to deliver enough user views to advertisers. Direct-response ad products are not getting traction.

The sell side reacted to the disappointing quarter by handing out at least five downgrades and at least 15 price target cuts. EPS estimates have gone down from $0.38 a month ago to $0.34 for 2015 and from $0.81 a month ago to $0.67 for 2016 (see the adjacent table for EPS trends).

This also raises the odds that the worst – in terms of potential analyst downgrade and downward EPS revision – has passed until at least the June quarter. And that probably creates an opportunity in the short-term for savvy options traders.

Make no mistake. The stock is not for the faint of heart. It is very possible the problems afflicting the company take several quarters to resolve. Periscope, its live streaming app, has potential, but it is a long-term opportunity. Streaming video on a cell phone will eat away minutes quickly on limited data plans. Comcast (CMCSA) is an investor in Meerkat, its competitor.

With all that said, the June-quarter bar is now lower. Those that wanted to sell on earnings news probably did so already. Combined volume on April 28-29 was nearly 200 million, as opposed to a three-month daily average of 21 million. This gives an opportunity for the stock to stabilize. And it is attempting to do that.

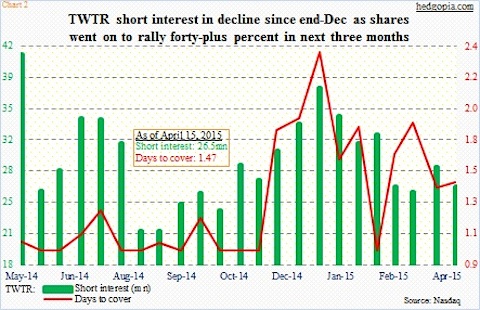

As it stands, TWTR is a broken stock. Just look at that long red candle (see the blue arrow in the first chart above). And there is not much short-interest to fuel a lasting rally either (see the chart directly above). At the end of 2014, short interest was 37.4 million, just before the stock began a three-month rally, squeezing shorts along the way. By mid-April, short interest had dropped to 26.5 million. (End-April numbers will be published later today.)

So if it is too soon to aggressively go long TWTR and at the same time the stock is trying to stabilize, how about generating some income using options?

May 37 puts (options expire this week) are selling for $0.47 (subject to change with Monday’s market). A short put, if assigned, effectively results in going long the stock at $36.53. That was the intra-day low last Wednesday, and likely will not break in the next five sessions.

But, as I mentioned above, Twitter is a broken stock (trading at $37.59 as of Friday’s close).

Follow Paban On Twitter: @Hedgopia

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.