Considering that the Dow Jones Industrial Average has risen 18 times in a row on Tuesdays, investors probably shouldn’t be hitching their wagons to the potential for a “Turnaround Tuesday,” or trend reversal as the saying goes. But then again, maybe they should? 18 times is pretty crazy, and indicative of a run away freight train. So, heed some advice and get out of the way… but also do yourself a disciplined favor and stay alert heading into Turnaround Tuesday this week.

Considering that the Dow Jones Industrial Average has risen 18 times in a row on Tuesdays, investors probably shouldn’t be hitching their wagons to the potential for a “Turnaround Tuesday,” or trend reversal as the saying goes. But then again, maybe they should? 18 times is pretty crazy, and indicative of a run away freight train. So, heed some advice and get out of the way… but also do yourself a disciplined favor and stay alert heading into Turnaround Tuesday this week.

With the market recording sell signals on almost every time frame, a rest could come at any moment. And whether that comes through time and/or price, investors should be on their toes for an uptick in volatility. A couple things to ponder as we near another super Tuesday:

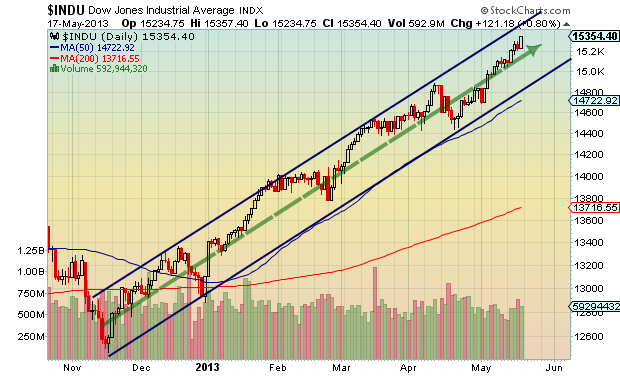

1) The Dow Jones is 12% above its 200 day moving average

2) The Euro has formed an ominous head and shoulders pattern and may be foreshadowing a continuation of the European drama. This could upset the equities apple cart.

3) The US Dollar is close to a price breakout.

4) In Maria Rinehart’s recent piece on time and price, she highlighted the significance of May 20-21 and found general time and price alignment with other market metrics.

The Dow is overbought, vertical, and, well, unstoppable. Or is it?

With Turnaround Tuesday lurking, and “Sell in May” upon us, we’ll soon find out how much more juice this bull has. Good luck in the week ahead.

Twitter: @andrewnyquist and @seeitmarket

No position in any of the mentioned securities at the time of publication.