We’ve been watching the Short Treasury Bonds ETF (NASDAQ: TBT) AND Long Treasury Bonds ETF (NASDAQ: TLT) for some time over here @seeitmarket.

Check out our post highlighting the potential for a longer term top in TLT (bonds).

The inverse of the $TLT is $TBT. So when you are long $TBT, you are betting on higher interest rates.

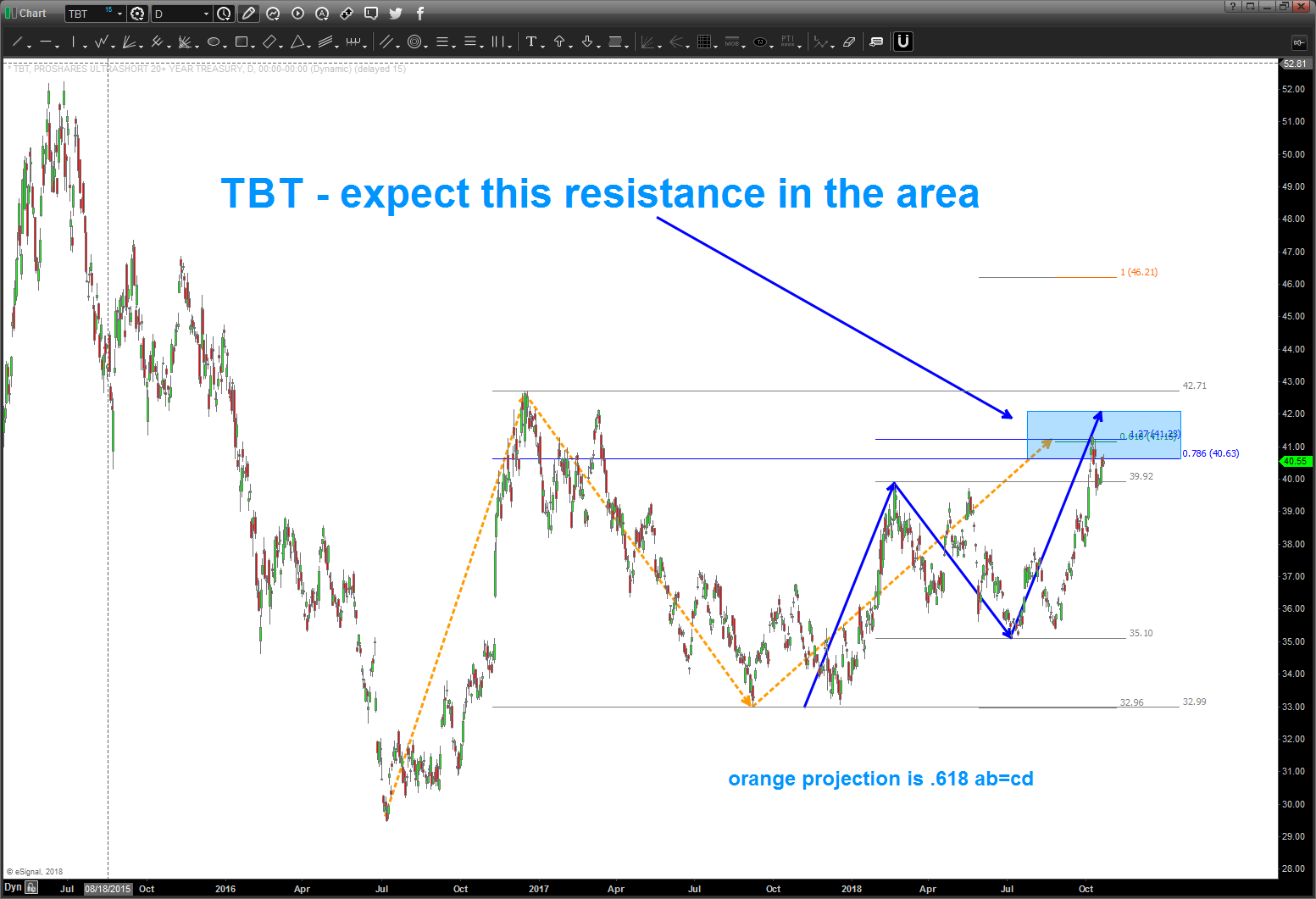

Most recently, $TBT ran into a strong resistance area as shown below. This means we are likely nearing a pullback TBT and interest rates.

$TBT Near-Term Resistance:

If you are bullish $TBT (and a raising interest rates environment) then you should look for a natural opportunity to get Long $TBT on a pullback.

As shown below, I’m looking for the 37’ish area over the coming weeks.

As always, thanks for reading and good luck out there.

Be sure to check out my unique analysis of stocks, commodities, currencies over at Bart’s Charts. Stay tuned and thanks for reading.

Twitter: @BartsCharts

Author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.