I my best to make time to communicate my thoughts on the markets each week. This week, I am going to share an article that I read about several large brokerage firms that are finally telling their clients to get out of stocks and into treasuries (The Telegraph). Hold on as stock market volatility takes off…

Sound familiar?

Well I’ve been advocating for that stance for several months. The major brokerage houses are just beginning to realize what I’ve been aware of (and sharing) for the last several months.

That realization is that the economy is slowing and things will likely get worse before they get better. And this is creating a heavy dose of stock market volatility in early 2016.

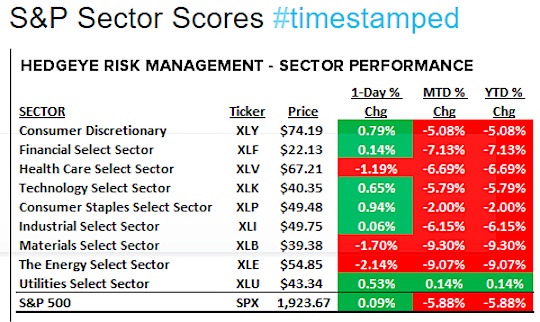

Speaking of the U.S. stock market, it has been the worst start to a year ever… and ever is a long time. Here are the stats as of the end of Monday (source: Hedgeye). All that red is indicative of the stock market volatility we’ve seen in early 2016.

There are a few things to note thus far this year… and these stats are only through Monday (likely much worse by publication!):

- The S&P 500 is down around 6% in just 6 trading days for 2016. And stock market volatility has exploded.

- 8 of 9 S&P sectors are negative for the year

- The Utilities sector (which are more defensive) is the only sector that is positive

- The consumer is supposed to be driving our economy, but Consumer Discretionary stocks are down -5.08% in 6 trading days…that doesn’t sound like a healthy economy to me!

- The financial sector is down -7.13% in 6 trading days!

- Materials and Energy sectors were hammered last year and the continue to be down big….down over 9% in the last 6 trading days.

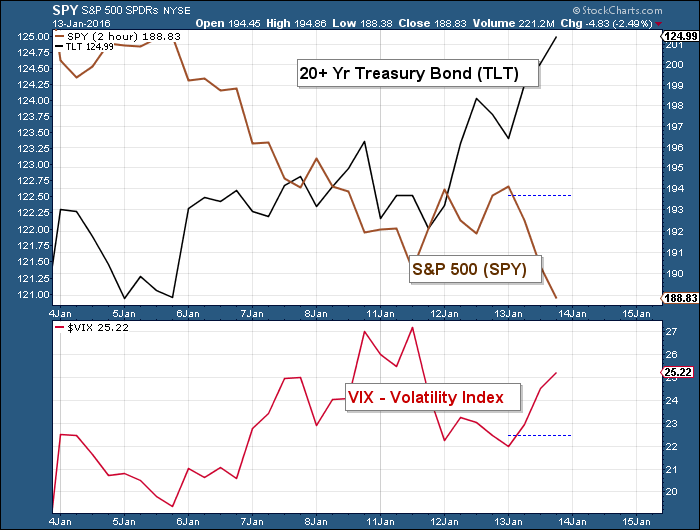

This may be a surprise to some financial pundits, but we have been expecting this. I currently have very little stock market exposure. We are holding US Treasury bonds ETFs across multiple durations. So while the stock market has been declining sharply, my portfolios have remained relatively stable. Check out the chart below of the S&P 500 ETF (SPY) vs 20+ Year Treasury Bond ETF (TLT) and the Volatility Index (VIX).

On most down days—especially when the stock market is down big, the US Treasury bonds positions have been up. They aren’t soaring to new highs, but in an environment of high stock market volatility (i.e. fear), it is considered a ‘win’ if you just stay even.

So I believe that we are positioned well for a slowing economy amidst much higher stock market volatility.

Twitter: @JeffVoudrie

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.