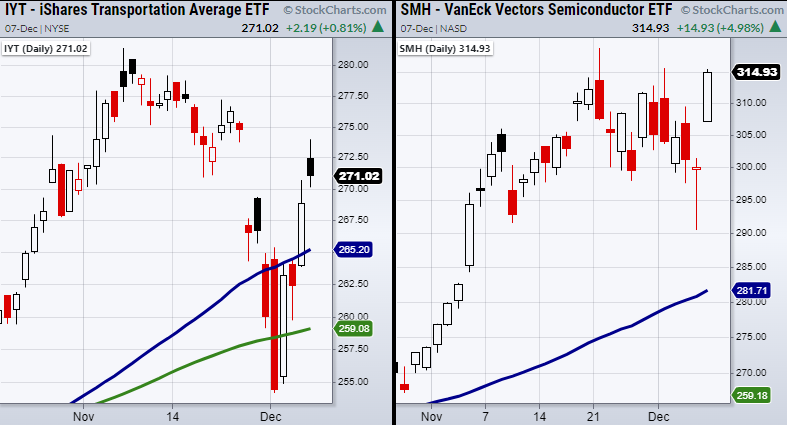

Two sector ETFs within Mish’s Economic Modern Family including Transportation (IYT) and Semiconductors (SMH) have rallied near all-time highs.

Now we should watch for the highs to clear as this could signify the next step for economic improvement (and advancement for the stock market).

Currently, semiconductor suppliers have one of the largest supply chain issues the U.S and world face right now.

Semiconductor shortages have affected prices and the availability of items across the board.

From trains, planes, and automobiles to the even smallest home appliances semiconductors can be found in almost anything these days.

Therefore, if the Semiconductor ETF (SMH) can break out to new highs, this could be showing that chipmakers are one step closer to ramping up supply.

This could also further accelerate economic growth which is why it’s important to pair semis with the transportation sector.

The Transportation Sector ETF (IYT) can show the demand side of the economy through the movement of goods while SMH can show if supply is finally increasing.

With that said, these are the key levels each ETF needs to clear.

SMH has an all-time high at $318.82 to clear while IYT needs to clear over $281.45.

If these price levels cannot clear and hold, we should be cautious of a potential rangebound market.

Watch Mish’s most recent appearance on Fox Business!

Stock Market ETFs Trading Analysis & Summary:

S&P 500 (SPY) 473.54 high to clear.

Russell 2000 (IWM) Could not hold over the 200-DMA at 224.10.

Dow (DIA) 354.02 new support from gap.

Nasdaq (QQQ) 401.19 to clear.

KRE (Regional Banks) Now needs to clear over the 50-DMA at 71.88.

SMH (Semiconductors) 318.82 high to clear.

IYT (Transportation) 281.45 high to clear.

IBB (Biotechnology) Watching to clear the 10-DMA at 151.82.

XRT (Retail) 93.68 watch to hold over.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.