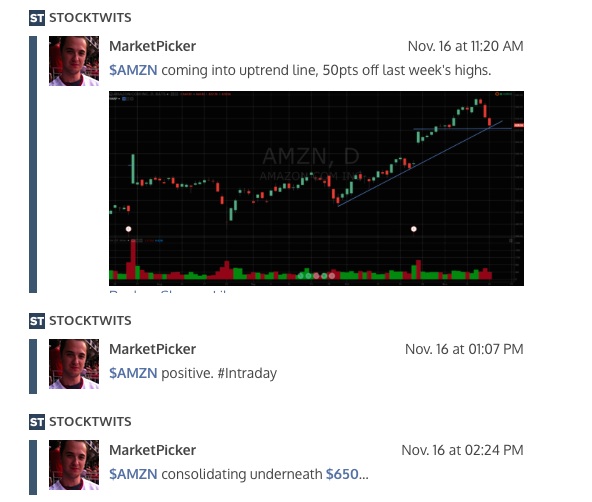

I played this setup on the long side via calls rather than the stock itself (I don’t trade options too much; I just decided to do so in this case primarily because I don’t like trading $AMZN stock due to how whippy and whicky it can be intraday). As you can see below, the stock closed up for the day and closed $25 off today’s lows.

Trade 4: VIX Short Term Futures ETN – $VXX

Similar to the $SPY long idea above, I decided to play $VXX on the short side. As you can see, I initiated my trading short position after the opening drive lower and then added to my position on the break below the opening range (i.e., price confirmation). I covered on the way down and ended up getting flat into the close.

$VXX Chart

$VXX 5 MIN Chart

What I want to emphasize in this trade review is the importance of waiting for price confirmation to add to your trading position. By adding to your position once you have price confirmation, the risk/reward of the trade will become more skewed in your favor, and you will be able to take more out of the market on a consistent basis.

Let me know if you have any questions or comments. Thanks for reading.

Twitter: @MarketPicker

The author has positions in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.