The stock market is off to a brutal start in 2016. The tricky part now for traders is trying to figure out how oversold we get before a legitimate bounce begins.

And much of this comes down to patience and discipline… the mental aspect of trading and finding sound trading ideas.

At this point, we have to be careful not to force trades. But, at the same time, we need to trust our process in finding trading ideas and setups that have good risk/reward… on both the short side and long side.

Below I have put together 4 trading ideas that are on my watch list for the week of January 11. These four stocks have trading setups that look interesting and may bear fruit for disciplined traders.

4 STOCKS TO WATCH

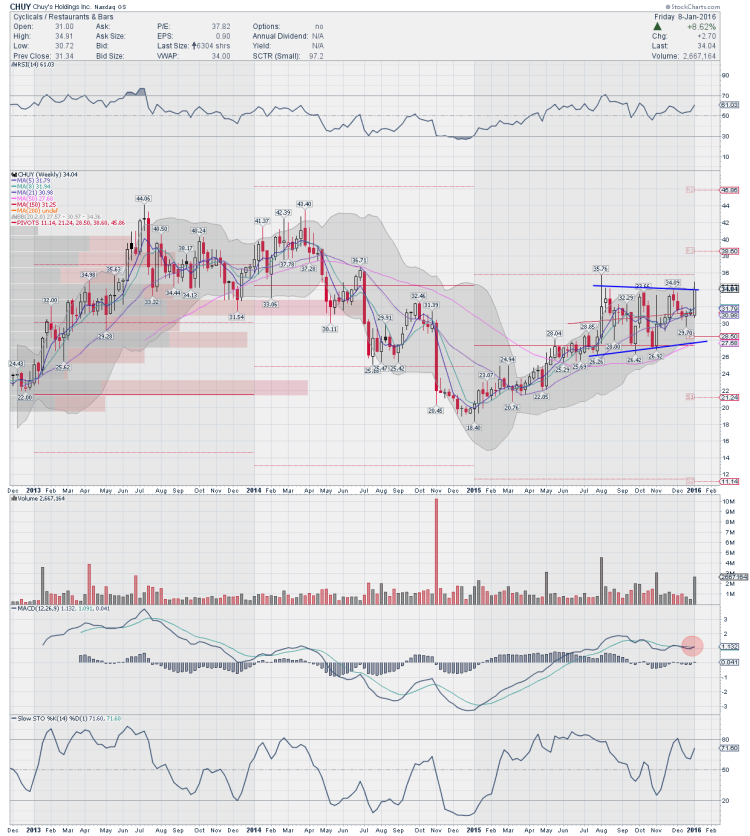

Chuy’s Holdings ($CHUY)

CHUY had formed a rounded bottom after consolidating well and gapped up on heavy volume last week when the entire market was down. Ever since that move, CHUY’s stock price has retested breakout zone and is now getting ready to breakout over 35… ideally with a stop at $33.50 for traders. The Relative Strength Index (RSI) has worked off the overbought conditions, while MACD is rising. CHUY could move much higher but will have to contend with resistance at $36.10, then $38.60 on a weekly basis with a possible move (as per the weekly chart below) towards $45.86 if it all plays out. Also note that the MACD on the weekly is crossing up, which bodes well for higher prices. Chuy Holdings doesn’t report earnings before the 29th of February.

CHUY – Daily Stock Chart

CHUY – Weekly Stock Chart

Garmin Ltd. ($GRMN)

GRMN has been steadily declining since February 2015 and continues to look weak. Garmin’s stock price held well during the August turmoil and bottomed in October. It tried to make a steady rise and break higher over 36.81 but it was in vain. GRMN now looks ready to lose its battle ground near the late October support zone of $33.40-$33.50. I am looking to enter short below $33.50 with a stop above at $35 with a minimum target of October lows to start with or lower. RSI is falling and near oversold zone while MACD crossed lower and falling. There is some more room before GRMN can get oversold and any rally might be shortable. Garmin Ltd. doesn’t report earnings before 17th February.

Rovi Corp ($ROVI)

After selling off in late July, ROVI formed a nice base from then till late December. The consolidation took place in lower volume. Rovi’s stock price broke out of the base in late December and ever since the break higher, it has been consolidating on lower volume. It has formed big bull flag and a move over 17.4 measures out to approximately 22.50-.60. Also seen is a Cup and Handle formation and the measured move for this is approximately 25.40. Rovi Corp reports earnings on February 18 after the market close. Note that ROVI has a high short float of 16.39%. Looking to enter long over 17.4 with a stop at 16.00.

Calpine Corp ($CPN)

CPN steadily declined from March and formed a huge descending channel. It bottomed around the early December timeframe and has now formed a bull flag. Calpine (CPN) should breakout over 14.70 with target of approximately towards R2 if it pans out and continues to show some strength. RSI is in bullish zone and rising while MACD also is rising. Calpine Corp reports earnings on 2/12 before market open. Note that the short float is about 4.89%. Looking to enter long over 14.80 with a stop at 14.25.

Thanks for reading.

Twitter: @sssvenky

The author does not have a position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.