For several days now traders have been expecting an uptick in market volatility. And although we saw a modest tick higher Thursday, the VIX Volatility Index (INDEXCBOE:VIX) closed the week at 11.54.

All things considered, it was a pretty quiet week. The S&P 500 Index (INDEXSP:.INX) ended down 0.2%.

In any event, the markets are due for a bigger move. We have been moving sideways for weeks. There’s no need to anticipate it; simply follow price and let it guide you.

2017 is shaping up to be an interesting year. Better have your game face on!

Enjoy this week’s version of “Top Trading Links” – there’s some great investing research, trading education, and market news.

MARKET & TRADING INSIGHTS

2 Reasons to be bullish on stocks – Ari Wald via Myles Udland

Where are Interest Rates going next? – All Star Charts

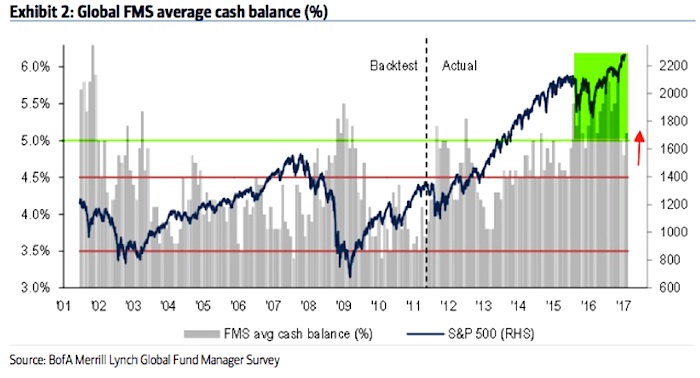

Fund Managers Current Allocation – The Fat Pitch

How to emerge from a trading drawdown – The Trade Risk

Things I believe to be true in options trading – Sean McLaughlin

The humility factor – FMD Capital Management

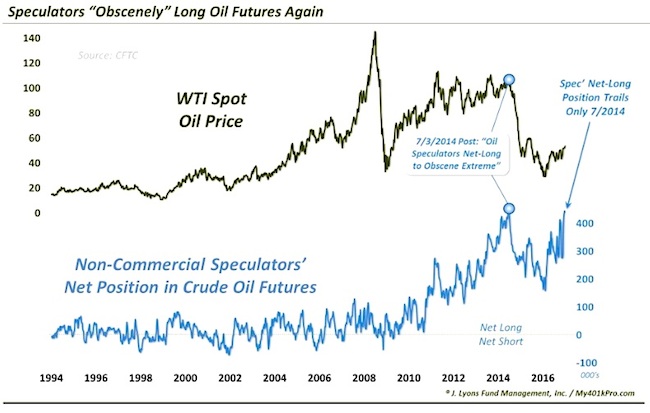

Are oil speculators about to get lit up again? – J. Lyons Fund Management

Guy Spier on how to generate investment ideas

INVESTING NEWS & RESEARCH

HFT is taking over the Bitcoin Market – Bloomberg

The myth and magic of deliberate practice – James Clear

Car dealers are highly uneducated about new features – Wired

Multitasking literally drains your brain – Quartz

How reading awakens us – Brain Pickings

This month’s Put Into Perspective – Skenderbeg

Check back every weekend for more links to some great investing research blogs and trading ideas. Thanks for reading!

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author and do not in any way represent the views or opinions of any other person or entity.