The markets hit the turbo boost button last week. The stock market reversed course Tuesday and didn’t look back, rallying back above 2100 by week’s end. But +/- 2100 also 18 month resistance on the S&P 500 Index (INDEXSP:.INX). As well, futures headed lower over the U.S. Holiday weekend into Tuesday.

So stocks are giving back some of those gains early this week.

But there’s a lot going on intermarket: Gold (NYSEARCA:GLD) has raced above $1370 and treasury bonds are still strong (yields are near lows). It’s definitely an interesting time to be trading in the markets.

Happy belated 4th of July. Enjoy this week’s curation of great market reads in “Top Trading Links”.

MARKET INSIGHTS

Valuation, Timing And A Range Of Outcomes – Charlie Bilello

A key level to watch in the Banking Index BKX – James Bartelloni

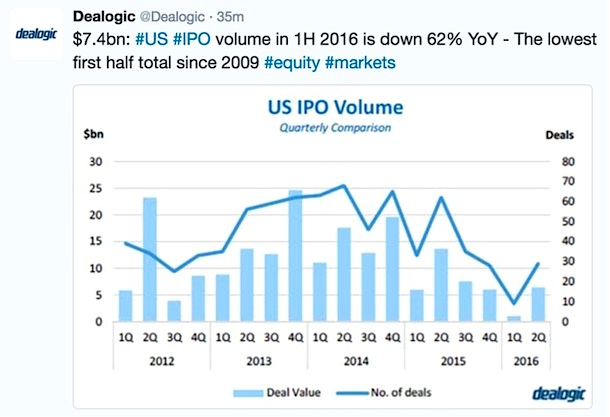

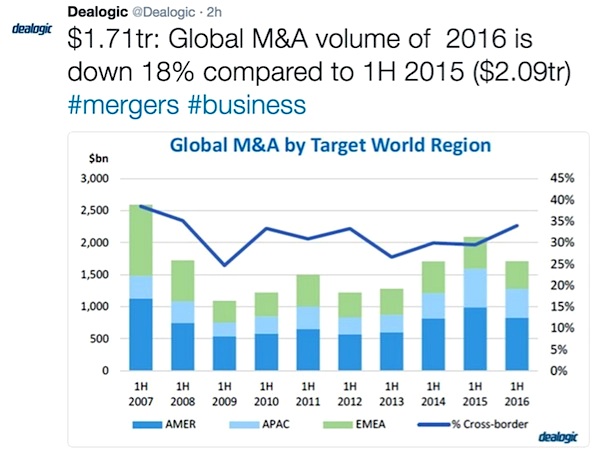

Two 1st half stats via Dealogic:

The IPO market saw the weakest first half since 2009

M&A is down 18% year over year

FitBit is Morgan Stanley’s top Consumer Electronics stock pic – IBD

Is a Black Swan event coming – Ryan Detrick

History suggests Stocks recover quickly from market events – Willie Delwiche

Also from Willie Delwiche – RW Baird’s 2016 mid year market outlook

NEWS & RESEARCH

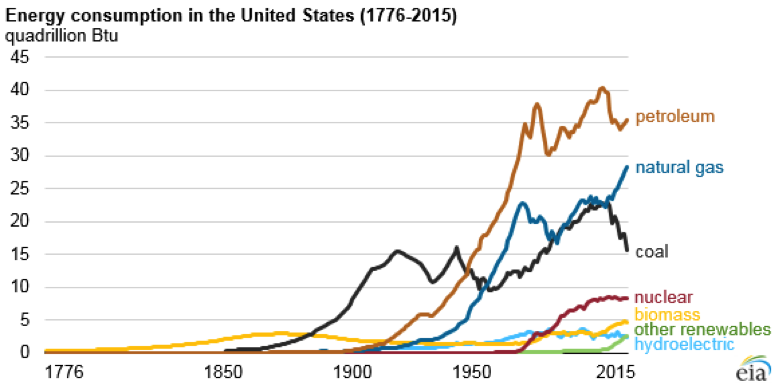

The history of the United States energy consumption – EIA

Microsoft’s plan to build the ultimate gestural UI – Fast Co Design

Video: How computers are learning to be creative – TED

How to read people – Barking Up The Wrong Tree

A new helium deposit has been found in Africa – Scientific American

Tune in this weekend for another edition of “Top Trading Links”. Thanks for reading!

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.