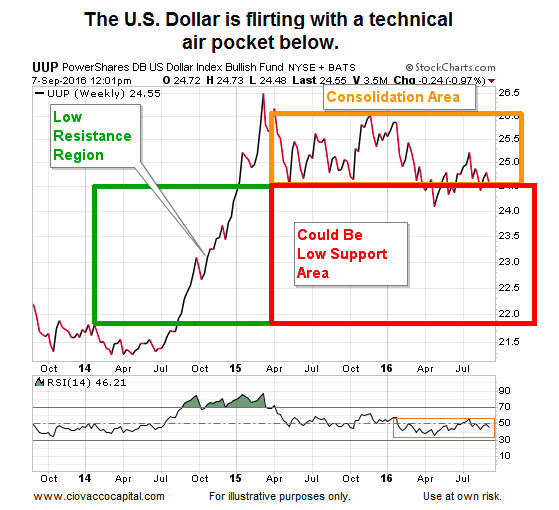

The U.S. Dollar Has A Possible Air Pocket Below Support

The chart below shows the U.S. Dollar ETF (NYSEARCA:UUP) dating back to late 2013. Notice how the dollar shot up like a hot knife through butter inside the green box. It then consolidated inside the orange box for over a year.

Just as the green box was an area of low/weak resistance, if the dollar enters the red box it could fall like a hot knife through butter.

How Could The Dollar Help Fundamentally?

With valuations stretched and economic data stuck in the tepid growth category, what fundamental catalyst could possibly allow stocks to push higher? One possible answer is a weakening U.S. Dollar. From Zacks Investment Research:

If the dollar drops in value, the price of goods denominated in dollars increases. Consequently, stocks in energy companies may rise as the dollar weakens. Imports become more expensive after a dollar devaluation, but foreign companies can acquire American goods at lower prices. This helps to drive up exports. As exports increase, profits rise and stocks in U.S. companies rise in value. Investors attempting to profit from rising stock prices may shift their cash from bonds to stocks. The increased competition for stocks drives prices up even further.

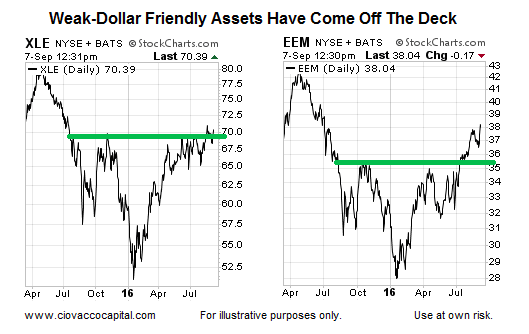

These Moves Align With Weaker U.S. Dollar

This week’s CCM video covers bullish developments in both energy and emerging markets; both moves could be based, in part, on expectations of a weaker U.S. dollar.

Thanks for reading.

Twitter: @CiovaccoCapital

The author or his clients may hold positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.