Note that this article was sent to clients of LaDucTrading on February 16th, an update on a long Dollar recommendation from January 10th.

USD Has Strongest Start in Five Years

The US Dollar is having its fastest start to a new year in half a decade. Here are my Top 5 Reasons why:

- Safe Haven status as COVID-19 spreads both fear and economic slowdown

- Stable U.S. economic data in comparison to China, Germany, Rest of World

- US Bond Yields Remain High relative to rest of world (even as interest rates slid year to date)

- Forward guidance from both ECB and FED keep rates low and higher-yielding USD bid

- Euro has fallen as industrial production in Eurozone shrinks and the German economy flatlines

The bad news, higher USD hurts global growth.

When the Fed shifted gears to easing and cutting rates, all it really did was open the door for everybody else to either cut rates or increase the size of balance sheets, or both. So the interest-rate differential, monetary-policy differential, balance-sheet differential arguments in favor of a weaker dollar haven’t worked either. Strongest Start in Five Years

If this analysis is correct – a stronger dollar causes a bull flattening in the US curve – in which case disinflationary signals will pick up.

Growth Projections and Inflation

Growth projections are being revised downward, for the most part, as a result of ‘pricing in’ the economic contraction from COVID-19 which should support disinflation.

- Goldman: the fallout from the epidemic is set to approximate “the entire US workforce taking an unplanned break for two months”.

- JPM: “we have slashed our global GDP growth projection for the first quarter of 2020 in half. In China, to a 1% annualized rate this quarter from 6.3% pre-outbreak”

- UBS: China’s 1Q GDP growth to fall by 1/100ths of a percentage point…. Full-year down to 5.6% from 6.1%

The interaction between the dollar and the curve slope is now “a result of persistent dollar strength and its dampening effect on inflation expectations”. Heisenberg

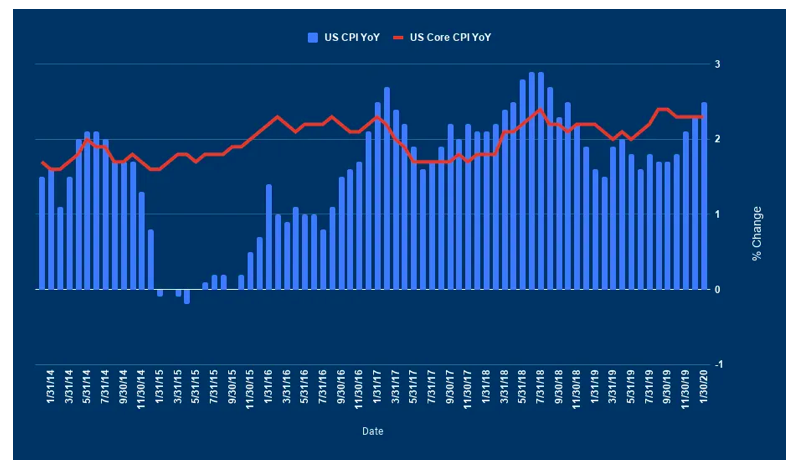

However, Inflation is actually creeping up not declining – most likely as Fiscal policy talks ramp up and tariffs pass through to prices.

Fed is also talking up inflation as part of its forward guidance now. Why?

- A stubbornly strong greenback will in time import the world’s disinflation which works against the Fed’s rate cuts which were/are suppose to kick-start inflation expectations.

- So Fed really needs to pass the baton to Fiscal policy advocates, but Fiscal policies drive debt and deficits which we have already seen trigger Repo madness to finance them and keep money markets working smoothly.

- Fiscal policies may be good for stocks (bad for bonds), but they also drive currencies higher (bad for Gold) and higher USD is defacto tightening (eventually bad for stocks)!

Given this closed loop, it begs the question: If Fiscal policy fails to materialize, THEN I can see the case for a falling USD. But right now if feels the markets are more likely front-running Fiscal effects than they are out-running COVID-19 affects.

I’ll say it again: “the markets are more likely front-running Fiscal effects than they are out-running COVID-19 affects.”

Gold and Yields

A four-month high in the U.S. Dollar Index has pushed commodity prices lower with help from risk-off sentiment from COVID-19 demand destruction in oil, copper and other industrial metals. But precious metals have gained with the dollar. Especially gold.

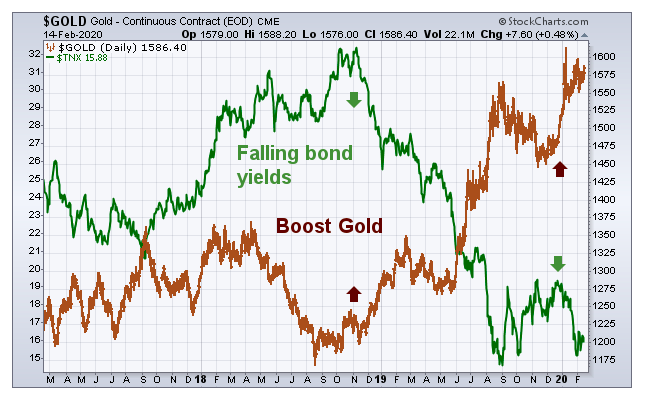

For 10 years, the USD and Gold traded inversely, but then during the second half of 2018, both started rising together. Why?

Falling yields. Gold offers no yield and pays no interest so it rises typically when real bond yields are falling.

So the unusually steep drop in Treasury yields from the second half of 2018 to the present has boosted the price of gold; and helped offset the usual depressing impact of a rising dollar. Chart/Courtesy John Murphy

[Gold] also responds to the trend of stocks. Investors usually buy gold when they’re nervous about stocks, or when stocks are in a serious correction.

Investors have been buying defensive stock market sectors like consumer staples, utilities, and REITs; as well as traditional safe havens like Treasury bonds since the start of the year.

They are buying gold for the same reasons.

So any bet on USD, Stocks, Bonds, and Gold are largely dependent on Yields, and right now, Yields don’t seem to be waiting on the Fed to further ease. They are watching the USD rise, which is defacto tightening, while Fed encourages inflation to run a bit hotter and all eye Global Fiscal Policies to kick in which will affect every other asset class and market on the planet.

Global Money Supply Matters

Curiously, as the USD rises, global money supply falls. And this despite China injecting $380B worth into their economy over the past two weeks to help offset the damaging financial impact of COVID-19.

Important Takeaways:

- The divergence (circled in blue) shows markets have hit fresh records this week despite global liquidity dropping markedly. A market correction could follow.

- Global money supply is reported in dollars even though it’s based on a currency mix. It dropped because the dollar strengthened, so that mix now translates into fewer dollars in the global system, rather than because money supply actually decreased anywhere in local FX terms. THIS IS AN IMPORTANT DISTINCTION.

- My annotated Head & Shoulders pattern (highlighted section) will mean something very shortly. Either, it is ‘A Top’ of some significance OR a Continuation of the trend in the making.

And when it comes to predicting the direction of the stock market: The US Dollar makes the weather and its rate of change determines the severity.

Samantha LaDuc is the Founder of LaDucTrading.com and the CIO at LaDuc Capital LLC.

Start with FreeBait! Then take the next step: Come Fish With Me.

Twitter: @SamanthaLaDuc @LaDucTrading

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.