Yet, looking at a chart like this does cause real emotional pain and regret for ordinary investors not familiar with survivorship bias.

Just this past week I had a real conversation with a client who was pained at having missed this amazing opportunity and we had a long discussion about hindsight in investing, its emotional consequences, and how to deal with it.

What is Wrong With You, Ronald Wayne?

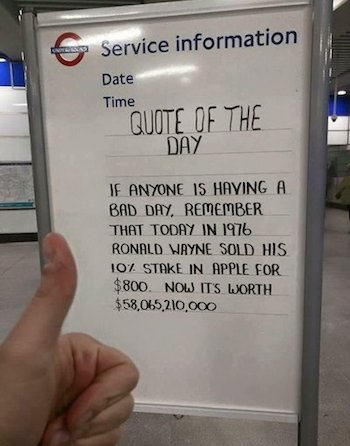

Another example of investing hindsight or survivorship bias making rounds on social media is the one about Ronald Wayne, who for some inexplicable reason sold his 10% stake in Apple (AAPL) in 1976 for a mere $800.

It is a cute factoid and in a perverse way makes us “Average Joes” feel better about ourselves through a mild case of schadenfreude, perfectly exemplified by the “thumbs up” in the below image.

With the benefit of hindsight (again) it seems that poor Ron made a stupendously bad decision forty years ago, and this is putting it mildly when describing someone who supposedly walked away from $58 billion.

Who in their right mind would do this?

Well, if you think about it rationally, you and I would have most likely done the same if we were in Ron’s shoes.

Unlike Starbucks in 1992, Apple wasn’t a publicly traded corporation in 1976 (actually, Apple wasn’t even incorporated until 1977). It was a dime-a-dozen garage start-up making DIY “homebrew” PC kits. Most of these companies never made it past the garage stage.

If you were a nerdy teenager in the 1980s like yours truly, you may remember the names of some of the much more successful companies in this space: Altair, Commodore, Atari, etc.

How many of these are still around today? This is the essence of the survivorship bias concept.

To go back to the Powerball analogy, in 1976 Ron had every reason to conclude that his odds of becoming a billionaire by holding a 10% stake in a garage start-up were no better than “investing” his $800 in lottery tickets.

Surviving the Bias

Beyond the occasional pangs of regret or envy, or fleeting pleasure of chuckling at someone else’s misfortune, investing hindsight is dangerous because it can undermine your investing.

Successful long-term investing entails having a well thought-out plan and process that ensures that your capital is well diversified, risk suitable to your tolerance, and choice of investments carefully selected to match and evolve with your individual needs and goals.

Survivorship bias is an alluring but dangerous siren song that offers the tantalizing possibility of incredible riches if you can just find that elusive one-in-a-hundred-million home run investment.

Motivated by one of the many survivor bias stories, many investors abandon their plans and embark on a quixotic quest to find the next Starbucks or Apple.

In the process they waste precious time and capital jumping from one hot IPO or stock to the next. In the end, the vast majority ends up with little more than what they were trying to avoid in the first place: emotional pain and regret.

The best way to effectively battle survivor bias starts with understanding what it means and being able to put the stories like the two above in their proper context. Doing this will make it easier to ignore the temptation and focus on making sure you have a well-crafted investment plan and you are sticking to it.

Finally, there is nothing wrong looking for the next Apple as long as you understand the odds and difficulties involved. More importantly, doing this should never be your primary long-term investing strategy nor should you devote significant capital to it.

Thanks for reading and have a great week.

Twitter: @NoanetTrader

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.