- With more than half of S&P 500 companies reporting thus far, EPS growth for Q4 2025 currently stands at 13%

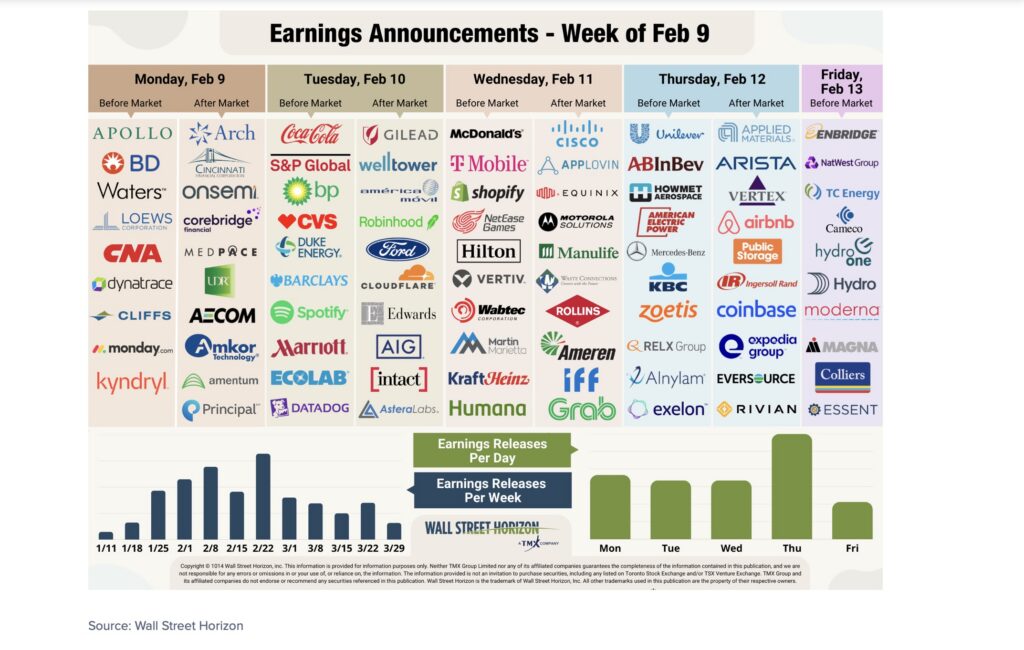

- This week, 1,662 companies are expected to report, including results from McDonald’s, Cisco, CVS, Shopify, and Coca-Cola

- Potential earnings surprises this week: Ford, T-Mobile, Quest Diagnostics, American Electric Power and more

The AI Reckoning: Massive Capex Meets SaaS Disruption

The AI spending scare that rattled investors during Microsoft’s earnings call nearly two weeks ago intensified last week as Alphabet and Amazon followed suit. On Wednesday, Google’s parent company reported record annual revenues exceeding $400 billion and a 48% surge in Google Cloud growth.

Despite the impressive results, Alphabet’s stock softened after management signaled a staggering 2026 capital expenditure forecast of up to $185 billion.1

The very next day, Amazon reported somewhat mixed Q4 results with EPS coming in at $1.95, two cents below what the Street was expecting. On top of this miss, AMZN caught investor’s ire by boosting its 2026 spending forecast to $200 billion.2 The stock settled 7% lower in the following day’s trading. This aggressive spending on data centers and compute capacity has left Wall Street wondering if the hyperscaler arms race is beginning to cannibalize free cash flow faster than it can generate new returns.

Beyond the hardware costs, a new existential dread took hold of the software sector last week, and it was also related to AI. A massive sell-off, led by stalwarts like Salesforce and Adobe, was triggered by fears that AI is no longer just a copilot but a potential replacement. The catalyst? A wave of new AI agents and vertical automation tools, exemplified by Anthropic’s latest legal-tech releases, which sparked concerns that traditional Software-as-a-Service (SaaS) models are being eaten by the very intelligence they helped birth.3

Adding a layer of supply-chain anxiety, Qualcomm issued a cautionary note this week regarding rising memory chip costs.4 Their warning echoed that of Tim Cook’s from last week’s Apple earnings call, where he admitted that while the iPhone maker absorbed rising costs in Q4, the impact would become “a bit more significant” in the coming months.5 With AI infrastructure hoarding the world’s supply of high-end memory, the rest of the hardware world is starting to feel the pinch.

Q4 2025 Scorecard – Beyond the Half-Way Point

We are now over half-way through S&P 500 reports for the Q4 2025 earnings season. With 59% of those constituents having reported as of Friday, profit growth stands at 13% and revenue growth at 8.8%.6

- Positive Surprises: 76% of companies have beaten EPS estimates, below the 5-year average, but in-line with the 10-year average. Meanwhile 73% have beaten on the top line, above both the 5- and 10-year averages.7

- Sector Leaders: Information Technology, Communication Services are leading the charge in top and bottom-line growth.

- The Laggards: Meanwhile, Consumer Discretionary and Health Care are expected to post YoY declines in EPS, while only Energy is estimated to show a YoY revenue decline.

Looking Ahead – Software and Consumer Names in Focus this Week

This week, the market shifts focus from Big Tech’s massive spending to the broader tech ecosystem’s health. Following the capex signals from Microsoft, Alphabet and Amazon, investors will look to Cisco (Feb 11) and Applied Materials (Feb 12) to see if that capital is flowing into hardware orders or if rising memory costs are choking margins. These reports will be the ultimate reality check on whether the AI infrastructure build-out is benefiting the wider semiconductor and networking sectors.

The software replacement panic remains front and center as Shopify (Feb 11) and Cloudflare (Feb 10) step up to the plate. After last week’s sell-off in SaaS giants, traders are searching for proof that AI is a tailwind for growth rather than a threat to traditional subscription models. Any guidance suggesting that customers are pausing software spend to experiment with AI agents could trigger further volatility across the cloud sector.

Finally, consumer giants like McDonald’s and Coca-Cola will provide a pulse check on the health of American shoppers. The consumer names reporting thus far, such as Starbucks and Chipotle, have been giving mixed signals.

Outlier Earnings Dates This Week

Academic research shows that when a company confirms a quarterly earnings date that is later than when they have historically reported, it’s typically a sign that the company will share bad news on their upcoming call, while moving a release date earlier suggests the opposite.8

This week we get results from a number of large companies on major indexes that have pushed their Q4 2025 earnings dates outside of their historical norms. Eight companies within the S&P 500 confirmed outlier earnings dates for this week, five of which are later than usual and therefore have negative DateBreaks Factors*. Those names are: Zimmer Biomet Holdings (ZBH), Xylem (XYL), Quest Diagnostics (DGX), Ford Motor Co (F), and T-Mobile (TMUS). The three companies with positive DateBreaks Factors this week are Public Storage (PSA), Entergy (ETR) and American Electric Power (AEP).

* Wall Street Horizon DateBreaks Factor: statistical measurement of how an earnings date (confirmed or revised) compares to the reporting company’s 5-year trend for the same quarter. Negative means the earnings date is confirmed to be later than historical average while Positive is earlier.

Investors will want to keep a close eye on those Ford results on Tuesday, February 10 to see if the electronic component shortages warned of by Apple and Qualcomm are impacting the automotive supply chain. The automaker will be scrutinized for how those rising costs are impacting its 2026 EV and hybrid margins.

Q4 2025 Earnings Wave

This week marks the third peak week of Q4 earnings season with 1,662 companies expected to release results (out of our universe of 11,000+ global names). Currently, February 26 is predicted to be the most active day with 837 companies anticipated to report. Thus far, 68% of companies have confirmed their earnings date and 26% have reported. The remaining dates are estimated based on historical reporting data.

The Bottom Line

While Big Tech’s capex figures dominated the headlines, the next phase of this earnings cycle will determine the health of the broader ecosystem. With 1,662 companies slated to report this week, we are entering the true reality check for the market’s record-high valuations. Investors are no longer just looking at AI infrastructure, they are looking for evidence of a reflation narrative where growth spreads across sectors. From Ford’s supply chain hurdles to Coca-Cola’s pricing power, the coming days will reveal if the earnings momentum is broad enough to carry the S&P 500 through 2026.

Sources:

1 Alphabet Announces Fourth Quarter and Fiscal Year 2025 Results, February 4, 2026, https://s206.q4cdn.com

2 Amazon.com Announces Fourth Quarter Results, February 5, 2026, https://s2.q4cdn.com

3 “Anthropic AI Tool Sparks Selloff from Software to Broader Market,” Bloomberg, Carmen Reinicke, Joe Easton, Henry Ren, February 3, 2026, https://www.bloomberg.com

4 “Qualcomm stock sinks 8% as company issues dire warning on memory shortage,” CNBC, Samantha Subin, February 5, 2026, https://www.cnbc.com

5 Apple Reports First Quarter Results, January 29, 2026, https://www.apple.com

6 FactSet Earnings Insight, John Butters, February 6, 2026, https://advantage.factset.com

7 FactSet Earnings Insight, John Butters, February 6, 2026, https://advantage.factset.com

8 Time Will Tell: Information in the Timing of Scheduled Earnings News, Journal of Financial and Quantitative Analysis, Eric C. So, Travis L. Johnson, Dec, 2018, https://papers.ssrn.com

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.