On August 15, 2019 the Washington Post led with a story entitled Markets sink on recession signal.

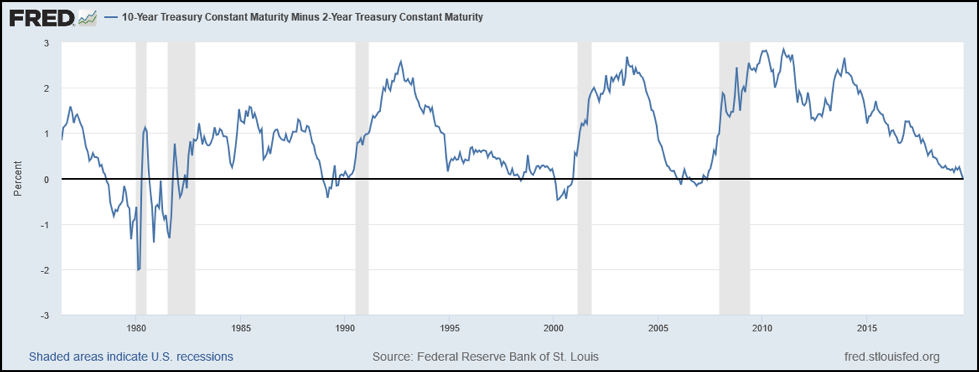

The recession signal the Post refers to is the U.S. Treasury yield curve which had just inverted for the first time in over ten years.

I have been highlighting the flattening yield curve for the past six months.

As I have discussed, every time the ten-year Treasury yield has fallen below the two-year Treasury yield, thus inverting the yield curve, a recession has eventually developed.

Blaming the yield curve for market losses because it inverted by a couple of basis points is a nonsensical narrative for talking heads on business television.

This article is about a different concern, a second-order effect caused by headlines like the one shown below. The story in the Post and similar ones in many major publications have awoken the public to the real possibility that a recession may be coming. It is a dog whistle that may cause the public to alter their behavior, and even slight changes in consumption habits can produce outsized effects on economic activity.

Reality

The 2s/10s yield curve stood at 265 basis points on January 1, 2014, meaning the ten-year yield was 2.65% higher than the two-year yield. From that date forward, as shown below, it has steadily declined. Like the changing of the seasons, as the days passed, that spread steadily fell. Unlike the seasons, investors are somehow now suddenly shocked to learn that economic winter follows fall. Since the beginning of 2019, the curve has been as steep as 25 basis points but has flirted with inversion on numerous occasions.

Given that the shape of the yield curve has been steadily flattening for five years, its current inversion ought not to be news. From an economic perspective, who cares, nothing has changed. The difference in a few basis points on the yield curve is truly meaningless. What has changed is investors’ behavioral instincts.

Explanation Bias

Blaming the yield curve for a market downturn is a narrative designed to fill the public need for an explanation on equity market losses. My firm talked to Peter Atwater, a behavioral specialist and guest on the Lance Roberts Show, to help us understand human behavior.

Per Peter: Confidence requires perceptions of certainty and control. Easily grasped narratives – even when they are woefully incorrect – fulfill both needs. Not sure that there is a formal name to the bias, but I would call it “Explanation Bias” – we need an easy story to fight against the anxiety that would arise from what would otherwise be randomness. And randomness is untenable.

I highly recommend following Peter on Twitter at @peter_atwater

In our need to explain and attempt to understand randomness, the public is now aware of a real and growing threat that was ignored just days prior. The sudden drop in the stock market and a potential catalyst for a much steeper decline is not necessarily about finance and economics; behavioral instincts are now in play.

Over the past several months I have said the window for a potential recession is open. By this, I meant that economic stimulus was waning, global growth was slowing, and the potential for a recession has increased as a result. The hard part of our forecast was to name the catalyst that could tip the economy into recession.

I postulated that it might be the brewing trade war, Iran, slowing global growth, or any number of other topics in the media at the time. The problem, as I pointed out in naming a single catalyst or narrative, was that it really could be something inconsequential or something I have not pondered.

This concept is akin to avalanches. The structure of the hill, weather, and the way the snow is perched determine whether an avalanche will occur. The catalyst, however, is but one snowflake that causes a chain reaction.

It is possible the snowflake in our case is the media and the public’s awareness of the relationship between yield curve inversions and recessions.

If the headlines do spark new concern and even slightly modifies consumption patterns, a recession may come sooner than we think. If you harbor concerns that a recession is coming, aren’t you more likely to eat in or put off buying a new TV? These little and seemingly inconsequential decisions made by a minority of consumers can tip the scale and create negative economic growth.

Here is another way to think about it. Picture your favorite restaurant, one that is always packed and has a waiting list. One day you arrive on a Saturday night expecting to wait an hour for a table, but to your delight, the hostess says you can sit immediately. You look around and the restaurant is crowded, but uncharacteristically there are a few empty tables. Those empty tables, while seemingly insignificant, may mean the restaurant’s sales are down a few percent from the norm.

A few percent may not seem like a big deal, but consider that the average annual recessionary growth low point was only -1.88% for the last five recessions. If economic growth is weak, then small negative changes in output can take an economy from expansion to contraction quicker than if growth rates were stronger. This seems to exemplify the current situation as growth has been fairly tepid post-financial crisis.

Summary

We can follow all the economic data and trends diligently, but consumption accounts for over 70% of U.S. economic growth. Therefore, recessions ultimately tend to be the effect of changes in consumer behavior. If the narrative de jour is enough to trouble even a small percentage of consumers, the likelihood of a recession increases. The evidence of such a change will eventually turn up in sentiment surveys, and when it does, the problem has already taken root. This is not a dire warning of recession but rather offers consideration of a legitimate second-order effect that potentially threatens this record-long economic expansion.

While the media focuses on the inversion narrative, alerting the public to recession warnings and driving consumers to re-think their planned purchases, I care more about when the yield curve will steepen. The steepening curve caused by aggressive Fed action after a curve inversion is the tried and true recession warning. For more, please read Yesterday’s Perfect Recession Warning May Be Failing You.

Twitter: @michaellebowitz

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.