If there is one area to watch should the stock market have another run up, it is the Biotechnology Sector NASDAQ: IBB.

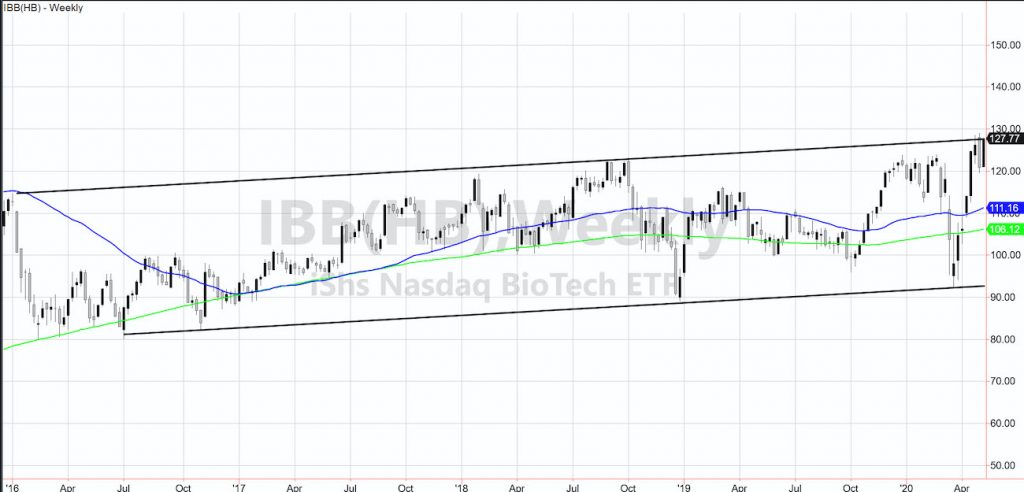

The channel lines that are perfectly parallel, go back to 2015.

Since this is a weekly chart, what matters most is the weekly close.

That means that intraweek, we can consider price movements, but cannot consider a legitimate channel break up or down until the closing price on Friday.

Fundamentally, the Biotechnology Sector (IBB) is strong as a lot of the hope that the economy returns to normal depends on pharma to create a vaccine, and drugs to help with symptoms.

Also interesting is that IBB made its all time highs in 2015 and has not traded up to that price since.

A weekly close over 128 area would be a good reason to believe new highs are imminent.

In the middle of the channel, I would expect a lot of chop.

Note the moving averages at 111.14 and 106.12-good midpoints to remember.

And although far away, a close below 92 would not be good at all!

Please watch Business First Interview May 4th with Angela Miles- 2-minute view https://www.youtube.com/watch?v=Jgzw65o12TA

S&P 500 (SPY) 285 support with 300 big resistance

Russell 2000 (IWM) 126 support to hold and over 130 better

Dow Jones Industrials (DIA) Since could not close over 240 looks vulnerable

Nasdaq (QQQ) Failed at least week’s highs needs to hold around 215

KRE (Regional Banks) 35 must hold or do not think market will hold

SMH (Semiconductors) 128-131.75 range near-term range

IYT (Transportation) 143.64 has to clear. 140 support.

IBB (Biotechnology) 128 has to clear

XRT (Retail) 35.00 support 37.50 resistance

Volatility Index (VXX) 40.00 pivotal

Junk Bonds (JNK) 97.70 resistance 96.25 support

LQD (iShs iBoxx High yield Bonds) 127.20 support

Twitter: @marketminute

The author may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.