Tesla Inc (NASDAQ:TSLA) Inc has been on a historic run of late much to the dismay of the doubters on Wall Street.

And there is an exceptional way to use stock options to profit from the run.

Tesla Inc Stock Options Tendencies

Buying an at-the-money call (also known as a 50 delta call) is a bullish stance on a stock, but the real secret behind successful option strategies is found in the nooks and crannies of the trade. Let’s take a look.

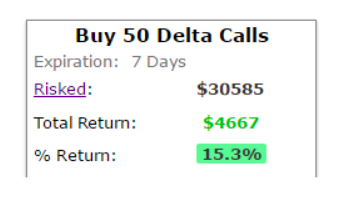

First, here is how buying a 50 delta call every week for the last 6-months has done.

Even though Tesla Inc has seen a historic run, it turns out that blindly buying an at the money call was actually not a very good approach — returning 15.3%. But this is not the end of the analysis – it’s the beginning. The strategy we just looked at must be improved upon, and we start by addressing the risk.

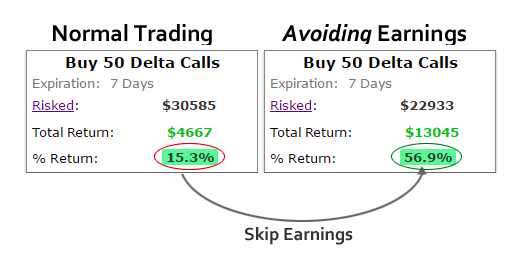

First, we can see what happens if we avoid earnings — that is, while we buy a weekly at the money call every week — when earnings comes around, we simply skip that week. Here are the results.

For ease of analysis we have included the original strategy on the left, and the new approach on the right. By avoiding earnings, we can see nearly a quadrupling of returns while taking less risk.

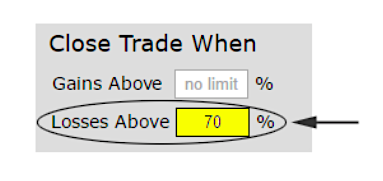

Even still, this is the beginning, not the end of maximizing returns. Another smart approach to optimizing the reality of Tesla Inc’s stock dynamics is to let the winners run, but cut the losing calls off early. We can do this by putting in a stop loss. While a long call can lose 100% of its value, what we can do is put in a rule:

In any week, if the call loses 70% of its value, let’s cut it off, and trade the next week. We are effectively removing fully 30% of the downside risk.

We can do this with the tap of the mouse:

For example, if we bought a $5 call option, if during the week it starts to fade and falls to $1.50 (down 70%), we simply sell it, and don’t wait for it to fade to nothing. We then continue with the same approach the next week.

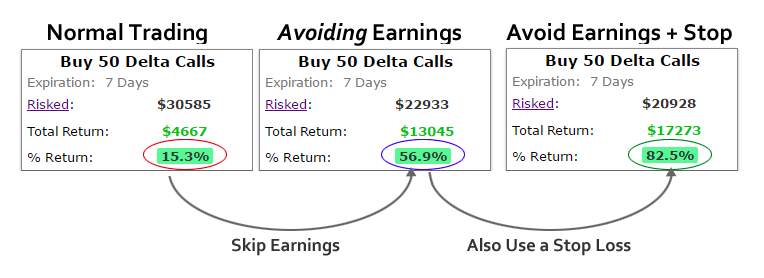

And here are the results using a stop loss and avoiding earnings. Again, we have put the old strategy on the left and the new, risk adjusted strategy, on the right:

We have gone from a 15.3% return by buying weekly calls, then taken less risk by avoiding earnings and returned 56.9%, and further yet, by cutting off 30% of the downside risk again, we now see 82.5% returns.

In short, we see more than a quintupling of returns while taking substantially less risk. There was no magic bullet, but rather a systematic approach based exactly on the dynamics of Tesla Inc’s stock price tendencies.

Is This Really Analysis, or Just Luck?

Skepticism is natural — trading isn’t a game. We can prove to ourselves that this isn’t luck or happen stance. If our trading analysis is correct, avoiding earnings and using a stop loss should have worked better than the normal strategy of just buying and holding for all time periods. That is, 6-months, 1-year and 2-years, across the board.

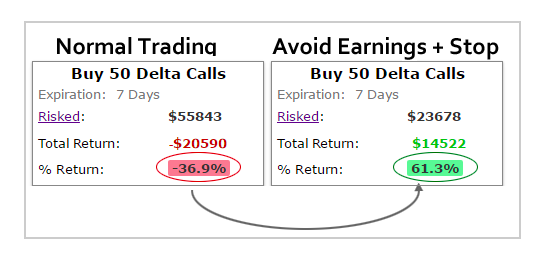

It turns out that this is exactly what we find. Here are the results, side-by-side, for one-year for Tesla Inc (NASDAQ:TSLA):

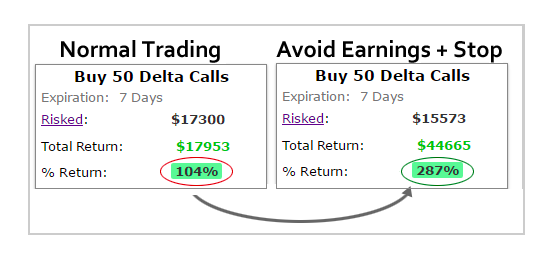

Again, there is no magic bullet here, this is objective data — a 36.9% loser, when shedding a bundle of risk by avoiding earnings and then using a stop loss, has turned into a 61.3% winner. We can even look at how this approach worked over the last two-years for Tesla Inc:

There it is again — taking less risk, knowing when to trade, knowing when not to trade, and knowing when to close the trade, has nearly tripled the results over the last two-years.

This is how people profit from the option market – it’s preparation, not luck. Every stock has its own dynamics, Tesla Inc has its own patterns, we just need to identify them and manage risk around them.

Thanks for reading.

Risk Disclosure from the author:

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment. Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Twitter: @OphirGottlieb

The author does not have a position in TSLA at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.