Innovation and technological advancements are changing the world as we know it. These trends are unlikely to fade anytime soon as the internet of things connects more people and devices across the globe. It is not only a privilege to live in these times but also an epic opportunity for investors to profit alongside revolutionary companies.

This next segment of our Core Income Refresh is focused on the Industrial and Technology sectors.

When designing the Core Income strategy over six years ago, we found it imperative to have the ability to invest south of the border. This has given our investors access to companies that are changing our lives with innovations in technology, industry, health care and to other areas where our great nation lacks in the breadth of investible opportunities.

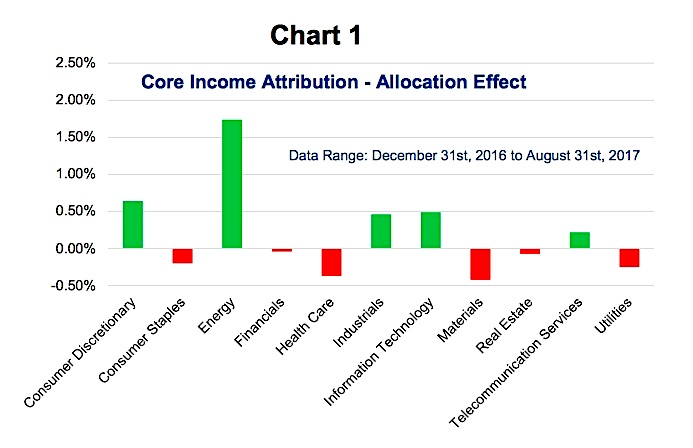

Canada has world-class financial institutions, energy and material companies so we tend to focus our precious U.S. allocation towards other sectors which are under-represented in the great white north.

Note that this post was written with Chris Kerlow.

Industrials

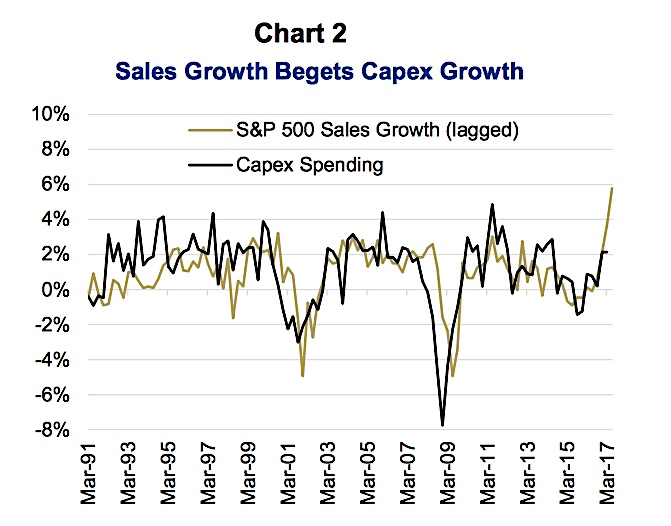

Not only are there long-term secular trends supporting this sector but we have also seen sales growth accelerate in both Canada and the U.S. This bodes well for capital spending, which tends to lag sales (Chart 2 below).

Capex spending, along with increases in public infrastructure spending, are certainly a boon for stocks such as Aecon and WSP. Aecon, which focuses nearly exclusively on Canadian infrastructure development for both the public and private sectors, has been a top performer as of late. Recently, there were rumors that the company had engaged advisors to explore a possible sale. Aecon confirmed the news shortly thereafter, boosting the stock in the process.

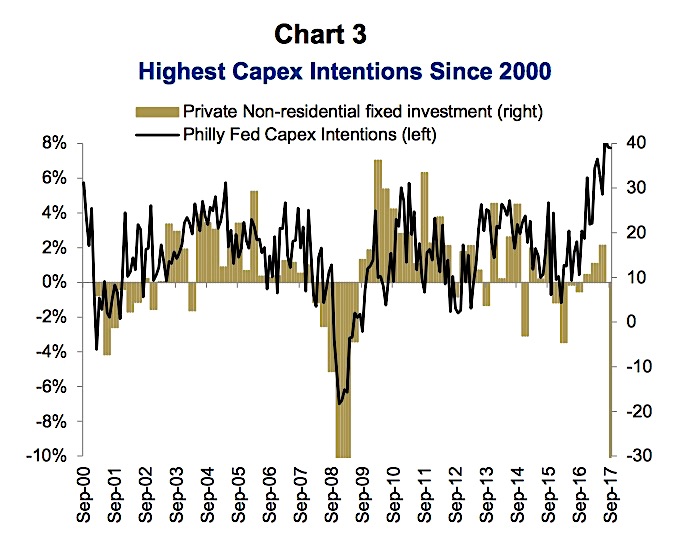

WSP is focused on engineering projects outside of Canada, generating only 18% of revenue domestically in 2016. It’s also a beneficiary of rising capex spending intentions (Chart 3 below). The stock offers a very attractive 2.9% dividend yield, which is supported by strong fundamentals. As a result, it scores very well on our dividend health monitor.

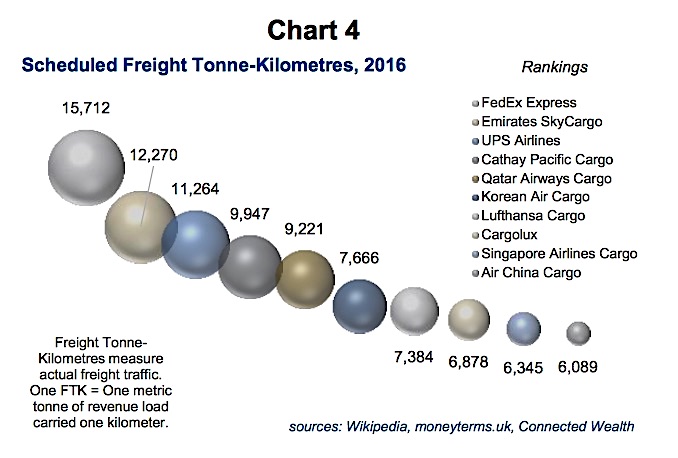

TFI International and UPS specialize in getting tools and supplies to infrastructure developments. That said, there are other reasons why we own these two shipping companies. The driving thematic is simple: e-commerce. The marketplace is becoming global. This has allowed start-ups and small businesses to compete with larger competitors by utilizing the logistics networks of these two companies. TFI focuses exclusively on North America and has a fleet of nearly 12,000 trailers. UPS services consumers all across the U.S. and globally and was ranked 3rd in the world in terms of scheduled freight tonne-kilometers in 2016 (Chart 4 below). Large companies are offering free shipping and returns to consumers in order to maintain market share and to appeal to their growing appetite for online shopping. This competition is likely to provide continued support for these shippers. UPS was unprepared for the volume spikes that took place during the Christmas seasons in years past. Even so, we believe that they should have things figured out this time around.

Making America Great Again (MAGA) starts with protecting the homeland and U.S. allies. One of the companies doing just that is General Dynamics. We bought the stock in the summer leading up to the U.S. presidential election on attractive valuations, a strong order backlog and the outside chance that if Donald Trump was elected then he would prioritize on defense spending.

We chose this stock after recognizing that the U.S. nuclear submarine fleet was nearing the end of its operating life and would need to be replaced. Unlike planes that can be repaired and upgraded, nuclear subs have a finite life since they use uranium as a power source. On Thursday last week, the U.S. Navy awarded GD a $5.1 billion contract to create the Columbia-class submarine. The stock also acts as a hedge, should geopolitical risks drastically rise. We also have a unique opportunity to play this theme with a MacDonald Dettwiler, a company domiciled here in Canada, at least for now. This communications equipment provider currently generates just 30% of sales from its Surveillance and Intelligence segment. Even so, the segment is poised to grow and could offset pressure from its cyclical commercial satellite business. Last week, SSL, a wholly owned subsidiary of MDA’s, won a contract with the U.S. Air Force Space and Missile System Center. This has helped to propel the stock and to remove doubts that it will be able to close a transformative deal with DigitalGlobe. Completion of that deal would allow the company to reclassify itself as a U.S. based corporation and could provide the company with even greater opportunities to compete for lucrative government contracts.

Information Technology

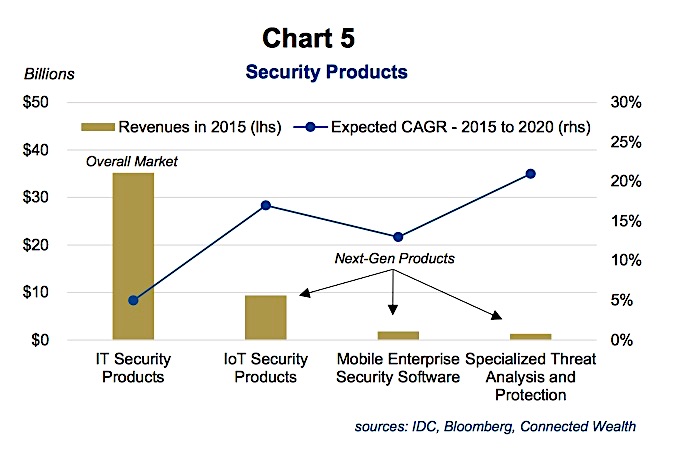

Corporate spending definitely aids industrials; but, in this digital era it might be an even bigger tailwind for technology companies. Enterprises are updating their systems and are spending to protect (Chart 5 below) against malicious electronic attacks, which can ruin a company overnight.

It is a little unfortunate that we run a dividend mandate because the opportunity set of dividend-paying tech companies mainly consists of large legacy players. Opportunities are even more limited here in Canada; however, we did find one gem here: Evertz Technology. This thinly-traded name presents us with a unique opportunity since larger fund competitors often cannot take advantage of small companies such as this one because of liquidly considerations. Evertz is a market leader in entertainment technology solutions, with a niche in 4k and UHD solutions. They recently inked a deal with Cratel, an HD sports provider with a mobile production truck for live sports.

Our other two tech names are names that you are all familiar with: Intel and Microsoft. Intel is trading at its lowest price to earnings level since 2013 and offers us a nearly 3% dividend yield which is supported by cash flows from its market-leading semiconductor chips. The company’s competitive advantage comes from its vertical integration, i.e. owning its manufacturing facilities. This legacy business is being supplemented by growth initiatives in data center and cloud products, as well as in autonomous vehicles, following their acquisition of Mobileye.

Out of all of the stocks we own, Intel has the second highest dividend health score. The only one ranked higher is Microsoft.

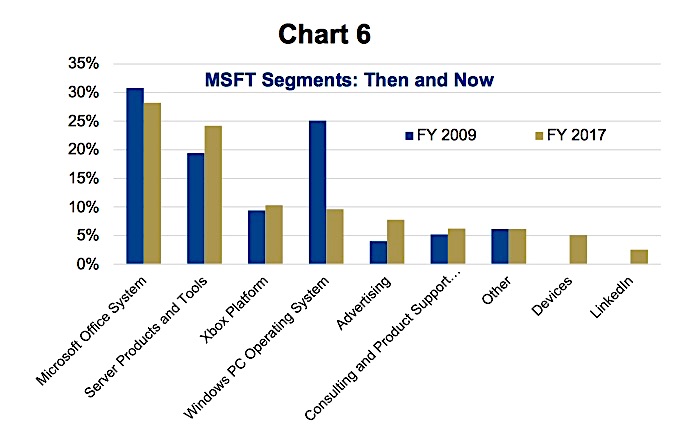

Bill Gates’ garage start-up is now valued at over half a trillion dollars and has diversified away from relying heavily on Windows and Microsoft Office (Chart 6 below). The company is seeing tremendous growth from its server products and tools division with Azure, the hybrid cloud offering, growing 98% in the past year. Valuations have begun to get a little stretched but we continue to hold a modest weight in the name.

Stayed tuned for next week when we wrap up our Core Income Refresh series with a look at both the Consumer Sectors and at Health Care.

Charts are sourced to Bloomberg unless otherwise noted.

Twitter: @sobata416 @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.