Whether you’ve published to it 100,000 times or just recently became acquainted during a 48-hour lurking marathon of accessing instant and vital documentary footage of Justin Bieber deftly evading Miami-Dade police, an event uniting all of us occurs tomorrow: Twitter earnings.

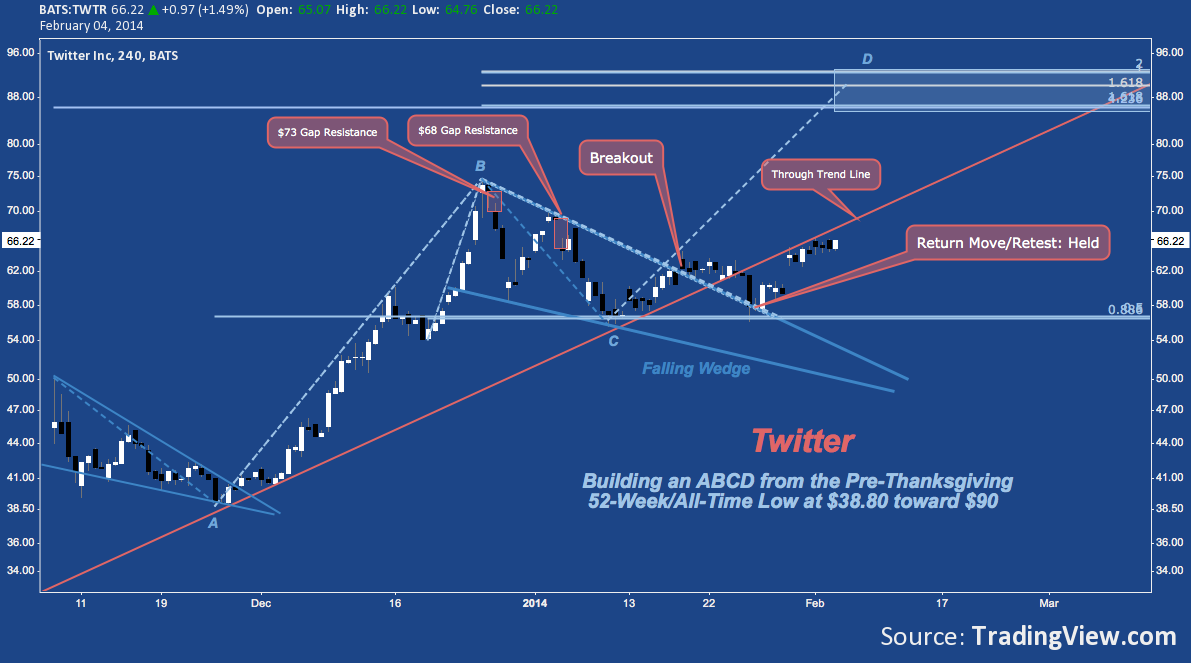

After weathering a concentrated volley of negative analyst activity around the turn of the year, Twitter (TWTR) broke higher from its falling wedge on 01/17/14, only to move sideways and then slip to retest 2014’s YTD low (at C) near $56. In contrast to the congestion installed then, 01/27’s return move was brief. Barely grazing the fibonacci cluster support there, TWTR sprang higher nearly 20% over the next 6 sessions to close out today +1.67% to $66.34.

Twitter’s rally following the wedge revisit is parts halo effect given off by last week’s well-received Facebook earnings, and great anticipation of its first-ever earnings release tomorrow (02/05/14).

Questions concerning the social media giant’s outsized market cap, whispers of Tech Bubble-like irrational exuberance and whether the market will choose to unfavorably discount present deficiencies or favorably price in anticipated growth are everywhere – just as they have been since its November IPO. For what it’s worth, the community at Estimize does a great job generally beating the Street: their consensus here shows in-line $-0.02 EPS but remains more optimistic on revenues, forecasting $215.23MM v. $212.11MM (interested in Estimize? Check out See It Market Contributor Alex Salomon’s interview with CEO Leigh Drogen).

As a technical purist, I’m interested but entirely indifferent to whether, how and which of these questions are answered tomorrow. Every fundamental query, quandary and conundrum has been voiced and entered into the price record, but there’s hardly unanimity about where TWTR will report; and even less about what the report will mean or the net result it will exact from sentiment around the stock. Moreover, as a first post-IPO earnings report, the release is likely to stimulate more questions than it answers. Price recapitulates all of these questions better than any piece of research or curated social media stream and will quickly communicate if the report is seized upon as positive or negative, relegating what makes it so to secondary importance.

With that in mind, here are major nearby technical levels to keep in mind ahead of the Twitter earnings release tomorrow:

- Though it’s a brief one in absolute terms, TWTR has spent most of its post-IPO period in a solid uptrend. The ABCD pattern off its late November low near $39 suggests a continuation toward a general medium-term target of $88-$92. How quickly this may occur is (predictably) a function of a) earnings and b) the eventfulness (or non-eventfulness) of the 02/15/14 lock-up expiration. Until and unless $56 definitively breaks, the path of least resistance lies here.

- Major levels posing resistance:

- 1) the through trend line running from A, currently near $68;

- 2) 01/06’s unfilled gap near $69;

- 3) 12/27/13’s unfilled gap near $73; and

- 4) 12/26/13’s all-time high just above at $74.72.

- Major levels acting as support:

- 1) Horizontal support at $63

- 2) Facebook gap support at $59.50

- 3) Major horizontal support (held on two major tests) at $56-$57

Trade’em Well.

Twitter: @andrewunknown and @seeitmarket

Author holds long exposure to TWTR via common and net long calls. Commentary provided is for educational purposes only and in no way constitutes trading or investment advice.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.