The term “priced in” is a phrase used frequently by Wall Street and the financial media. This expression is used to describe how much the price of stock or a market has accounted for an anticipated event.

For example, consider a pharmaceutical stock that has risen 50% over the last few days on the prospects of getting regulatory approval for a new drug. If the collective “market” deems that the stock should increase a total of 100% if the drug is approved, then we can say the “market” has “priced in” a 50% chance the drug will be approved.

The Spurious Math of a Tax Cut Rally

The term “market”, as used above, is vague. It is meant to represent the consensus view. Importantly to investors, it represents potential opportunity when an investor has a view that differs from the consensus. If you were 100% certain the drug in the prior example would be approved, you could make a 50% gain on the stock if proven correct.

This article is a follow-up to one published November 29, Corporate Tax Cuts – The Seen and the Unseen. In that piece, we provided an analysis of the proposed corporate tax reduction that lies within the pending tax reform bill. We pointed out that, while investors appear focused on the benefits to corporations, they are grossly negligent ignoring the negative economic effects that higher individual taxes will have on consumption (70% of GDP) and the adverse influence of an additional $1.5 trillion deficit.

In this piece, we consider how the consensus is quantifying the positive effect the tax bill should have on stocks. Specifically, we discuss what is “priced in” to the market. This example, unlike that of the drug maker, is not black and white. However, by explaining how market projections are created, we offer guidance on how much the market has priced in for corporate tax cuts. This in turn offers investors a non-market opinion on what the corporate tax cut is worth and a basis to take appropriate actions.

To be clear, our view of the implications of this legislation are likely negative to GDP and therefore corporate earnings. That said, we also want to understand how the consensus views the proposal in order to form an opinion about how the market may trade. In due time the consequences of poorly constructed tax reform will appear but in the meantime, 720Global does not set the market price, the consensus does.

Corporate Tax Cuts

Since at least 1947, historical data has provided sufficient evidence to show that corporate tax reductions, subsidized by federal deficits and individual taxpayers, have resulted in slowing GDP growth. Accordingly, we believe that the current proposal will follow the path of prior tax reductions and result in weaker economic growth and ultimately lower corporate earnings than would have occurred without the legislation.

While our opinion, as stated above and detailed in the previously referenced article, differs widely from the “market”, we thought it might be helpful to provide a framework using the logic of most investors to value the corporate tax reduction. The following paragraph from the article reviews our findings.

Based on this simple analysis thus far, it is easy to understand why equity investors are giddy over a sizeable reduction in the corporate tax rate. If the statutory rate is reduced to 20% as proposed, and the effective rate remains 10% lower, the amount of money corporations pay in taxes will be reduced sharply. Based solely on this assumption, corporate after-tax profits, in year one alone should increase by almost $200 billion, while federal corporate tax receipts will be reduced by the same amount. Such a boost in corporate earnings would increase the forecasted internal rate of return (IRR) on the S&P 500 (INDEXSP:.INX) by approximately .90%. Holding everything else constant, this equates to a price increase of 285 points for the S&P 500 or an 11% gain from today’s level.

We recently read an article in which the Swiss investment firm UBS claims “Stocks could surge 25% if the Republican tax bill passes.” Given the juxtaposition between the paragraph above and the UBS forecast, we wanted to walk you through the math and let you judge for yourself what investors think the tax cut is worth.

Valuation Math

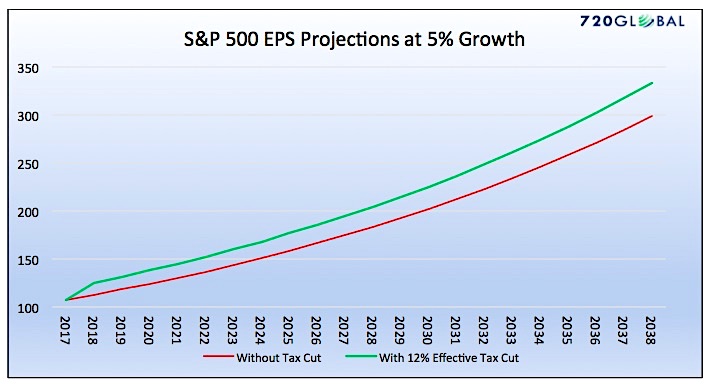

The graph below compares corporate earnings with a tax cut (green line) to one without the cut (red line). As a reminder, corporate earnings will be affected by the changes in the effective tax rate not the statutory rate. As such, we base our analysis on an expected decrease in the effective tax rate from the current level of 22% to 10%. The graph below assumes earnings in both cases grow at 5% a year.

The present value of the difference between the two lines above is the likely approach that most investors are using to price the value added from the tax plan. In turn, the present value figure of that differential yields a dollar premium that can then be added to the current price of the S&P 500 to arrive at an expected price after the tax cut. Based purely on the earnings shown in the graph, an investor looking to receive those cash flows would be indifferent between paying the current price for current earnings and paying the current price plus $285 per share or 2925 for the earnings benefitting from the tax cuts. The current price of the S&P 500 is 2640. Thus, investors that believe the tax cut will reduce the effective tax rate by 12% should expect the S&P 500 to increase by approximately 11%.

In order to validate our findings above, we take a different approach and quantify how the change in earnings would affect the price to earnings ratio (P/E). Currently, the one year trailing earnings for the S&P 500 are $107 per share and the P/E is 24.63. If earnings increased by 12% due to tax cuts, the P/E would decline to 21.99. If the market were to price in the increased earnings under the assumption that valuations are unchanged, the price of the S&P 500 would need to increase 12% to bring P/E back to its current level. This different approach delivers a very similar result.

Starting Line

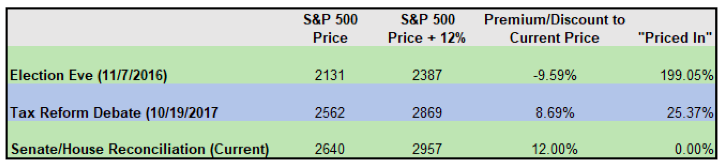

Thus far, the analysis seems relatively straight forward, however there is another major concern when gauging how much of the tax bill is priced in to the market. We need to ask, “When did the market begin to price in the benefits of tax relief for corporations?” Obviously it is impossible to pinpoint a date, but we selected three possibilities to show why this matters. The table below uses the night before the Presidential election, the date Congress began debating tax reform and the current date. The current price of 2640 allows us determine how much the S&P 500 has priced in.

As shown above, those that believe the tax deal has not been priced in and its passage will increase corporate valuations by 12% ought to expect a full adjustment in the price of the index from current levels. On the flip side, those that similarly believe the tax bill will boost valuations but believe this has been known by the market since the day Donald Trump was elected might expect a decline of 9.59%. They would argue the market has priced in a corporate tax reduction and then some. Another option is that in addition to tax cuts, the market is giving some consideration to other Trump policies that may be beneficial to the market such as regulatory reform. Although we try to isolate and quantify the effects of tax cuts, there are clearly many other dynamics in play.

Summary

UBS believes stocks are worth 25% more than current levels if proposed tax cuts become law. While we do not know how they arrived at such a large number, we can use our analysis above to solve for possible answers. Based on the framework of our analysis, it is likely that UBS thinks corporations will reap the entire 12% tax benefit and corporate earnings will grow 1.25% faster due to broad economic benefits stemming from the bill. Their assumption also implies that none of the 25% is priced in. In other words, the true gains due to the tax bill are likely even higher.

UBS clearly presumes the tax cut will benefit the corporate bottom line due to a decreased tax burden and will also spur economic growth. As we discussed in the aforementioned article, there is no precedent for such a claim. History does not support UBS’s case, nor does common sense. We also remind you that UBS makes money selling stocks. Despite spurious math, as a for-profit financial institution, their interests are well-served by pitching the idea of a big post-tax cut rally.

If you believe like we do that the benefits to corporate earnings are being grossly overestimated by the consensus you are at a distinct advantage. This does not mean you must sell all stocks and short the market immediately. It does however require you to proceed with caution, for when reality catches up with the consensus, market valuations could be at risk.

To reiterate a point we made in the prior article: Given the historical evidence regarding the implications of corporate tax cuts, we are left questioning the so-called “Trump bump.” We argue that a market rally based on that premise is incoherent, and the market should be discounting prices and valuations due to the tax cuts not inflating them.

Twitter: @michaellebowitz

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.