The strengthening of the U.S. economy continues to be the principal support for the equity markets.

Although the third quarter produced very strong earnings growth, firm economic numbers and healthy gains for the S&P 500, Dow Jones Industrial Average and NASDAQ, the rally lost steam last week as trade tensions with China continued.

Additionally, the Federal Reserve increased its federal funds rate by 25 basis points. Fed Chair Powell also raised the Fed’s GDP forecast to 3.1% from 2.9% growth in 2019 principally due to the impact of tax reform and soaring consumer confidence.

Powell also suggested the unemployment rate would be in the vicinity of 3.5% to 3.7% for several more years with inflation remaining at the 2.0% level. The Fed Chief’s remarks suggested that while the recovery is long by historical standards, economic growth can continue for several more years without disruption. Powell also raised the prospects for a ninth rate hike in December. As a result, the fed futures market has now priced in a 70% probability the Fed will move again later in the year.

The focus of attention this week will be on the September Employment Report due Friday and the ongoing trade discussions. Despite distortions created by hurricane Florence, consensus estimates are the economy created 175,000 new jobs with the unemployment rate declining to 3.8% from 3.9%.

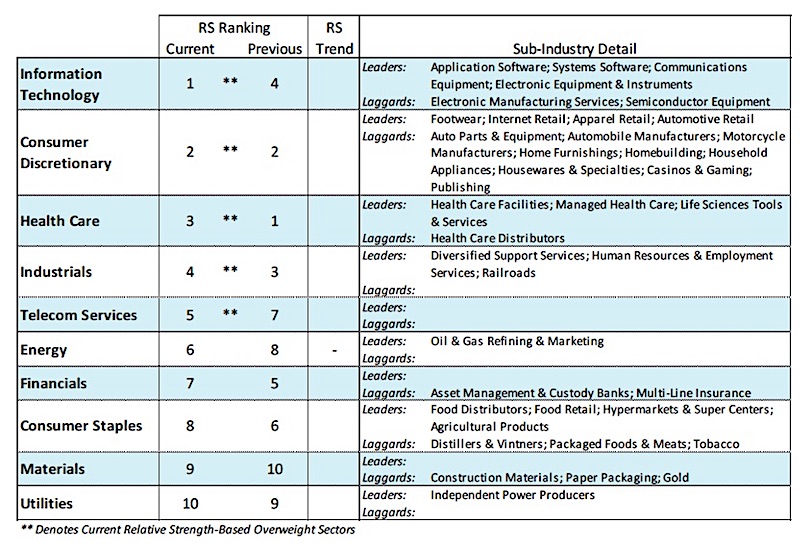

From here investors should assume a cautious approach concentrating on the strongest areas of the market which include health care, consumer discretionary and industrials.

While the strength in the U.S. economy continues to offer long-term support to the equity markets, the technical backdrop is less compelling. The healthiest markets occur when the uptrend is broad based, which is not the situation in the present example. Over the past several weeks, as the averages have moved higher there have been as many issues on the NYSE hitting new 52-week lows as new 52-week highs.

Moreover, 40% of S&P 500 stocks are down for the year with a declining number of issues responsible for most of the gains this year. Virtually all the gains for the year have been concentrated in just three sectors: technology, health care and consumer discretionary.

Additionally, while the NASDAQ is close to a record high, only 49% of NASDAQ issues are trading above their 200-day moving averages. The diverging trends also extend to small-cap averages and overseas markets. The Russell 2000 Index lost ground in the third quarter and the U.S. is the only important global equity market that is sitting on new highs.

Historically, bull markets are global in scope with major moves enjoyed by the vast majority of worldwide indices. Although the U.S. can continue to go it alone, the most powerful rallies historically have occurred when the move is global in nature. We continue to anticipate a year-end rally developing after the November elections. A recovery in world stock markets beginning in the fourth quarter would strengthen the argument that stocks are poised for a significant move higher carrying well into 2019.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.