Investing Research Update (May 3) – Key Takeaways:

The equal-weight index is slipping versus the S&P 500 as rally participation concerns persist.

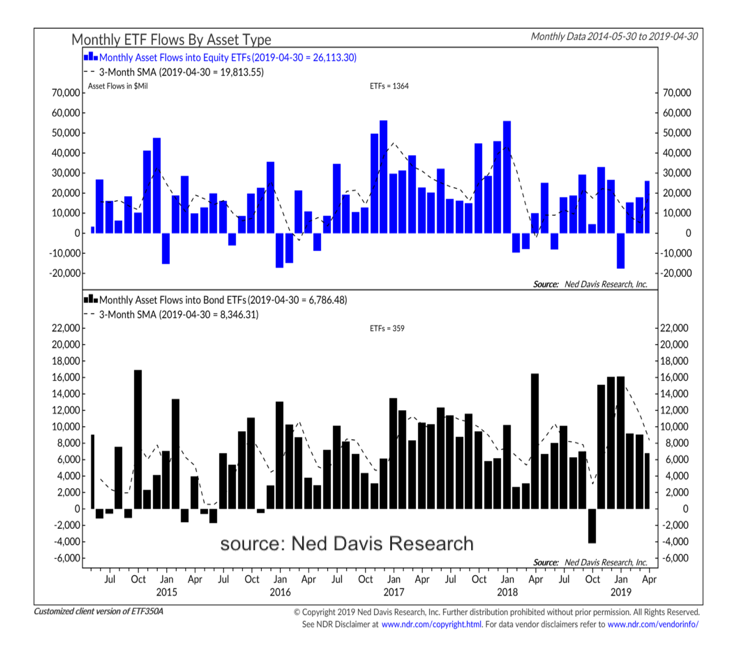

Amid other evidence of increasing investor optimism, fund flow data have reflected more caution. Equity ETF inflows, however, now accelerating. Bond market sentiment suggests too many have been looking for lower rates.

The evidence of broad market deterioration highlighted in last week’s Market Commentary (Rally Participation Narrows as Indexes Move to Record Highs) remains intact.

The percentage of NASDAQ stocks trading above their 50-day averages continues to slip (now just over 50%) and the new high list for the S&P 500 is not meaningfully expanding. Breadth deterioration can also be seen when looking at the S&P 500 on an equal-weight basis. This index has failed to convincingly clear the highs reached in January and September of 2018 as momentum has faded in recent months.

Perhaps more important is the deterioration in the ratio between the equal-weight index and the cap-weight index. This ratio led the rally in both indexes coming out of 2018, but peaked in February. After making a lower high in April, it is now making a lower low. If the rally over the first four months of 2019 was more than just a reaction to Q4 2018 weakness, we might expect the average stock in the S&P 500 to start to show more strength.

While stocks have moved to new highs, there is some evidence that investors have been slow to gain confidence in the rally. Equity fund outflows surged in late 2018 (nearly $100 billion over four weeks). While the pace has slowed in 2019, outflows have persisted. Over the past five years, all of the net gains for the S&P 500 have come when equity funds have seen outflows on a four-week total basis.

One caveat worth mentioning is that there was not a spike in inflows prior to the Q4 stock market weakness. In fact, the trend in fund flows then was similar to what we are seeing now (roughly flat over a four-week basis). Evidence of widespread inflows to equity funds would suggest near-term downside risks had risen.

ETF-only flow data suggest that may be happening already. Equity ETF inflows increased in each of the last two months. Even with the increase, April inflows were shy of the monthly peaks seen in 2018. Inflows to bond ETFs continue to slow.

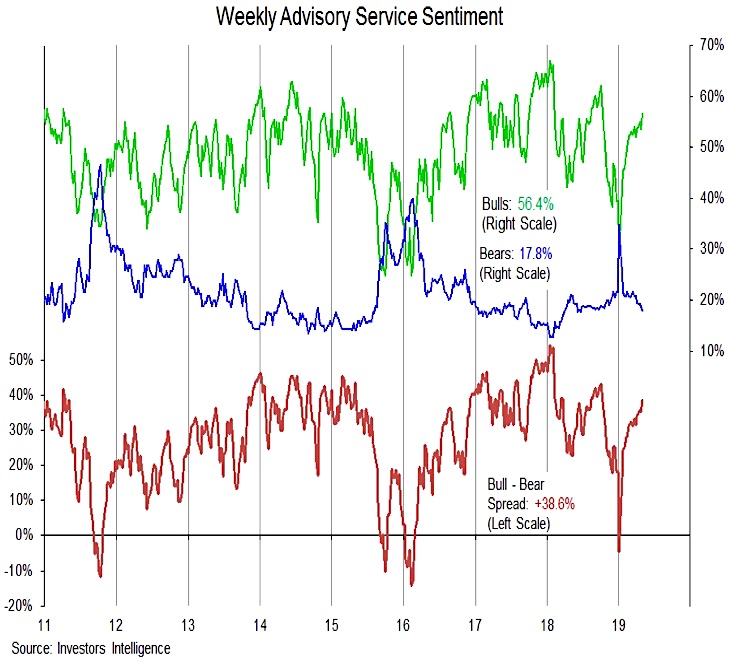

Outside of the fund flow data, sentiment data is showing a more conspicuous return of investor optimism. The NAAIM index ticked lower this week but remains at a level consistent with excessive otpimism. Investors Intelligence shows bulls and the bull-bear spread at their highest level since September, while bears have dropped to their lowest since June.

The NDR Trading Sentiment Composite also spiked this week, moving further in to the excessive optimism zone. One sentiment outlier has been the AAII survey, which shows only 39% bulls and 21% bears. The monthly asset allocation survey done by the same organziation, however, showed a sharp uptick in the ratio between equity and cash exposure in April, suggesting individual investors may not be as concerned as the weekly survey suggests.

In the wake of this week’s FOMC meeting (and Chair Powell’s post-meeting press conference) it is interesting to look at bond market sentiment. In this week’s Macro Update we discussed how fed funds futures were positioned in terms of looking for rate cuts later this year.

Bond market sentiment seems to show similar optimism. While shy of historically excessive optimism, senitment in bonds is similar to the level seen prior to the turn higher in yields in 2017 and the excessive pessimism that was present in late 2018 has been relieved. While too many may have been looking for higher yields coming into 2019, it now appears that too many may be looking for yields to continue to fall.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.