The Markets

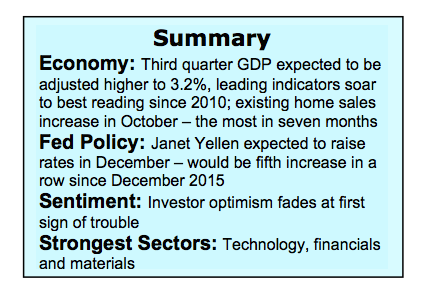

The equity markets ended the shortened holiday week at new record highs. The S&P 500 Index (INDEXSP:.INX) is up more than 23% since the first week of November 2016.

Additionally, this is the longest running winning streak in history absent of a 3.00% stock market correction. This is remarkable given that for nearly 100 years, the S&P 500 has had a 3.00% correction or greater every 22 days according to Ned Davis Research.

Stocks are now poised to enter the most bullish period of the year. December and January are the two strongest months of the year historically. This is particularly true for small-cap issues that are expected to benefit the most if tax reform legislation is passed in December.

Looking further out, the equity markets are anticipated to continue to benefit from improving economic conditions. The Conference Board’s Leading Economic Index (LEI) jumped 1.2% in October, the most in seven years. This argues that the odds of recession are very low and that the economic fundamentals going forward in 2018 are favorable for stocks.

Interest Rates and Inflation

The largest threat to the equity markets in 2018 is that inflation pressures will cause the Federal Reserve to adopt a more aggressive posture in terms of monetary policy. Benign inflation readings have given central banks cover to reduce policy accommodation at a gradual pace despite the fact that the growth rate of world economies is rising.

The Fed’s favorite measure of inflation is the Personal Consumption Expenditures Price Index (PCE). The PCE has been below the Fed’s target of 2.00% inflation for more than five years and has fallen this year to just 1.3%. Although the Fed is widely anticipated to raise interest rates in December, the potential for more aggressive action next year could be stalled by the fact that inflation remains stubbornly low. This is reflected by the fact that the yield on the benchmark 10-year Treasury note is virtually unchanged (2.38%) from January levels. Bonds are not expected to be formidable competition for stocks until such time that the 10-year T-note yield rises above 2.65%.

Stock Market Technicals

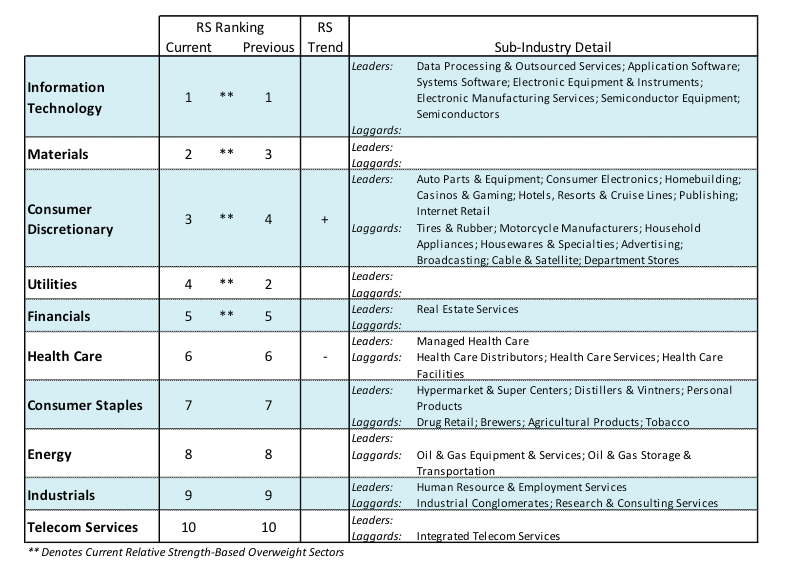

The short-term technicals for the equity markets continued to improve last week. Concern over the performance of the broad market and growing investor optimism in October and early November have for the most part been relieved in recent weeks.

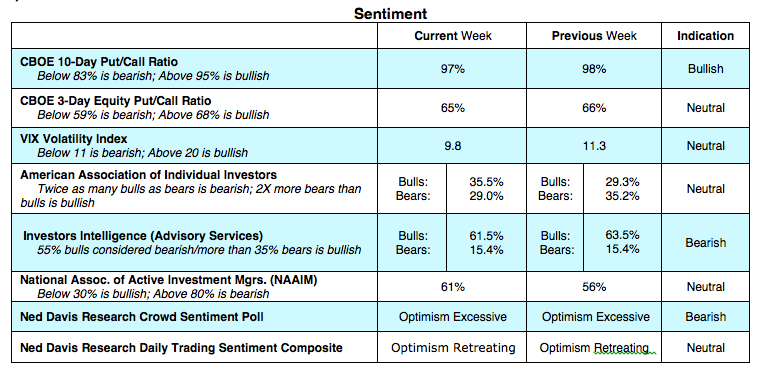

Historically, the broad market leads the averages by four months or more. The fact that the NYSE Advance/Decline line hit a new high last week is an indication that the popular averages have more room on the upside. Further evidence of breadth improving is found in the fact that last week witnessed an increase in issues hitting new highs and a reduction in the number of stocks hitting new lows. Indicators of investor psychology were unchanged last week. Historically, the top of the market is the point of maximum optimism. Although some sentiment indicators show optimism bordering on levels considered excessive, the euphoria found at important peaks in the market remains elusive.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.