Last Friday, I covered the poor jobs report highlighting why it may be just what the market ordered. That may have been a bit of an overstatement, but perhaps the market took it literally. S&P 500 futures were down over twenty points on Friday as many speculated about a big Monday selloff.

Meanwhile I tweeted about how holidays and weekends love to bury bad news, and wrote a post about the jobs report highlighting how “bad news deserves a tombstone at the cemetery.” At the time, I wasn’t necessarily implying that the market would rally on Monday… rather I was highlighting that companies and proverbial “bad news” releases love to come out when few are watching, or when there is time to take the sting out of it.

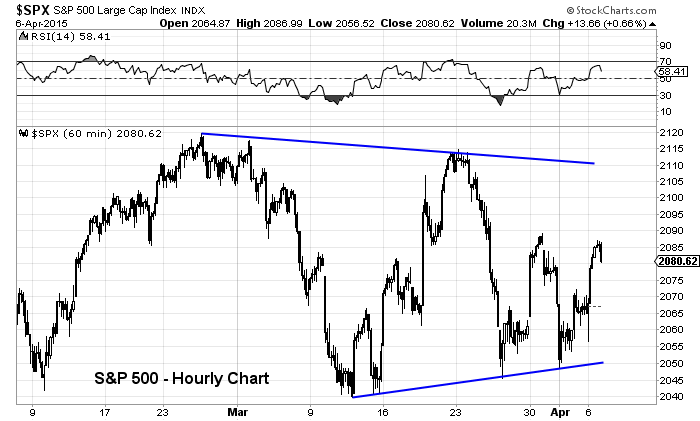

Sure enough, the S&P 500 turned its lower opening prices around and continued higher for much of Monday, closing up 13.66 points at 2080.62, or 0.66 percent.

The Dollar was lower, propelling commodities and equities higher, and bonds lower. As well, large caps (S&P 500) were favored over small caps (Russell 2000). Note Sal Cilella’s post about large caps outperformance in April.

Financial Markets Performance Chart – April 6 2015

The S&P 500 high of the day was just two points off of key resistance (last Monday’s highs). A break above 2089 should setup the index for a move higher and retest of 2105-2110. As well, commodities will look to see if they can see take advantage of a weaker US Dollar and follow through higher.

S&P 500 60min Chart

Good luck and stay disciplined.

Follow Andy on Twitter: @andrewnyquist

No position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.