U.S. stock market indices gained nearly 2.0% last week supported by friendly comments from Fed Chief Janet Yellen and the release of better-than-expected economic data.

Continued gains in the labor markets, a rebound in manufacturing and the apparent disconnect from oil prices, which fell 7.0% last week, suggests the support for improved performance by the stock market will now be shared by improving economic fundamentals with a friendly monetary environment.

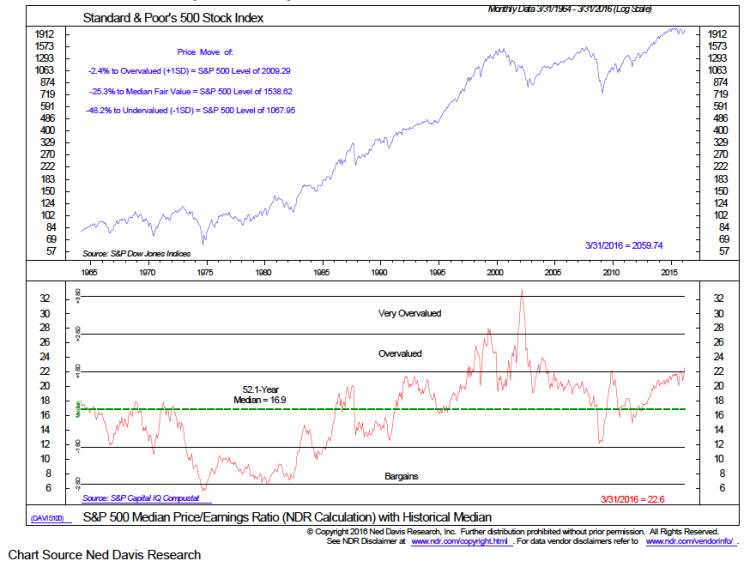

The largest obstacle for stocks in 2015 and 2016 has been excessive valuations. This hurdle can be overcome should the economy gather sufficient momentum in the second half of the year to support stronger profit growth. The Commerce Department recently reported that corporate profits likely fell 8.0% in the first quarter. We anticipate, however, that first-quarter results could mark a trough in profits given the upward trend in the dollar has been broken and earnings comparisons should improve significantly in the second half of the year.

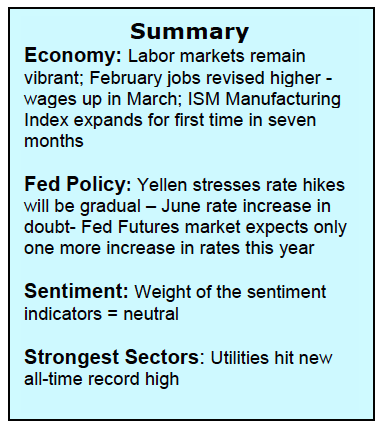

Entering the new week, stocks are trading near the top end of the trading range which is considered to be 2075 using the S&P 500. A large number of S&P 500 companies have warned of an earnings shortfall which could cause the current rally to stall. Despite the strong recovery in the stock market, many of the indicators of investor sentiment continue to show a large measure of skepticism. The latest data from the American Association of Individual Investors shows the fewest number of bulls since February. Investment pros also have a cautious sentiment bent. The latest report from the National Association of Active Investment Managers (NAAIM) shows that on balance they have only a 68% allocation to stocks. At previous market tops, the NAAIM numbers climbed to a 90% or greater exposure to equities. Peaks in the market are nearly always accompanied by broad based excessive optimism. The fact that skepticism and caution are widespread and deeply seated suggests that any weakness that does develop will be limited in both time and price.

Longer term, we continue to be impressed by the fact that the recovery has been very broad based. The percentage of NYSE issues trading above their 50-day moving averages expanded to 82% last week. In addition, more than 90% of foreign markets are trading above their 50-day moving averages. In a healthy market, the majority of groups and sectors including overseas markets are in uptrends. The performance by the broad stock market combined with a skeptical investment crowd argues that stocks could soon attack the 2015 highs for the Dow Industrials and S&P 500. The largest risk to this outlook is that the improved earnings picture for 2016 fails to develop which would leave stocks vulnerable to a correction.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.