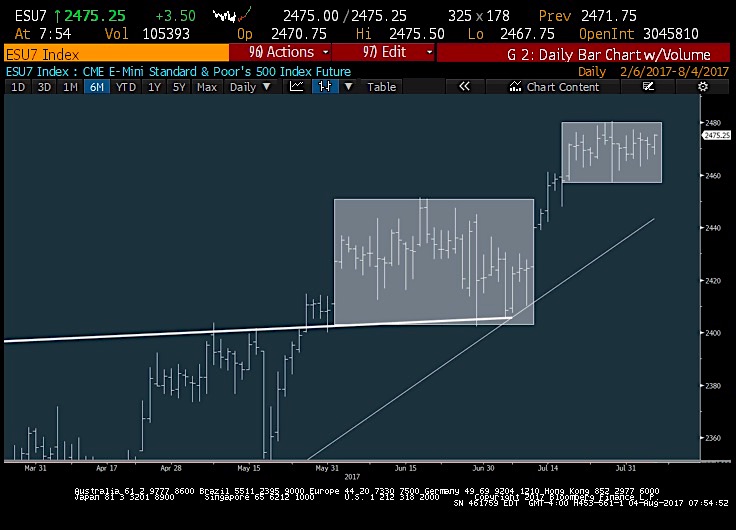

The last 12 trading days for the S&P 500 (INDEXSP:.INX) have been equally as range-bound as the trading action that we saw in June.

The S&P 500 is within 4 ticks of its closing price from JULY 19th. And the beat goes on…

This stairstepping pattern will only end when key levels (upside or downside) are taken out. The waiting has been tough, as this time around, the range has made it even tougher to make money.

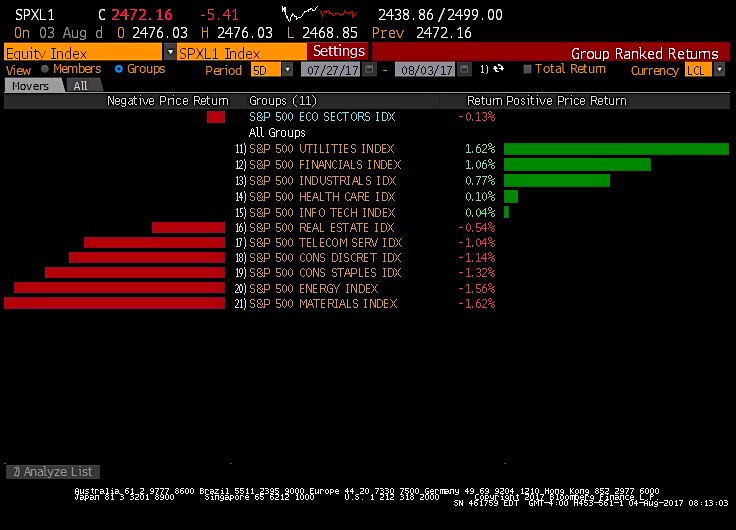

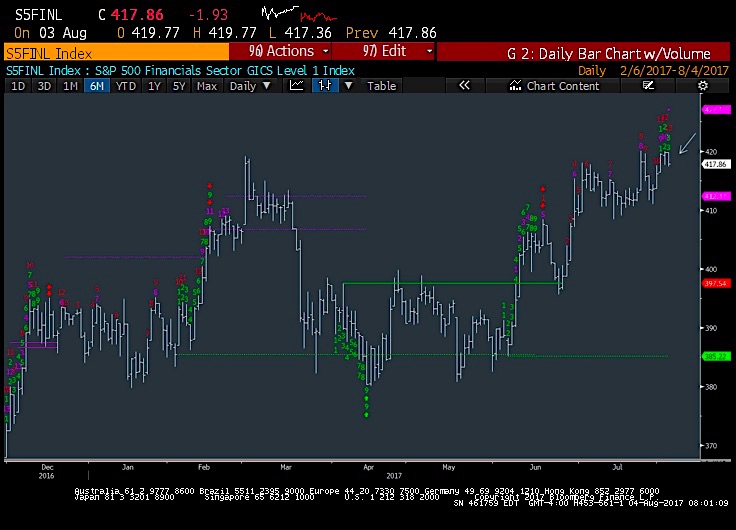

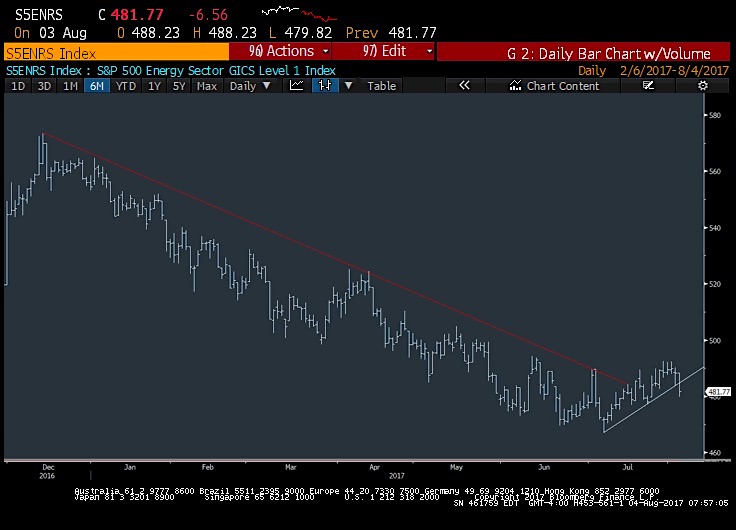

The last rolling 5 days show this in painstaking detail- Utilities (NYSEARCA:XLU) have been the top performing sector, higher by 1.6%. The next best gains have been with the Financials Sector (NYSEARCA:XLF), despite bonds having rallied. The S&P Financials Index is up 1.02% (see chart below). Yet NO other sector has been higher than 1%, and 6 of 11 sectors have actually been DOWN during this time with 5 of them showing negative returns of more than 1%: Telecom, Cons Discretionary, Consumer Staples, Energy and Materials..

Overall this is not a picture that inspires a tremendous amount of confidence. The direction has been SIDEWAYS since mid-July and tough to have a lot of confidence for what will happen next. For now, it’s important to keep track of the sector rotation. In this case, its moved into Utilities and Financials, and out of Consumer stocks, Tech, and Energy

Below I highlight 5 charts that show the ongoing trading range and some key sector shifts which are worth noting. This indeed has been an incredibly lackadaisical, range-bound consolidation.

1). S&P 500

2). SECTOR PERFORMANCE

3). UTILITIES

4). FINANCIALS

5). ENERGY

Thanks for reading and good luck out there.

If you are an institutional investor and have an interest in seeing timely intra-day market updates on my private twitter feed, please follow @NewtonAdvisors. Also, feel free to send me an email at info@newtonadvisor.com regarding how my Technical work can add alpha to your portfolio management process.

Twitter: @MarkNewtonCMT

Author has positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.