The stock market has been quite volatile for the past few days and this can be in connection with GameStop and RobinHood which brings to the table some very important topics regarding regulations.

As you know retail-forum traders successfully fought the hedge fund which lost a lot of money as the price of Gamestop (GME) shares increased significantly. Well, that’s the market and how it functions; price moves on supply and demand, and I dont see anything wrong with that.

But it looks like the problem is when big players lose money, and they want to fix that.

So the big players can trade how they want, only it’s not okay to lose money… but small people can’t trade freely and it’s okay if they lose money.

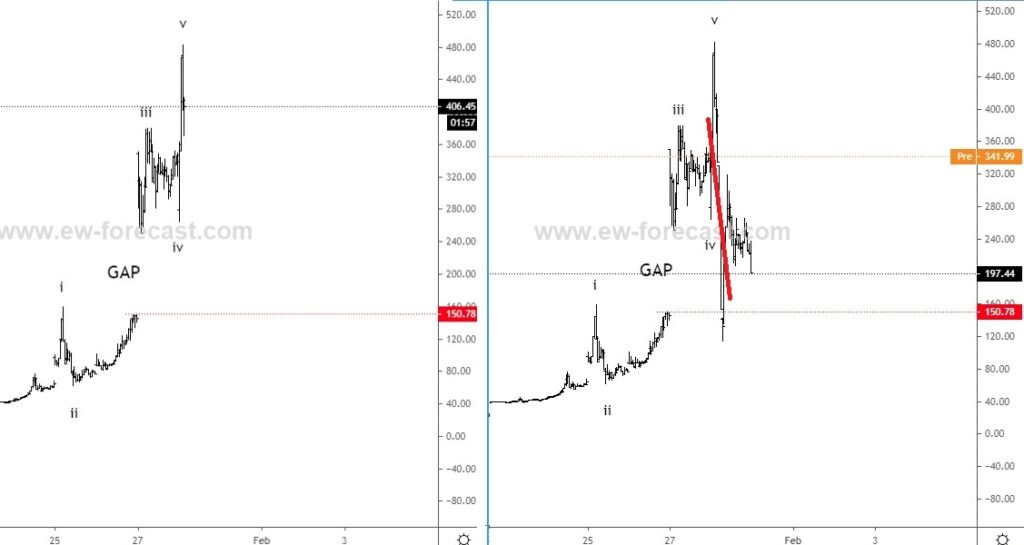

By the way, that fifth wave top on Gamestop (GME) came after five waves up… and filled the gap later.

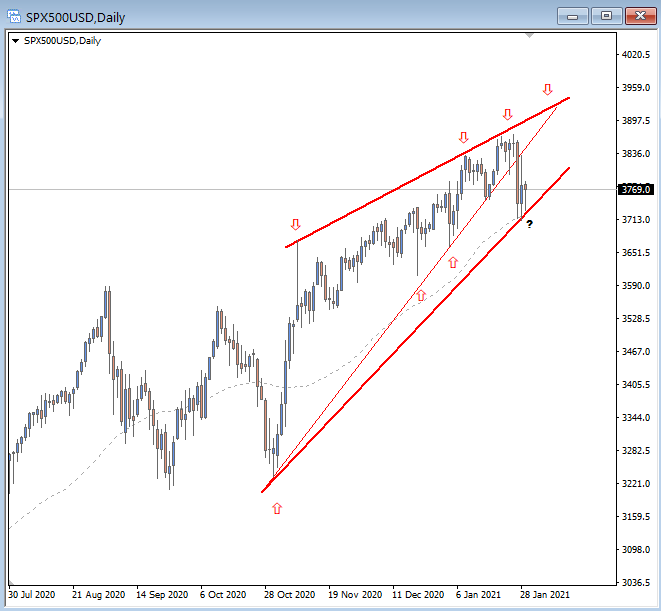

I also think that this entire situation, greed, FOMO and the latest events are telling us how late we are in this stock market cycle.

It’s sound almost like mania that can potentally cause the opposite moves. It will be very interesting to see the Weekly and Monthly closes today. I am also keeping an eye on this S&P 500 wedge pattern and the German DAX January/February reversals shown on the charts below.

If you are interested in cylce of the major global markets and FX then I wellcome you to look inside of our Premium Services at http://www.ew-forecast.com.

Twitter: @GregaHorvatFX

The authors may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.