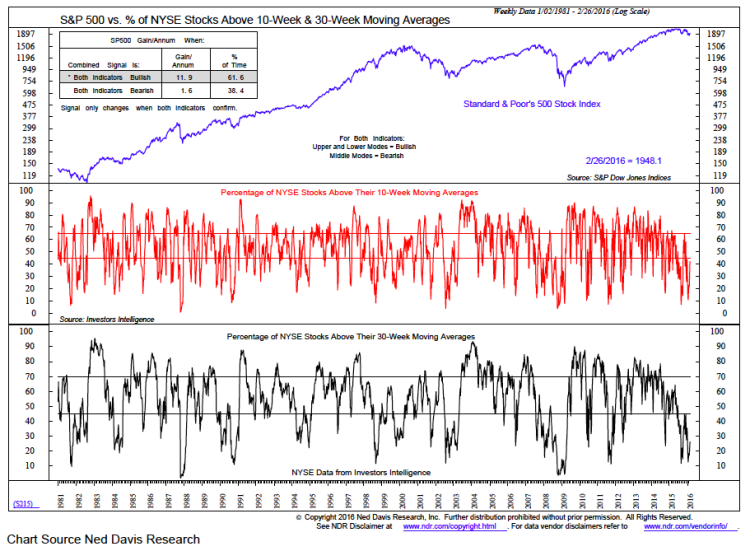

U.S stock markets registered gains for the second week in a row last week. The S&P 500 and Dow Industrials gained more than 1.50% last week, reducing the year-to-date losses to 4.5%. The broad market also turned in a strong performance with small- and mid-cap averages outperforming large-caps.

The stock market rally was supported by a 3.00% move higher in oil and indications from the European central bank that more stimuli would be added if needed to spur growth. The stock market indices were also supported by standout performances in utility and consumer staple stocks that hit new 52-week highs on Thursday.

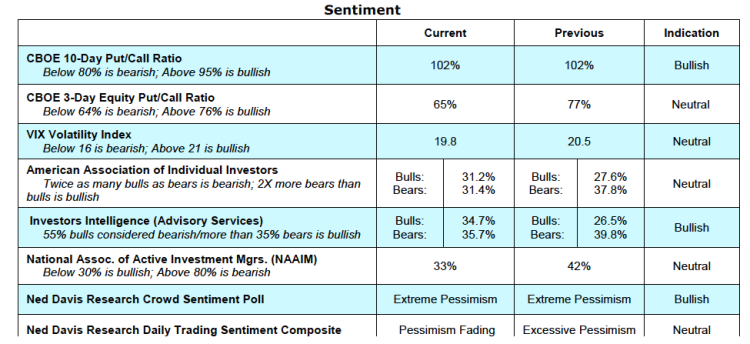

If this stock market rally is to have staying power, however, we should soon see aggressive areas of the market including the tech, energy and materials sectors take the leadership role. If the current strength proves to be another false start, that would become evident by the rally in the broad market stalling out followed by a break of key support, which is considered to be 1850 using the S&P 500 Index.

Near term, we anticipate that stocks will have to rally past 1950 on the S&P 500 and move into the upper band of the trading range near 1990.

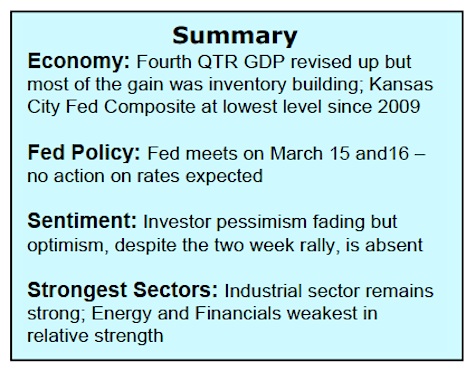

Investor psychology has moved away from the extreme pessimism found at the low on February 12 but widespread caution and skepticism remains. According to data from the Investment Company Institute, investors pulled $23.4 billion out of stock mutual funds the past seven weeks, which could help further upside progress in stocks in the final month of the first quarter.

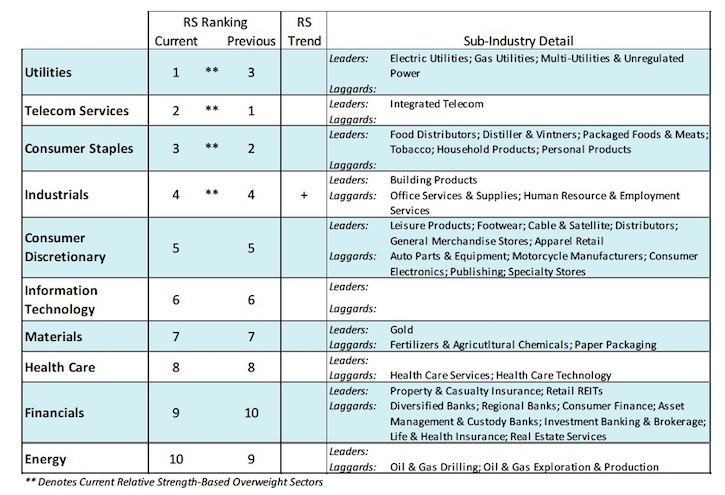

Additionally, stocks could benefit from the sharp rise in the short-interest and the fact that the number of issues trading above their 50-day moving averages made a higher high. Although last week’s rally stalled just below 1950 on the S&P 500, the Russell 2000 and S&P mid-cap indices ended the week at new recovery highs. The downside momentum in force since late December has been broken but it has not been replaced by a surge in upside momentum. To gain confidence that the current stock market rally can stretch beyond the limitations of a trading range would require at least one session where upside volume overwhelms downside momentum by a ratio of 10-to-1 or more.

The Federal Reserve meets on March 15 and 16. Given the weakness in the latest economic data and continued turmoil in overseas markets, the probability of a change in monetary policy is low. The economic data this week including Tuesday’s ISM manufacturing report and the February jobs numbers on Friday could add to short-term volatility in the financial markets. The ISM manufacturing report is anticipated to show further deterioration in the industrial portion of the economy while the employment data is anticipated to show the economy created 190,000 new jobs in February, primarily in the service sector. As a result the odds of the Fed hiking the fed funds level in March and June are remote.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.