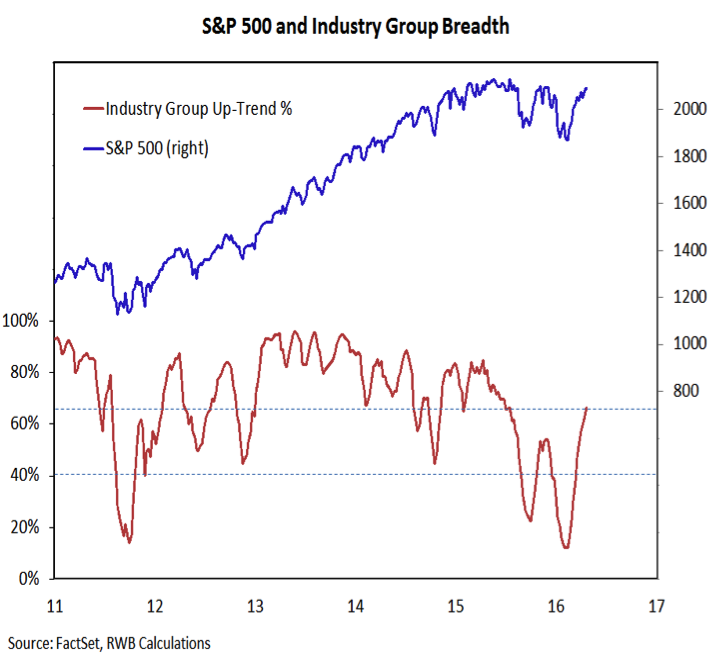

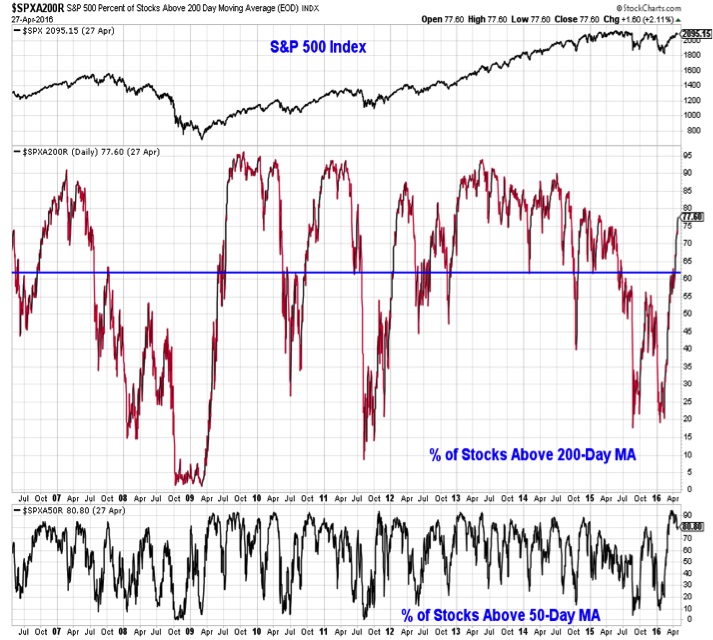

More than three-quarters of the stocks in the S&P 500 are trading above their 200-day average, the highest level we have seen in over a year. Gone are the rallies from 2015 that featured relative few participants and an increasing number of stocks in down-trends. The three-year-old pattern of lower highs and lower lows on a variety of market breadth measures is being broken.

Volatility Index – VIX

The decline in the Volatility Index (VIX) is attracting attention. The VIX soared above 28 in early 2016 but has recently dropped below 14. Despite this collapse, and a well-document history of losing value year-in and year-out, VIX-related funds continue to see inflows. Not only, however, is the VIX not yet at the lows seen over the past several years (in each of the past three years it got to or below 12), but low readings on the Volatility Index can persist for some time. The VIX is a much better indicator for spotting market bottoms (peaks in the VIX) than for spotting market tops (lows in the VIX).

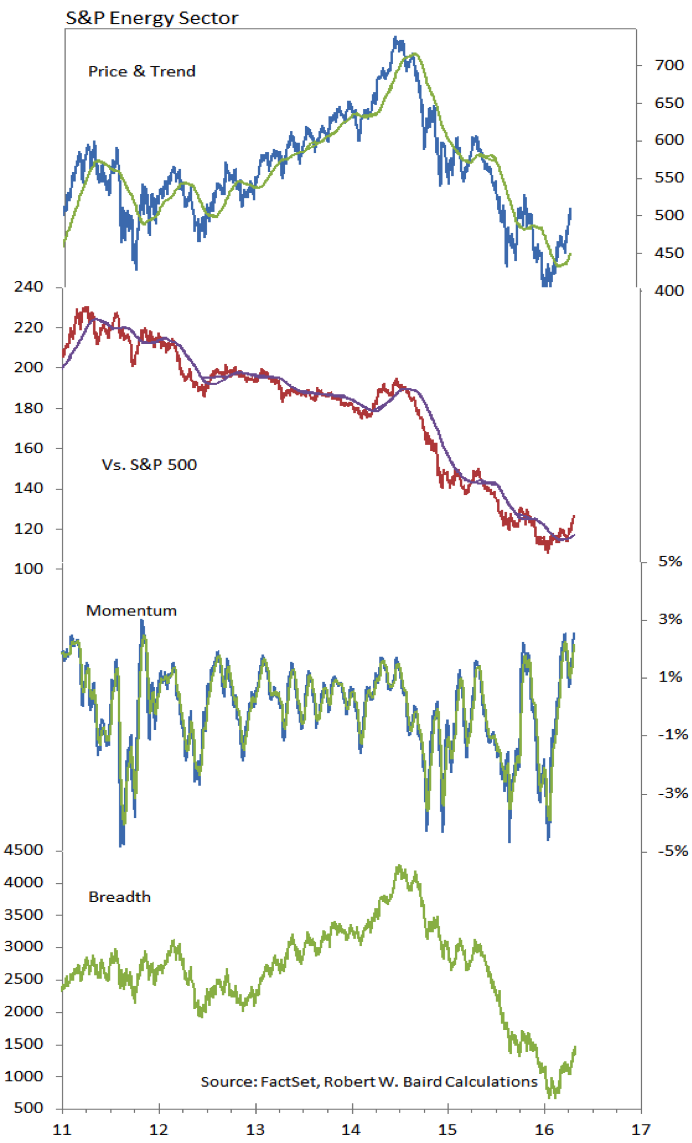

Energy Sector

Sector-level leadership rotation is ongoing. But even at the sector level, broad strength is evident. Four of the 10 sectors in the S&P 500 are up double digits on a year-to-date basis, with the Energy Sector and Materials Sector joining early-year leaders Telecom and Utilities. The bounce in the Energy sector is sarting to look more like a sustainable trend. Momentum remains strong, and price trends, on both an absolute and relative basis are turning higher. Market breadth too is looing better. If this is the case, the bounce seen in Energy so far, could be just the first leg in a more lasting move higher.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.