The equity markets finished the first half of 2017 with the best six month performance in four years. The star performer was the NASDAQ (INDEXNASDAQ:.IXIC) which gained 14% while the S&P 500 (INDEXSP:.INX) and the Dow Jone Industrials (INDEXDJX:.DJI) gained 8.0%.

Stocks were supported by the bullish configuration of strong first quarter earnings growth, low interest rates and a friendly central bank policy.

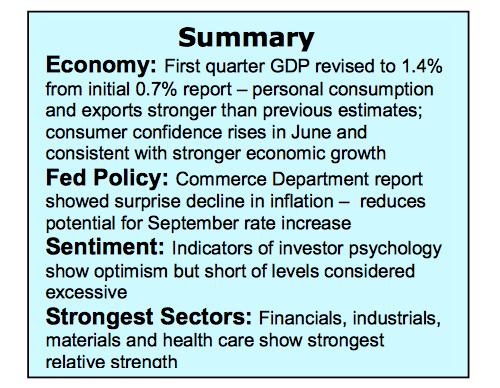

Entering the second half of the year, the underlying corporate fundamentals and technical condition of the stock market support the prospects for further gains. Less certain is central bank monetary policy, which is expected to be less accommodative than in recent years. Improving global business conditions can be a two-edged sword for stocks if it encourages inflation into the equation.

The first half of 2017 was also noted for an unusually low level of volatility. This is likely to change in the second half of the year as the markets face a less accommodative Fed and a shift in market leadership. Entering the third quarter, despite some shifts in the environment the path of least resistance for stocks remains to the upside.

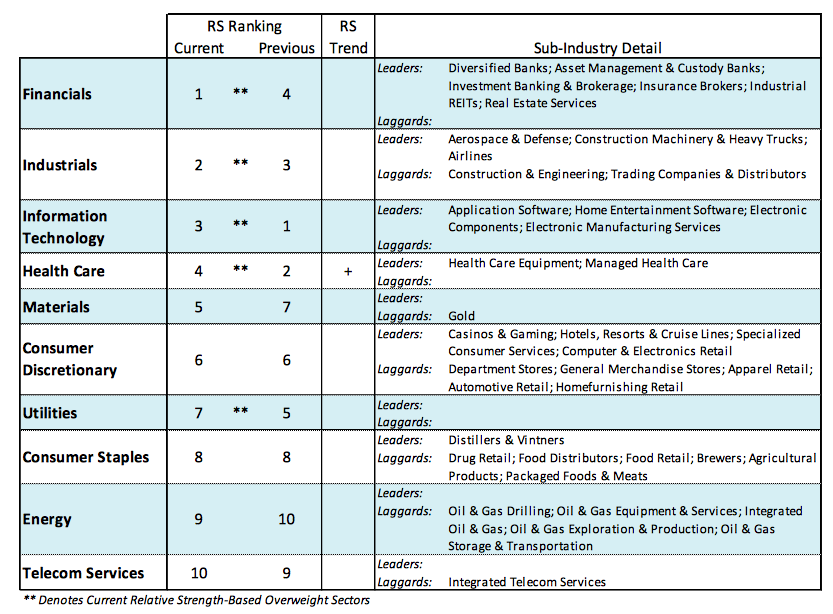

The financial, industrial and material sectors are the leading areas for the S&P 500. There has also been a shift in the leadership from growth to value, which suggests investors are more confident in the prospects for the U.S. economy.

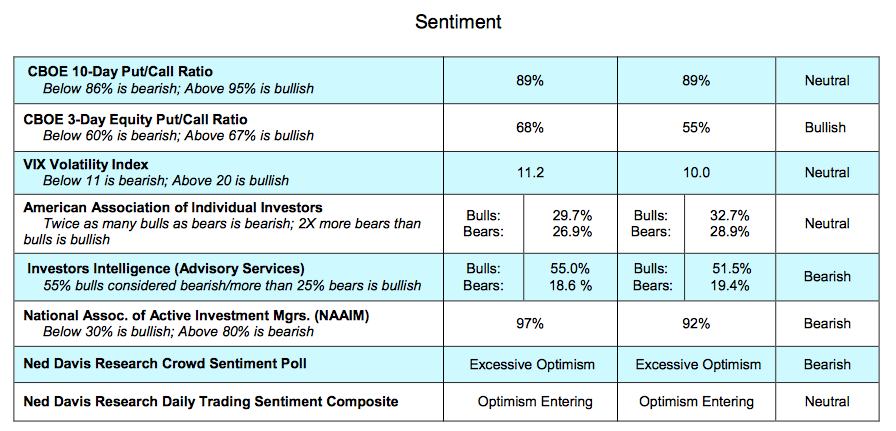

The technical factors that we believe help to determine the level of risk in the equity markets are changes in market breadth and investor psychology. The broad market has a long history of forecasting the path of the leading averages three to six months or more in advance. The fact that 74% of the industry groups within the S&P 500 are in positive uptrends argue that despite the likelihood of increased volatility the prospects for a sustained decline appear limited. Despite the wide swings in the equity markets last week the number of stocks hitting new weekly lows actually contracted. This is seen as a very positive sign as an expansion in the new low list historically is a precursor of a more serious weakness ahead.

Measures of investor psychology while failing to show excessive optimism indicate that complacency is widespread. Although complacency rarely results in a significant drawdown, it does little to support the upside either. An increase in market volatility could be a cure for a deeply seated complacency crowd leading to a more cautious and skeptical psychology that often is a building block for a sustained advance. Until such time as we see a breakdown in the broad market or excessive optimism our approach is that it is a bull market until proven otherwise.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.