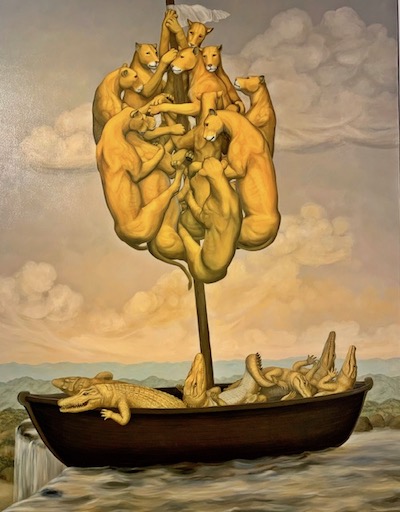

We recently saw this piece in a gallery. Artist: Juan Kelly at Nuart Gallery, Santa Fe, NM-The Sovereign Boat

As the big cats cling to the precarious mast to avoid the hungry alligators below, the entire boat is in peril.

I cannot imagine a much better metaphor for the current stock market conditions.

So who are the stock market’s big cats?

- Corporations, especially the ones who have been buying back their own stocks.

- The Federal Reserve, as they watch yields fall, the yield curve invert, all the while they have not commited to any changes in monetary policy.

- The passive investors, all of whom believe the market will come back in due time.

- The bulls, who still constantly tweet about buying every dip.

So, who are the alligators?

- The trade war, with its seeming longevity

- Domestic geo-politics, with Mueller the latest

- High US debt at $22 trillion

- Iran, North Korea and Russia

The word sovereign (as in the title of the painting) means supreme power.

To me, the takeaway is that even supreme power can be ephemeral.

Nothing or nobody is immune to encountering conditons beyond their control.

Such are the cliffs that pop up unexpectedly.

You know, the cliffs that catch you off guard when you do not have an effective rudder.

Every Tuesday and Thursday, I will be on KKOB radio at around 6:15 PM mountain time (8:15 PM EST) to discuss markets and market news. https://www.iheart.com/live/770-kkob-5411/

Want summer reading? Please check out my book, now back in stock on Amazon: Plant Your Money Tree: A Guide to Growing Your Wealth!Also on Kindle! Go here: www.marketgauge.com/plantyourmoneytree to receive a special $97 bonus for free while it lasts!

S&P 500 (SPY) – 277 or where the MAs sit essentially held for today. Now, it must show us it can at least get back over 280.

Russell 2000 (IWM) – Would have preferred to see this close over 148.41 the March low. At least it bounced from today’s low at 147.36. 150 pivotal now

Dow Jones Industrials (DIA) – This failed 253.44 is the 50-week MA. The Dow is the second but not the last index to break that level. Now 253.44 is the place to clear

Nasdaq (QQQ) – Held 174.40-174.60 the underlying MAs. So if there is going to be any pockets of strength, it will be in this index, especially if it can clear 177.50

KRE (Regional Banks) – Wild day here. Broke the 200-WMA at 51.40 to come back strong and close green. Worth watching.

SMH (Semiconductors) – 101.15 the 200-DMA resistance to clear if good.

IYT (Transportation) – The 180 support became resistance. Now must clear and hold if good.

IBB (Biotechnology) – Broke the 200-WMA at 103.14. Did hold 101-so there is the range to watch.

XRT (Retail) – Support around 40.00 held with today’s low 40.07

Twitter: @marketminute

The author may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.