S&P 500 trading considerations for December 27, 2017

Stocks are trading sideways in early morning action across the major stock market futures indices. The holidays have brought quiet trading but our trading process hasn’t changed. See key futures trading levels and commentary below for the S&P 500, Nasdaq, and crude oil.

You can access today’s economic calendar with a full rundown of releases.

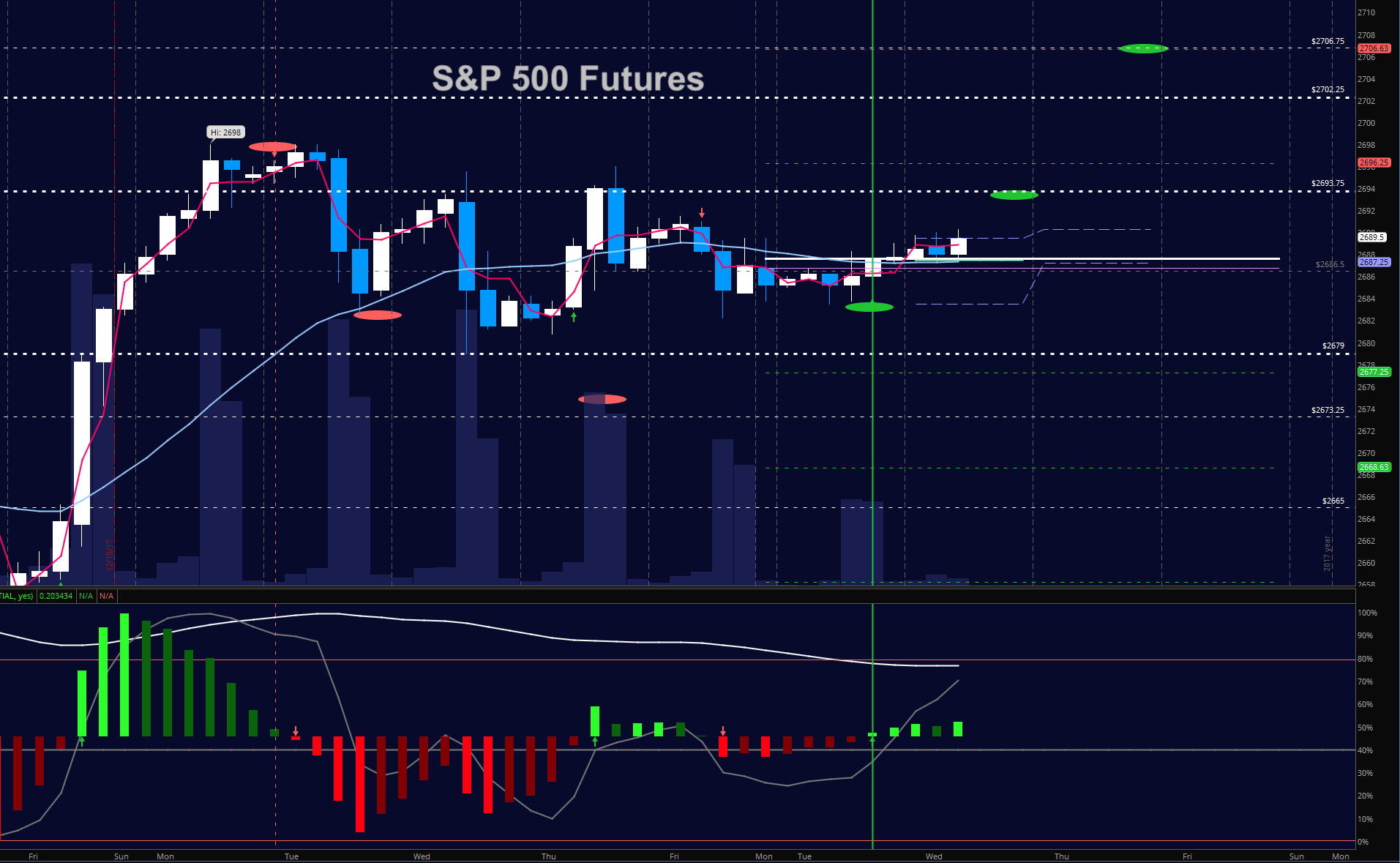

S&P 500 Futures (ES)

Levels posted on Dec 21 have given us solid ranges and price targets for all the instruments we follow. Prices have remained stagnant but momentum holds largely positive here in the ES_F. Retracements have been shallow, overall, and should continue to be shallow unless profit taking catches hold or a burst of accumulation that begins. We are essentially rangebound between 2679 and 2694. As mentioned before, levels near 2689 will be resistance if we have more downside ahead. The bullets below represent the likely shift of trading momentum at the positive or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 2691.5

- Selling pressure intraday will likely strengthen with a failed retest of 2682.5

- Resistance sits near 2690.75 to 2696.5, with 2702.75 and 2706.75 above that.

- Support holds between 2680.5 and 2682.5, with 2675 and 2671.25 below that.

NASDAQ Futures (NQ)

Negative drift holds here in the NQ_F with lower highs and lower lows being the order of the day. Support has drifted lower into the congestion regions near 6430.5 and this will be our primary region today to hold. The level above to breach today is 6482.5 for buyers to have a stronger chance at resuming control. The outlook for the day’s motion is currently mixed to bearish. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 6482.75

- Selling pressure intraday will likely strengthen with a failed retest of 6454.5

- Resistance sits near 6474.5 to 6482.5 with 6502.25 and 6521.75 above that.

- Support holds near 6455.5 and 6432.75, with 6411.25 and 6400.75 below that.

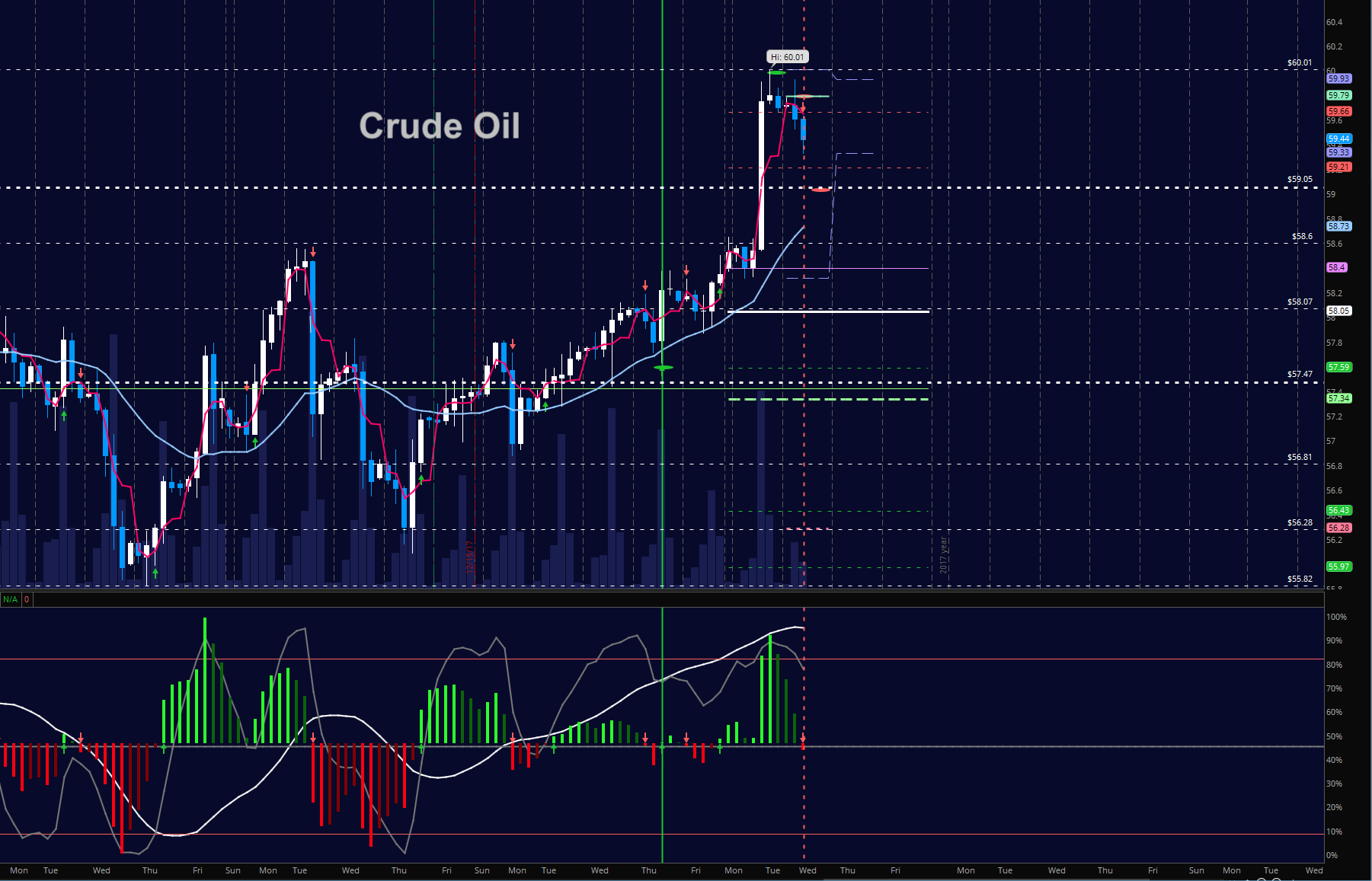

WTI Crude Oil

Libya saw pipeline disruption with an explosion yesterday that led to the test of 60 which was our internal target with traders here. From the test of 60, traders quickly began taking profit and I suspect we are quite likely to take profit all the way back to 59.05 or so – though we are seeing some new buyers step in near 59.30. We are in a bullish formation, so even if we see deep dips, they will not reverse the upward direction of the chart without an otherwise unlikely news event of some kind. The bullets below represent the likely shift of trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 59.57

- Selling pressure intraday will strengthen with a failed retest of 59.05

- Resistance sits near 59.46 to 59.63, with 59.76 and 60.35 above that.

- Support holds near 59.21 to 59.02, with 58.72. and 58.6 below that.

If you’re interested in the live trading room, it is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.