S&P 500 Futures Trading Considerations For December 8, 2017

The S&P 500 (INDEXSP:.INX) rallied yesterday after holding key price support. The futures market is now testing upside resistance. In the commentary below I break down the trading setups for S&P 500 and Nasdaq futures indices along with crude oil.

You can access today’s economic calendar with a full rundown of releases.

S&P 500 Futures

Buyers continue to hold steady into the jobs number this morning. Price is currently testing resistance that should eventually breach 2649.5. Failure will send us back into congestion but that seems a bit unlikely at this writing. Support at 2640-2637 is critical to watch. The bullets below represent the likely shift of trading momentum at the positive or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 2649.75

- Selling pressure intraday will likely strengthen with a failed retest of 2637.25

- Resistance sits near 2649.5 to 2655.5, with 2661.5 and 2671.5 above that.

- Support holds between 2644.25 and 2638.25, with 2627.5 and 2619.5 below that.

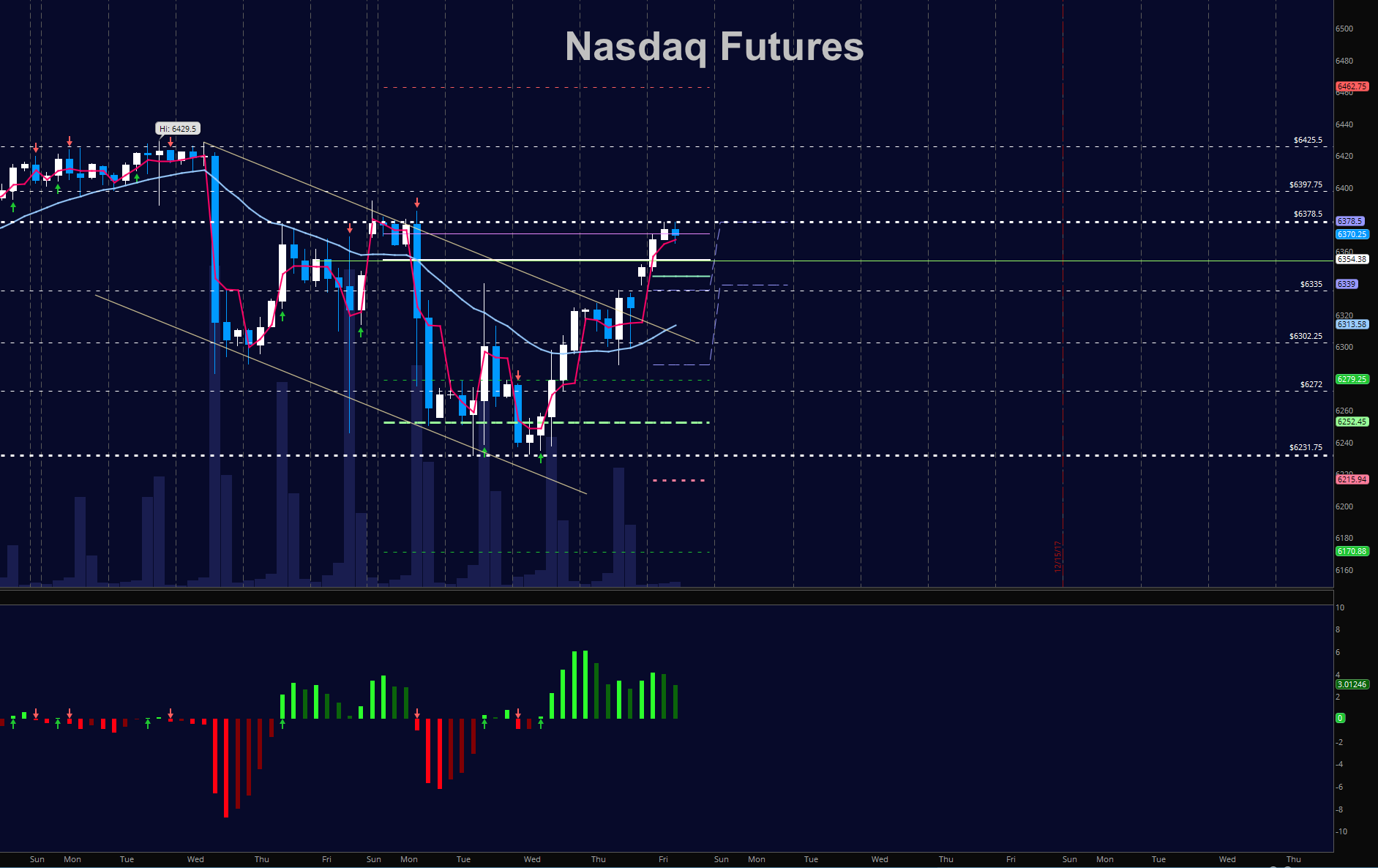

NASDAQ Futures

In a burst of recovery, traders resumed buying in this chart also sitting at the edge of resistance. Formations are mixed but support should find buyers based on momentum showing. Higher lows are also holding. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 6385.5

- Selling pressure intraday will likely strengthen with a failed retest of 6335.5

- Resistance sits near 6378.5 to 6397.75 with 6425.5 and 6462.75 above that.

- Support holds near 6363.5 and 6344.75, with 6335.25 and 6301.75 below that.

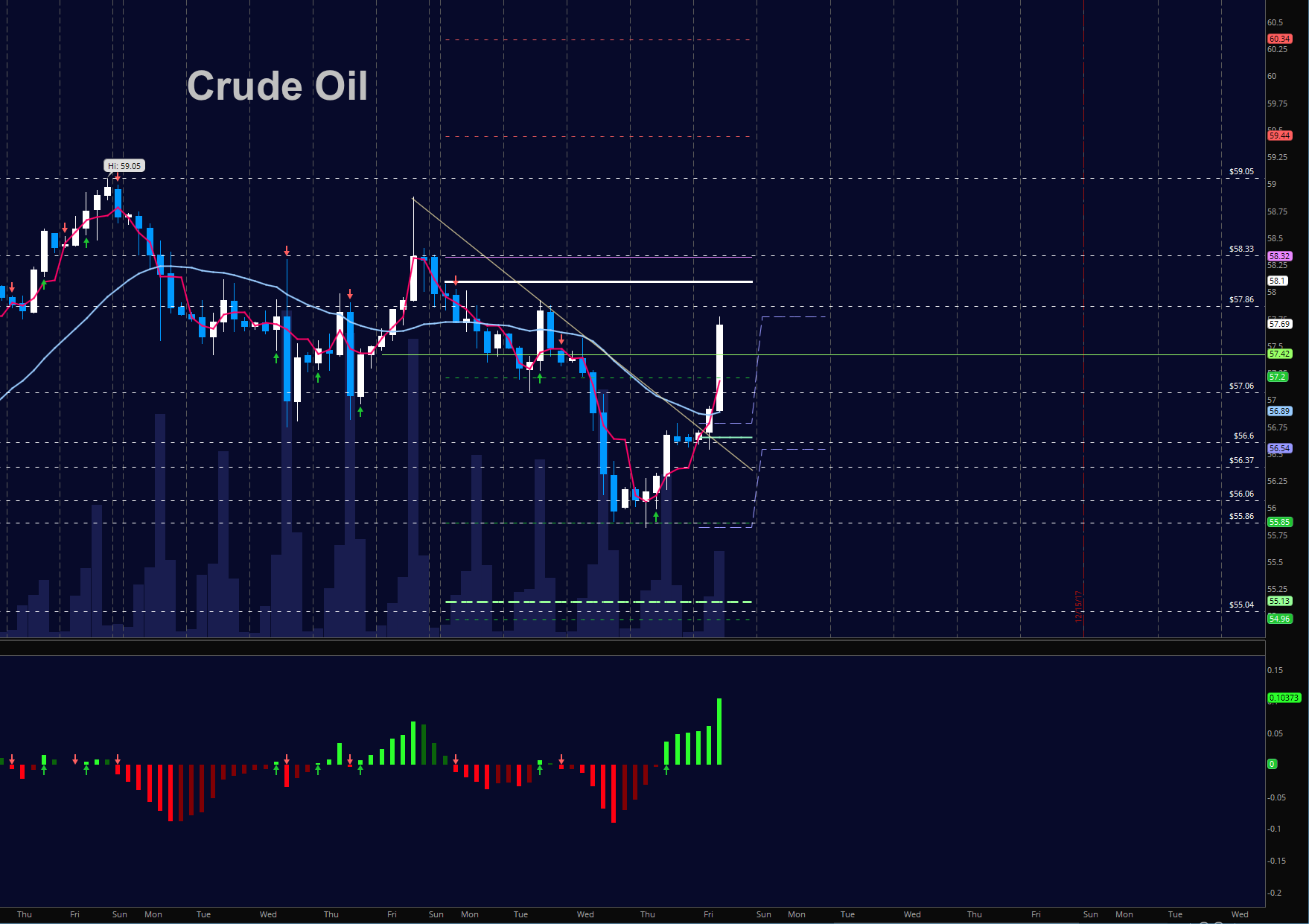

WTI Crude Oil

Buyers won the fight at 56 yesterday and we’ve been moving upward ever since. We are now near new resistance near 57.9. With the bullish undercurrent present, it will be difficult to short without topping formations and negative divergence present, and those fades should still bring us higher lows in the current environment. The bullets below represent the likely shift of trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 58.1

- Selling pressure intraday will strengthen with a failed retest of 57.4

- Resistance sits near 57.89 to 58.1, with 58.34 and 58.8 above that.

- Support holds near 57.42 to 57.06, with 56.89 and 56.27 below that.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.