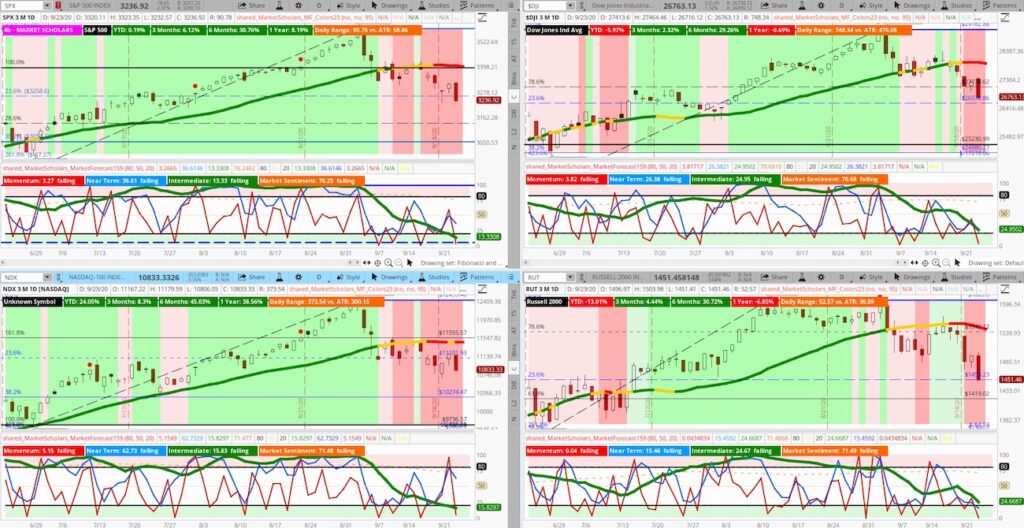

The Market Forecast indicator is showing a very interesting pattern that is similar to last May where we also experienced a month-long slow decline.

Back in May, the stock market initially declined to its 23% Fibonacci retracement level before eventually falling down to stronger price support near its 38% Fibonacci level. Perhaps this month will be similar to that decline.

The daily intermediate line, weekly near-term line and monthly momentum line are setting up for a move higher depending on how we move down towards volume support in the next week before September ends.

Margin of safety is better for the Russell 2000 and not nearly as good for the NASDAQ Composite. This can limit most of the downside damage to the mega cap tech names while the broader market gradually moves lower to the worst of the damage late in the pullback cycle – again, similar to the May 2019 decline.

Volume and trading range were bearish today but not volatility. This pattern also suggests we may be grinding towards the low – especially with the Russell 2000, Dow Jones Industrial Average and S&P 500 Index already sitting so close to strong price support levels on their respective one-year Volume Profiles.

Most of the damage continues to be primarily in the US markets, specifically in the large-cap technology sector.

In fact, Emerging Markets have been holding up fairly well. Also, tech stocks leadership remains despite the broad market weakness. I expect that it will remain a leader after it resolves its poor margin of safety.

Today’s Stock Market Video & Analysis

Get market insights, stock trading ideas, and educational instruction over at the Market Scholars website.

Energy, Financials and Industrials – some of the smallest sectors in the S&P – have had the worst performance over the past couple of weeks as tech has been holding up and maintaining its leadership on a broader level while most of the selling is contained in the mega cap space…

Twitter: @davidsettle42 and @Market_Scholars

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.