The S&P 500 (SPX) rose 15 points last week to 2907, an increase of 0.5%.

Meanwhile President Trump hinted at his next move with respect to trade, pointing to warped competition between Boeing and Airbus.

Our projection is for momentum to continue to push stocks towards the all-time high, with corrective pressures increasing by the end of the month.

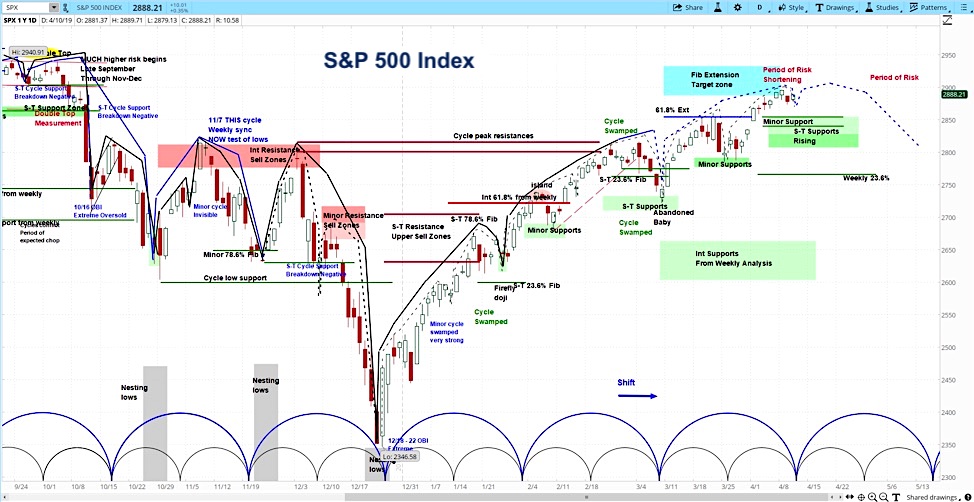

S&P 500 (SPX) Daily Chart

Our approach to technical analysis uses market cycles to project price action.

Our analysis of the S&P 500 this week is for a rally up to the top of resistance, maybe threatening the previous peak of 2940. Then we expect the rally to briefly falter by the end of April, with risk of a sizable correction into late May, before the rally picks up again.

Market Week Video – April 15, 2019

Stocks continue to climb during what was mostly a mixed week. The bulls nonetheless targeted new all time highs of infinity and beyond, as I pointed out in the latest Market Week show.

President Trump began the week with a fresh tweet. Eyeing the possibility of concluding the trade deal with China, he hinted at what might be next on his agenda: “The World Trade Organization finds that the European Union subsidies to Airbus has adversely impacted the United States, which will now put Tariffs on $11 Billion of EU products! The EU has taken advantage of the U.S. on trade for many years. It will soon stop!”

The International Monetary Fund later in the week revised its outlook for global economic growth to 3.3% from 3.5%. This is the third time it has reduced its outlook in the last 6 months, which forecasts the weakest economic growth since 2009. “This is a delicate moment for the global economy,” explained Chief Economist Gita Gopinath, who believes that if downside risks materialize in the coming years, it will require a coordinated effort with regard to monetary policy.

On Wednesday, the latest meeting minutes from the Federal Reserve showed that, “A majority of participants expected that the evolution of the economic outlook and risks to the outlook would likely warrant leaving the target range unchanged for the remainder of the year.”

On the other side of the world, the People’s Bank of China revealed that aggregate financing soared in March to $426 billion compared to $104 billion in the previous month. This nearly doubled the median estimate.

Turning to the new Q1 earnings season, 83% of firms have reported an earnings surprise and 59% have reported a revenue surprise, according to FactSet. However, earnings are growing at a negative rate, at -4.3%, and negative guidance continues to outpace positive guidance.

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.