Key Stock Market Takeaways:

– In the wake of initial selling look for rallies and retests.

– Economic resiliency would limit overall downside.

– If evidence turns negative, investors should get more defensive.

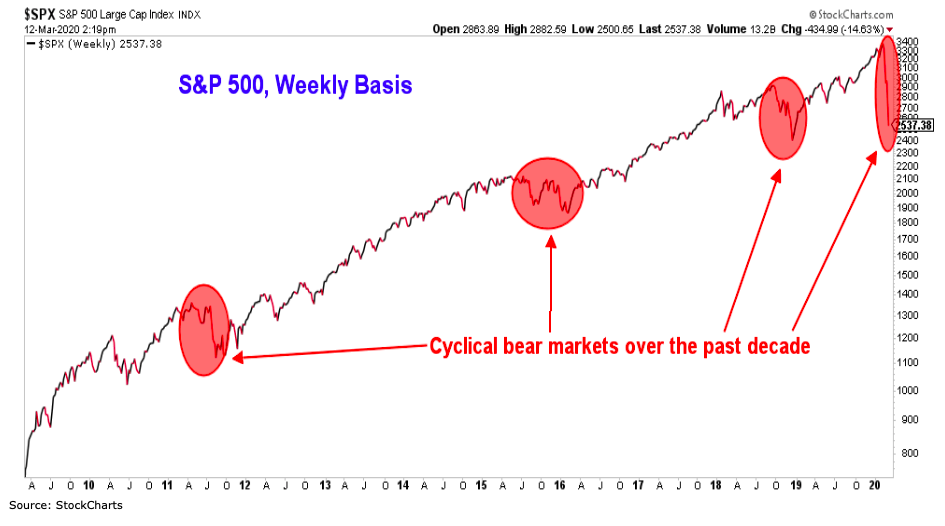

With the S&P 500 Index now down more than 20% from its February peak, the emergence of a bear market is being widely acknowledged. Indicators that move beyond the “20% decline on the S&P 500” definition suggest that this is the fourth such bear market since the March 2009 stock market lows.

While they have differed in intensity, they helped relieve excesses and eventually opened the door to better opportunities. Exact definitions are more useful to historians than they are to investors making portfolio decisions in real-time.

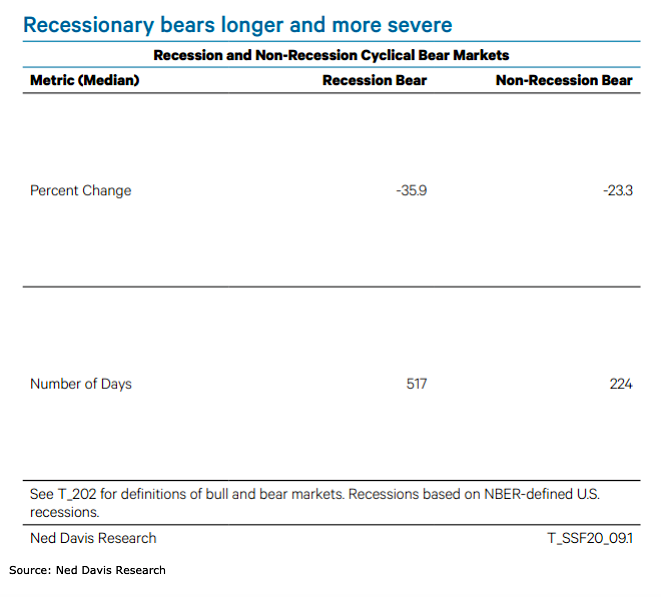

For investors, two important points can be made right now: 1) Bear markets run their course through price and through time. 2) The degree of overall weakness seen in a bear market is heavily influenced by whether or not the economy experiences a recession.

Based on data from Ned Davis Research, non-recession bear markets see median price declines of 25% (and can last 6 months) while those that come near recessions typically experience declines of 36% (and drag on for nearly a year).

Bear markets tend to make initial lows, which are followed by short-lived rallies which ultimately yield to re-tests of the previous lows. The experience of 2018 appeared to be an exception that tested that rule. The initial lows tend to be marked by signs of panic and exceedingly bad breadth measures. Seeing more than two-thirds of stocks making new lows this week would fit with that. That alone is not a signal that the indexes are near a low, but does suggest we could be near the end of the beginning of the current bear market.

Context is important. While non-recession bear markets do tend to run their course faster than those that emerge near economic recessions, they still take some time to unfold. Looking for a quick end to the current bear market, especially in light of the ongoing uncertainty surrounding both the human toll and the economic effects of the coronavirus, is premature.

Bear markets usually do not just relieve upside excesses but often create downside excesses. In addition to price weakness, the later stages of a bear market will often see widespread investor pessimism and valuations moving toward or below their long-term averages. In this regard the recent improvement in the Value Line P/E ratio is encouraging.

Knowing in real-time whether the economy is heading into a recession can be a challenge. We know that the economy was experiencing an upswing prior to news of the coronavirus (we discussed this in a recent Macro Update). Economic data is exceeding expectations by its large degree in two years. This bit of momentum may prove to be a saving grace for the economy.

For now the coronavirus is a problem of biology rather than policy (in terms of either fiscal or monetary stimulus). That being said, doing anything is better than doing nothing because it shows you can do something (which helps confidence) and it will be an important support once the biology of the virus runs its course.

Near-term disruptions to growth are likely in coming months, but how long those persist may depend on the resiliency of business and consumer confidence. Risk of a recession-like bear market would increase if the weight of the evidenceturns negative. If that happens, active investors should consider taking a more defensive approach to stocks, including even raising cash where prudent.

With so much of focus on buy-and-hold passivity, the volatility that comes with the second bear market in six quarters could contribute to a generation of investors who are overwhelmed by the path of their portfolios and underwhelmed by the destination. Proactive risk management is preferred to reactive selling, though trying to sit tight in the face of volatility can be a challenge. Patience is the preferred strategy for now.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.