On July 13th I wrote a market update on how the July 6-month Calendar Range Resets.

To refresh your memory.

The July Stock Market Pattern

The Six-Month Calendar Ranges

- Provides directional bias for the next 6 to 12 months.

- January and July divide the year

- Simple levels that matter + the right indicators and tactics.

Overall, we look at 2 simple things.

- If an instrument breaks out of the range or breaks below with momentum and price and then has follow through.

- If an instrument breaks out or down and then reverses back into the calendar range high and low.

Subsequently I wrote this:

Maybe I am just a technical geek, but this chart is so perfect, it will require only execution and no second guessing if it aligns into one of these scenarios (I wrote 5 but number 3 worked out).

Scenario 3: XRT takes out the July highs and then fails it (low risk short)

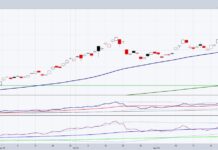

Note the chart (above) of the Retail Sector ETF (NYSEARCA: XRT).

On July 22nd the Retail Sector ETF (XRT) cleared the July range. Then on July 28th, XRT failed it.

Retail then spent the next 3 days selling off, despite the strong earnings in the tech stocks. Do consumers care about rising CAPOEX in META?

Not really.

Then, as we ended the week, XRT is under the 50-DMA but over both the July 6-month calendar range low and the 200-DMA.

Looking at momentum, we see no divergence between price and momentum.

Looking at the Transportation Sector ETF (NYSEARCA: IYT):

The picture is different.

Transportation, a huge component of the US economy, shows not only stagflation potential, but a recession potential.

The Transportation Sector ETF (IYT) never cleared the July 6-month calendar range high.

The momentum went into a bearish divergence before the price broke down under the July calendar range low AND both the 50- and 200-day moving averages.

Thus far, XRT is telling us that this could be just a correction to July lows and support, while IYT is suggesting perhaps a bigger correction is in store.

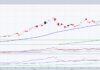

Hence, we go to the Semiconductors Sector ETF (NASDAQ: SMH) for more clues about what’s next.

Always look at the weakest link and the strongest link to gauge whether dip buying is the right thing to do or not.

We see IYT says be patient, the worst could yet be around the corner.

XRT says maybe Friday was the end of the selloff.

And Semiconductors Sector ETF (SMH) says:

The July 6-month calendar range barely cleared for 2 days.

Even with Microsoft, META, GOOGL, AMD all reporting spectacular earnings, our sister was not convinced that the bull case would still work with her Family down in the dumps.

SMH broke the July range high (green horizontal line) on Friday with a price gap lower.

However, the July low made on July 1st at 272.16 is still $10 away.

Looking at momentum, once again real motion gave us a head’s up.

Momentum never made a new high when the price did.

That is another type of bearish diversion.

Now, to answer the question of whether this is a buy opportunity on a dip, or we go further south, SMH is key.

IYT must stop bleeding.

XRT must hold the July 6-month calendar range low (red horizontal line).

And SMH must maintain momentum above its 50-DMA AND hold the price above 280.

We do that, dip a toe.

We fail to hold, stand by for more August pain.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.