The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

- The Inflation Reduction Act includes a controversial 1% excise tax on share repurchase programs that goes into effect next year

- Wall Street Horizon’s corporate event data show a downtick in total buyback announcements this year after a 2021 surge

- Investors must carefully weigh risks and understand what they own ahead of 2023

On August 16, President Biden signed the Inflation Reduction Act (IRA) into law. With its passage comes a new 1% excise tax on corporate net share repurchases. “The buyback tax” aims to penalize companies for engaging in this type of shareholder accretive activity.

Like so many pieces of legislation, this tax could spark unintended consequences such as a wave of corporate buyback authorizations and executions this year since the excise tax only applies to the market value of net corporate shares repurchased starting in 2023.

Trends In Stock Buyback Program Announcements

Wall Street Horizon closely tracks buyback authorizations in two flavors: initial and modifications. We tend to see more announcements of this corporate event type during the good times. Our data reveal that there was a relative dearth of share repurchase announcements during the middle of 2016 when global growth was sluggish and then again around the March 2020 Covid uncertainty. Buyback program initiations and modifications rose big in 2018 following a strong year for stocks in 2017 and the passage of the Tax Cuts and Jobs Act. Another flurry of activity happened during the year of speculation that was 2021. This year, however, the count of buyback events has dropped off. It’s important to recognize that these data are a count of events among companies around the world – it does not measure the dollar value of share repurchase authorizations or executions.

Buy Back Now Before the Tax?

The second quarter earnings season is in the books. It’s quite possible that the next several weeks could feature unanticipated buyback program initiations among U.S. companies seeking to pull-forward share repurchases before next year’s 1% tax hits. We already might be seeing this – Bank of America Global Research reports that its corporate clients bought back stock at the highest rate since January in the week after the bill went into effect. While a 1% tax is not much, some argue it could open the door to heftier tax rates down the line. Gauging the political winds is never easy, but the Congressional Democrats are gaining ground in the polls and betting markets. A divided Congress could be in the offing. Therefore, it is unlikely that we would see major tweaks to the tax in the next two years after the midterms.

More Uncertainty: Capital Allocation Plans Could Change

Investors should watch how things unfold. After all, an excise tax on corporate shares repurchased is essentially a tax on shareholders. That is how former Securities and Exchange Commission chairman Jay Clayton described it recently to CNBC. The C-Suite understands this, and corporate executives will change policy depending on the tax situation. Fifty-five percent of U.S. CFOs surveyed said a hypothetical 2% excise tax on buybacks would make them rethink how they return cash to stockholders.

More Dealmaking?

The trickle-down effects from this piece of the IRA should not go unnoticed. If buying back stock is more expensive, then other methods to reward shareholders could become more popular. It’s natural to assume that dividend announcements would increase, and perhaps one-off special dividends would be more common if a long-lasting or higher buyback tax is in place.

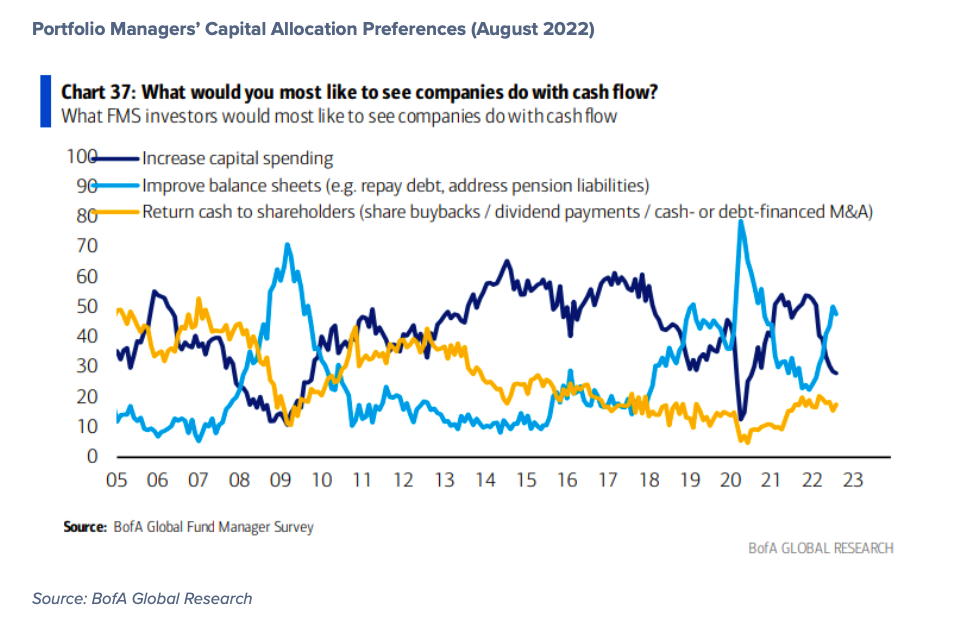

Moreover, corporate cash is building, so executives might be antsy about how to allocate capital. Another possibility is that CFOs might get more creative with cash flow – cash- or debt-financed merger & acquisition activity may appear more attractive. According to August’s Bank of America Global Fund Manager Survey, returning capital to shareholders in one form or another is not a major preference right now. But that preference could change should volatility in the markets calm.

The Sector Perspective

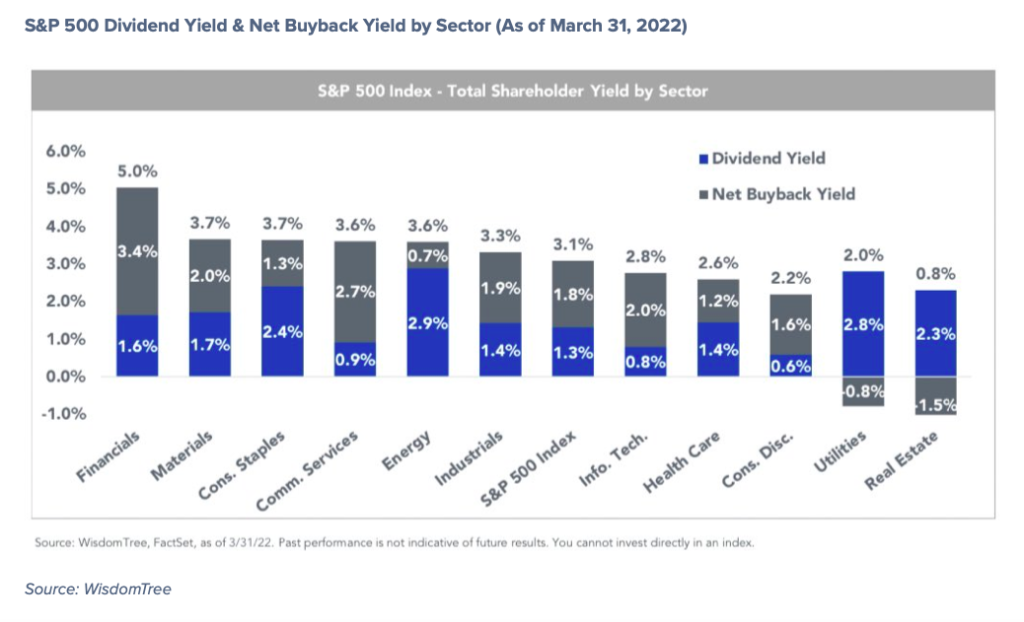

Investors must also know what they own. While a stock’s dividend yield is commonly known and cited, less bantered about is a company’s net buyback yield. That is, the net value of shares repurchased divided by a firm’s market cap. According to WisdomTree, using data from FactSet, investors with significant positions in the Financials and Communications Services sectors face the most risk from a buyback tax (but perhaps potential upside this year before the tax is applied). Two sectors have negative net buyback yields and would be largely unaffected by the excise tax: Utilities and Real Estate.

The Bottom Line

Wall Street Horizon’s corporate event data coverage includes a detailed count of global share repurchase initiations and modifications so investors know what’s happening with buyback policies of the stocks they own. We also aggregate the data to spot macro trends. The new IRA legislation brings about more uncertainty regarding shareholder accretive activities. Investors must carefully weigh portfolio risks ahead of 2023.

For more information on the data sourced in this report, please email: info@wallstreethorizon.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.