U.S. Dollar Index

Amid the mania surrounding Bitcoin, it might be useful to consider what it is measured against. The dollar has been trending lower for pretty much all of 2017. The bounce that emerged off of the September lows has failed to produce any follow-through, stopping at resistance in the form of the down-trend line. The yearly change has trended lower for most of the past three years and momentum remains lackluster.

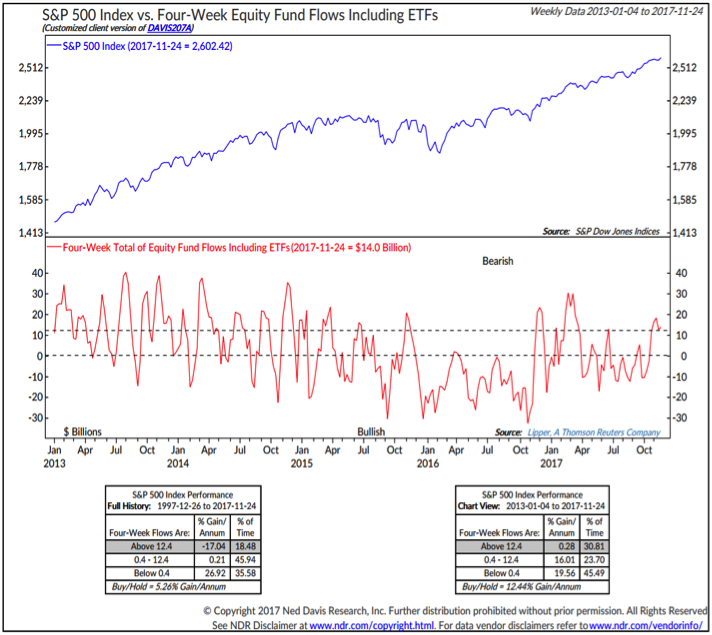

S&P 500 Fund Flows

While the strength of the cyclical rally is being confirmed with improving trends at the individual stock level and new relative leadership, we are also seeing evidence that the move higher may be getting ahead of itself. In other words, after celebrating the tax bill working its way through Congress, stocks could be due for some near-term consolidation. Not only have equity funds started attracting inflows, but options data show increasing complacency. The 10-day total put/call ratio has moved sharply lower over the past two weeks and the 3-day equity put/call ratio is at its lowest level of 2017. The NDR Trading Sentiment Composite is back to showing excessive optimism, a reading consistent with little-to-no market gains in recent years (as is the level the equity fund inflows).

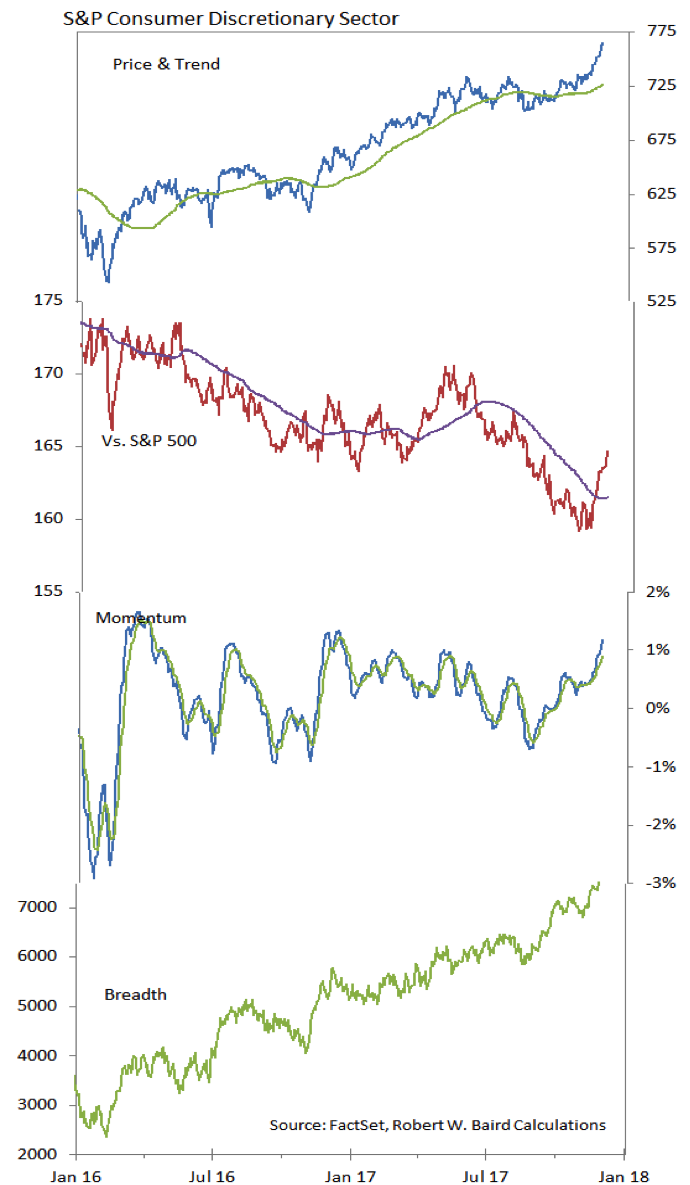

S&P Consumer Discretionary Sector

The Consumer Discretionary sector has continued to make new highs, a move that comes as momentum has continued to expand and the relative price line has surged through down-trend resistance. The sector has moved back into the leadership group in our relative strength rankings.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.