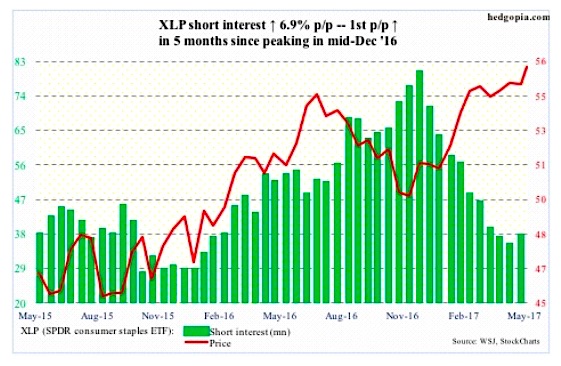

SPDR S&P Consumer Staples ETF (NYSEARCA:XLP)

XLP (55.94) bulls defended 54.40 – again. This was preceded by a persistent rally beginning early December last year, during which shorts got hammered. The latter would not get traction until 54.40 is lost.

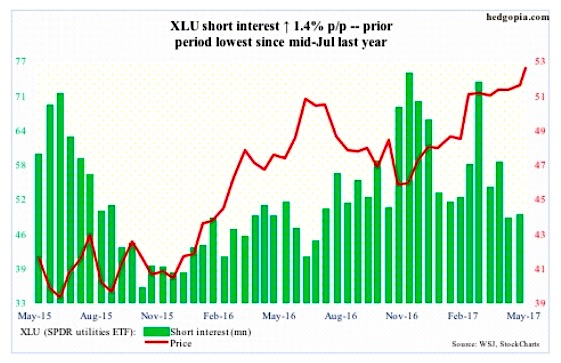

SPDR S&P Utilities ETF (NYSEARCA:XLU)

XLU’s (52.97) chart looks similar to XLP’s. In the past three sessions, it closed outside the daily upper Bollinger band. Way overbought near term.

That said, bears do not stand a chance until they push the ETF under 51 and change.

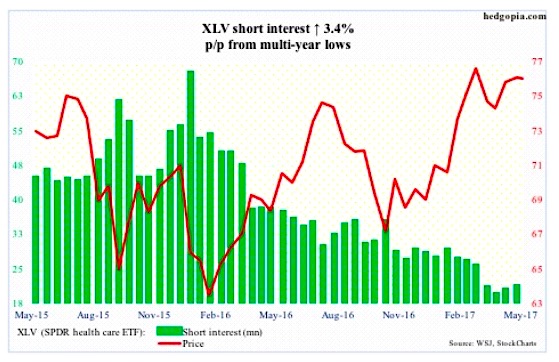

SPDR S&P Health Care ETF (NYSEARCA:XLV)

XLV (75.67) keeps hammering at nearly two-year resistance at 75-plus. Since mid-March, there have been two false breakouts. Shorts are behaving as if they expect a genuine one. Short interest remains tiny.

Nonetheless, bulls need to hurry up. The 50-day is gradually rolling over.

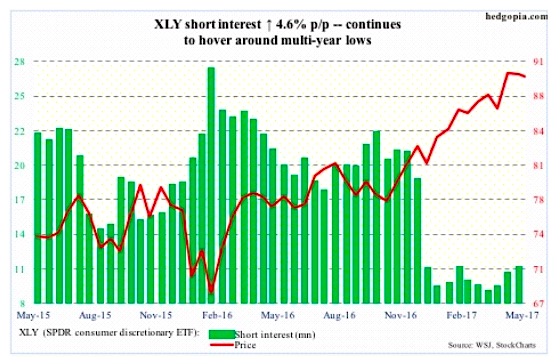

SPDR S&P Consumer Discretionary ETF (NYSEARCA:XLY)

XLY (89.68) rallied to yet another high – 90.93 – on May 9. The subsequent drop found support at the 50-day.

Shorts were right to massively cut back during December 16-30 last year. Beginning April, they have been adding a tad, but not much to cause a big squeeze.

Thanks for reading.

Twitter: @hedgopia

Author may hold a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.