As summer trading (hopefully) comes to an end we all might be in store for a bit more volatility and an increased likelihood for some downward pressure on the S&P 500 (NYSEARCA:SPY) in the coming days.

Historically we are entering a negative time of the year dating back to the S&P 500 futures emini contract’s inception.

Turbulence Ahead For Stocks?

The troubled period seems to be slightly after OPEX in September or more specifically the fourth trading week of the month.

There can be many reasons for why this has been the case whether it be options expiration (OPEX), contract expiration (quad witching), nearing quarter end, repositioning for Q4, etc. but the point is that as traders we should be aware of the seasonal tendencies as well as our own systems/methodologies.

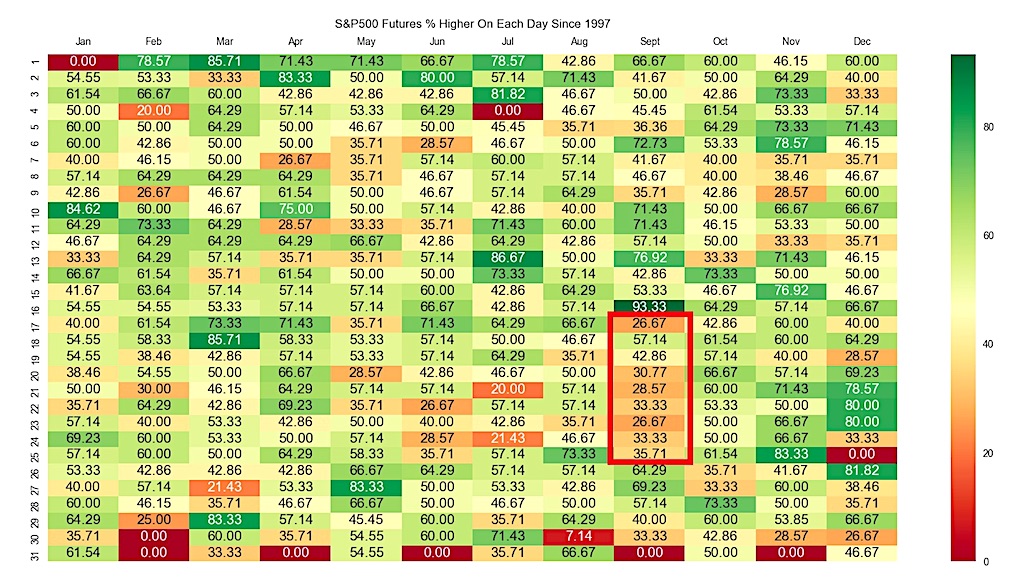

Below is a grid showing the percentage of days that have closed higher on the day given the month and day number. The red highlighted box shows a streak of subpar performance for September 17th to about the 25th. For example, for all trading days September 17th from 1997 to 2016 only 26.67% of them have closed higher.

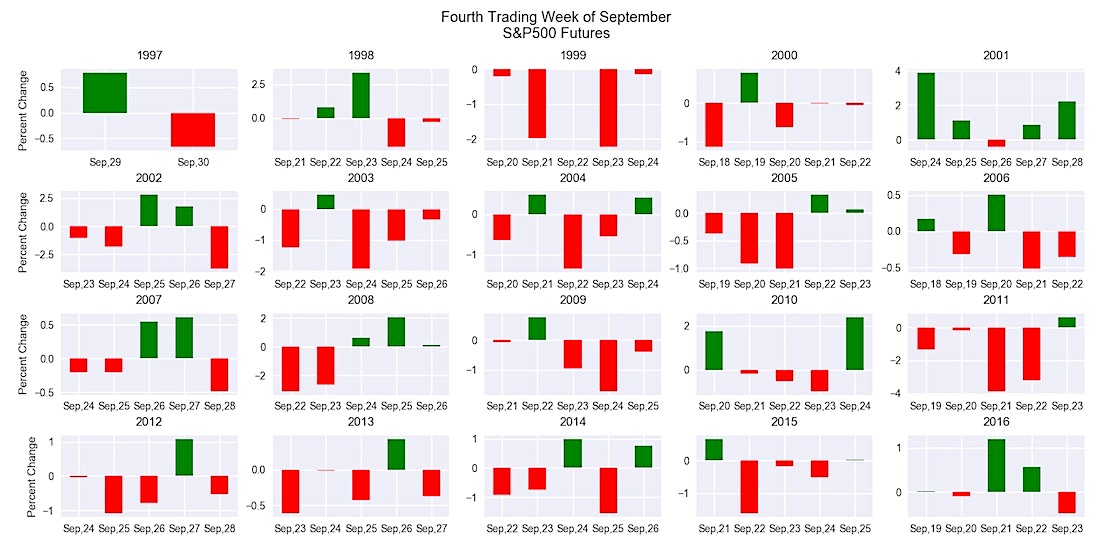

The second thing I want to share is how the fourth trading week of September has fared since the S&P 500 futures emini (ES) inception.

If the first trading day of the month is a Friday that would be considered trading week number 1. The following Monday would begin trading week 2. Often times trading week number 4 will follow OPEX. Below you can see there are a lot of red days and also a lot of red days that moved down 1-2%. Below is trading week 4 for every year since ES inception. Trading week 4 begins next Monday, the 18th.

I am not forecasting a down move because nothing is ever that black and white in trading. However, the seasonals are surely pointing that way. Trader beware.

Also read: The ‘Noise’ Test and Lying Backtests

Sometimes all one needs is a handful of simple, time-tested rules like this. Over at Build Alpha, we have tools that can help those with no programming capabilities to do simple and complex testing.

Thanks for reading.

Twitter: @DBurgh

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.