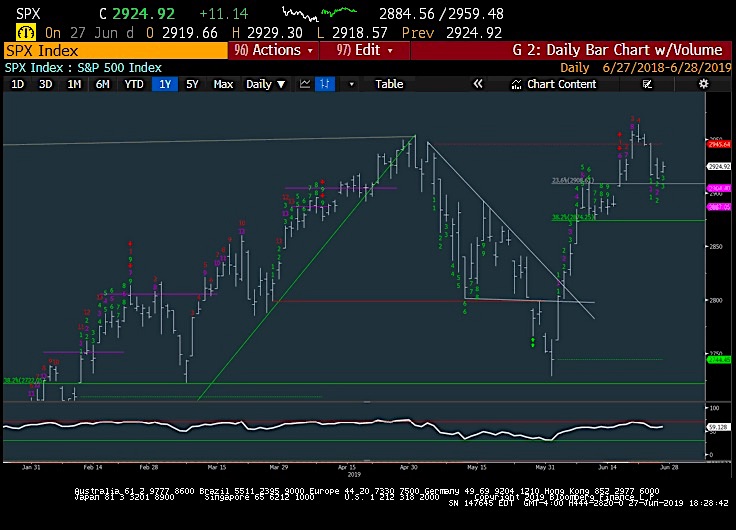

S&P 500 Index (INDEXSP: .INX) Trading Outlook (3-5 Days): Bearish, but over 2939 would turn trends back to bullish on a close.

Yesterday’s rally attempt failed to get high enough to turn trends bullish and leaves open the possibility of a final pullback Friday/Monday before trends turn back higher.

The S&P 500 Index has now fallen for four of the last five days, yet Thursday’s gains are not convincing just yet that lows are in to this pullback.

Movement back up and over 2939 in the S&P 500 would give far more evidence that prices could push back to highs. For now, its encouraging that Technology has roared back, and there’s some evidence of Financials starting to strengthen.

Both of these are positive developments ahead of the G-20 given that recent weakness has lost very little ground. Yet, some evidence of moving back above prior days highs will be necessary towards thinking that a move back to new highs can occur.

Given the uncertainty of this weekend’s G-20, most are betting that very little progress will happen, and as such, it’s right to wait on prices to turn up before thinking this decline has run its course.

Broad Market Commentary

Final trading day of the month and quarter, S&P has lost four of the last five days, but yet set to record a stellar month, higher by nearly 6%. This week’s pullback has barely made a dent in the recent strength seen since 6/3 lows, and now we’re seeing evidence of Financials trying to come back to life given the stabilization in Treasury yields. Healthcare’s bounce has been constructive technically, though not strong enough to lead thus far.

Materials and Energy along with Tech, have all made very good gains in the last month, outperforming all other sectors, though only Tech has real weight in the SPX. Overall, it’s thought that regardless of the outcome of this weekend’s G-20 which the market has been eagerly anticipating the outcome should be bullish for stocks, technically given the setup on most charts. Thus, any pullback Friday into Monday likely should be one to buy into.

Outside of equities, Gold and precious metals look to have started a minor pullback given the bounce in DXY and TNX, and this is thought to continue in July. It’s thought that TNX moves higher to 2.25-.35% and that DXY is near support and should also bounce. Both of these together might hurt EM performance, which for now, still looks to be ongoing.

Cryptocurrencies look to have shown a lot more volatility in recent days both on upside and now downside, while Crude oil has risen to sit near key resistance ahead of the upcoming OPEC meeting which will take place next week, directly following G-20. Thus, we’re starting to see a lot more volatility lately in nearly every asset class for the first time in weeks. Stay tuned for Monday’s report which will take a closer look at the Financials, which i believe are trying to form a bottom.

If you have an interest in seeing timely intra-day market updates on my private twitter feed, please follow @NewtonAdvisors. Also, feel free to send me an email at info@newtonadvisor.com regarding how my Technical work can add alpha to your portfolio management process.

Twitter: @MarkNewtonCMT

Author has positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.