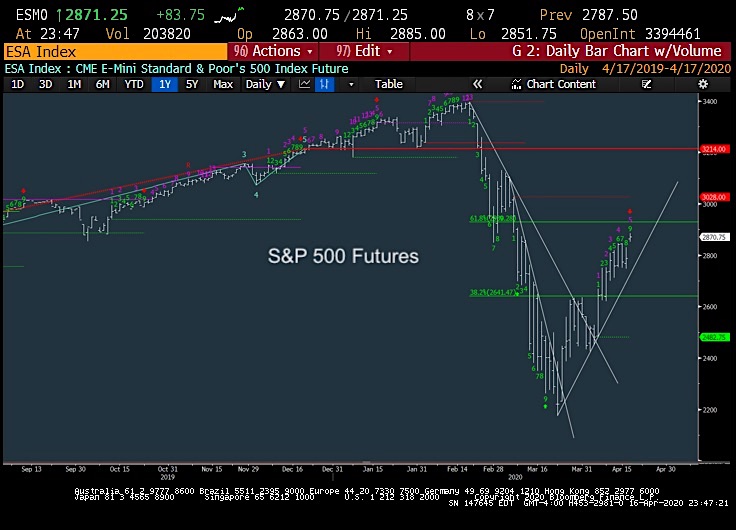

S&P 500 Index Chart

Trading Outlook (3-5 Days): Futures Surge, Bearish into 2875

Selling into futures gains on this rip higher in Equity futures. Markets could be setting up for a possible Reversal so it seems wise to consider lightening up (or hedging) into this move, in my view.

Broad Markets Overview:

I feel markets are at levels now (with futures surge) where it’s right to start hedging longs and/or considering technical shorts for a possible stalling out in this rally.

While it’s difficult to assume a “net short” type position with no evidence of any trend damage, the post Futures rip late Thursday into Friday gives a prime opportunity to sell into this move heading into Expiration.

While the uptrend since March is very much intact (a positive) along with other bullish factors such as Technology participation, negative sentiment and near-term positive momentum, there have been a host of negatives that have cropped up in recent days that are worth noting.

As discussed yesterday, we’ve begun to see a slowdown in both breadth and momentum on this recent lift, with breadth getting worse and worse on this move. (Thursday’s breadth actually was negative for the session despite S&P being up +0.50% and NDX up more than 1%. Volume was actually nearly double the amount, more than 2/1 bearish, into Down vs Up stocks Thursday. That’s problematic.

Treasury yields remain tilted lower which has been a noticeable drag on Financials, and areas like Transports, Small and Mid-caps have been lagging in recent days, which is also a concern. Additionally, one key market cycle I track shows a possible peak for Friday 4/17, and if that is not effective, it could possibly push until 424-6. However, Demark exhaustion should be now complete on equity indices by Friday (Completed Sell Setups) which makes selling into a near 3% futures surge on Expiration very attractive to consider.

Finally, weekly and monthly momentum remain tilted negative, creating a very tough investment climate, with daily momentum positive after a 25% gain while weekly and monthly are negative.

The Bottom Line: I like using the after hours move to sell into this surge, expecting that markets stall out Friday into next week. This might take the form of a small correction, or just consolidation after this recent gain. Important to watch Technology, Treasury yields and signs of momentum and breadth in the days ahead. Have a good weekend and stay safe.

Reiterating Key points

1) This remains a bear market bounce, NOT the start of a new bull market

2) Any stalling out by late April that backtracks likely will NOT reach new lows right away given the extent of our rally.

If you have an interest in seeing timely intra-day market updates on my private twitter feed, please follow @NewtonAdvisors. Also, feel free to send me an email at info@newtonadvisor.com regarding how my Technical work can add alpha to your portfolio management process.

Twitter: @MarkNewtonCMT

Author has positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.