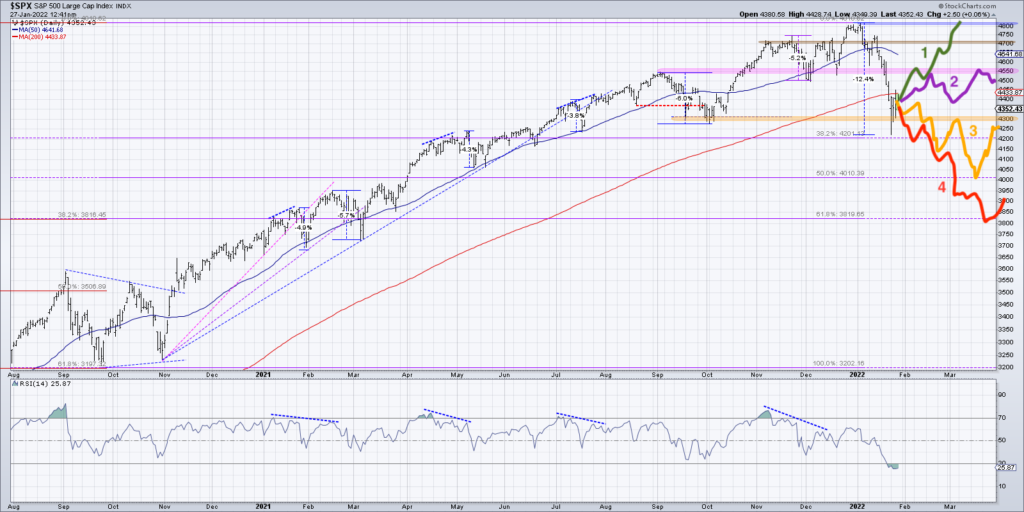

The S&P 500 index has dropped about 12% on an intraday basis from a high around 4800 in early January. So what’s next?

One of my favorite ways to answer that question is to lay out four scenarios- the very bullish, mildly bullish, mildly bearish and very bearish- and think through each of those four potential future paths.

While the purpose of this exercise is to determine what you see as the most likely future path, and position yourself accordingly, the real goal is to force yourself to consider four very different market outcomes.

How would your current portfolio fare in the very bullish scenario? What about the very bearish one? What signals/patterns/indicators would help you navigate that market environment?

Mindful investors think about the markets in terms of probabilities instead of certainties. While one of these outcomes is most likely, all four are possible!

In today’s video, we’ll unveil four potential outcomes for the S&P 500 index over the next 4-6 weeks. Here they are:

Very Bullish. The low is in for now, and the S&P retests all-time highs around 4800.

Mildly Bullish. The low is in but we don’t get much higher than 4550. More of a rangebound market.

Mildly Bearish. We break below 4200 but remain above 4000. That would mean less than a 20% drop from the January high.

Very Bearish. We break below 4200 and just keep going. S&P loses over 20%, making it a confirmed bear market, as we relive the March 2020 experience.

Check out today’s video for a breakdown of each of these future paths and how the charts would evolve in each case.

Ready to upgrade your investment process? Check out my free course on behavioral investing!

(VIDEO) S&P 500 Analysis: Choose Your Own Adventure

S&P 500 Index Chart with Fibonacci Levels

Twitter: @DKellerCMT

The author may have positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.