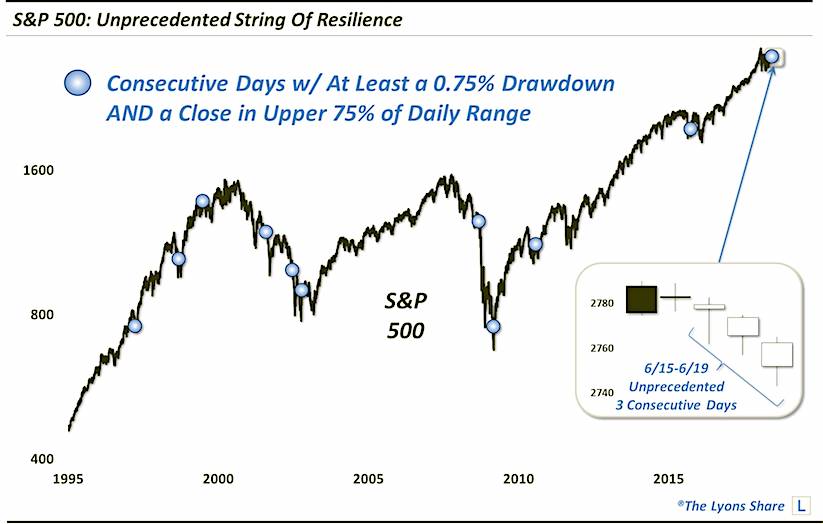

The stock market has been unprecedentedly resilient of late despite the bears’ efforts to take it down.

The story in the stock market over the past week has been about the bears’ attempts to push prices down – and the bulls’ ability to prop them back up.

As a matter of fact, in some ways, the bulls resilience over the past 3 days has been unprecedented. Consider this – in each of the 3 days from June 15-June 19, the S&P 500:

- Was down at least 0.75% at some point during the day and

- Rallied to close in the upper 85% of its daily range

How noteworthy is this 3-day feat? As the Chart Of The Day indicates, it is actually the first time the index has ever accomplished it in its nearly 70-year history.

So what can we glean from this episode? Well, from an intuitive, “tape-reading” perspective, we can “conclude” that the bulls are very resilient and that there is an apparent firm bid under the market. But is that an objective tangible that traders can rely on?

The only semi-objective way to test that conclusion based upon this particular set of conditions is to observe similar events from the past and subsequent results. In this case, as the S&P 500 has never put together such a 3-day stretch, it is impossible to test.

However, as the chart indicates, there have been 10 occasions in which we saw 2 consecutive days meeting the above criteria. For what it’s worth, the action in the S&P 500 following those events was wild – in both directions. For example, the average change 1 month following these historical events, on an absolute basis, was a whopping 7.8%. 6 months following the events, the S&P 500 was up or down by an average of nearly 18%.

So will our current episode result in wild action in the stock market again? And will it be wild up” or “wild down”? In a Premium Post at The Lyons Share, we take a closer look at the particular historical events and their potential suggestion for our present case.

Twitter: @JLyonsFundMgmt

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.