Broad Stock Market Futures Outlook for May 2, 2018

The edges of the wedges were tested and held yesterday and this morning we are at lower highs and at another price compression event. These are spaces that test our patience if we are looking for continuation.

If we are prepared to take what the market gives us, however, we are keeping inside our bounds and still making gains during the trading day. Overtrading can be a particular problem here. Watch the edges noted for continuation or for collapse back into the region.

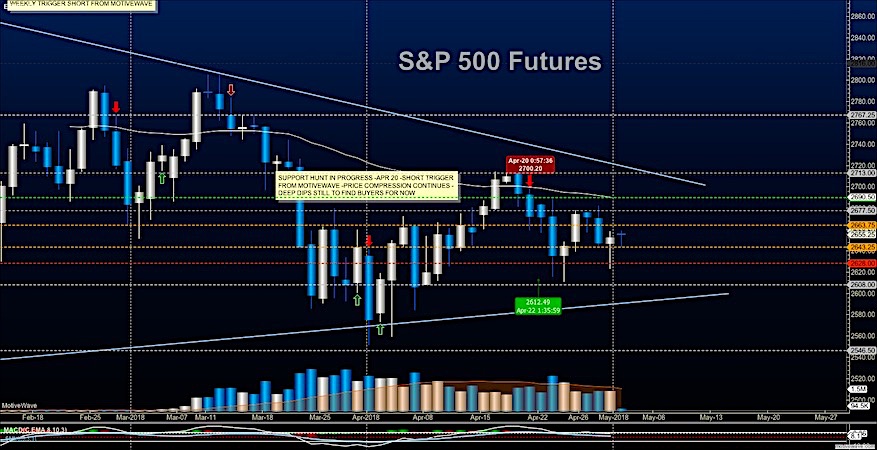

S&P 500 Futures

Support of importance was broken and recaptured in a 4 hour period as traders jockeyed to position themselves at the base of support. Our ‘slinky‘ performs as expected. Price compression continues with a big employment number on the horizon. The bullets below represent the likely shift of trading momentum at the successful or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 2659.75

- Selling pressure intraday will likely strengthen with a bearish retest of 2642.50

- Resistance sits near 2656.75 to 2664.75, with 2674.25 and 2686.75 above that.

- Support sits between 2650.75 and 2626.5, with 2619.5 and 2606.50

NASDAQ Futures

AAPL earnings have pushed this chart to the upper edge of its wedge and is stalling out. Weak bullish undercurrents are still present but we could see an extension that should also end up being a wick on the daily candle. Expansion of price is likely to be followed by a retrace. Deep support near 6610 will be a critical hold today. The bullets below represent the likely shift of trading momentum at the successful or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 6727.75

- Selling pressure intraday will likely strengthen with a bearish retest of 6691

- Resistance sits near 6718.5 to 6744.5 with 6774.25 and 6807.25 above that.

- Support sits between 6700.5 and 6686.5, with 6657.5 and 6578.75 below that.

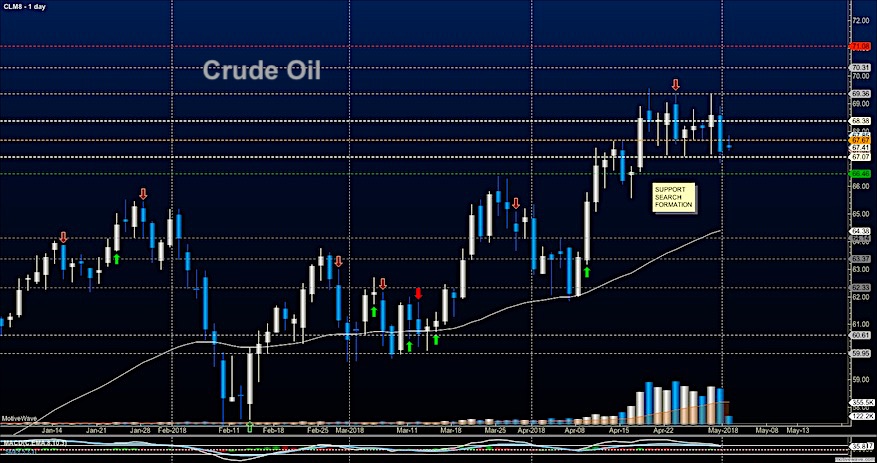

WTI Crude Oil

Significant price compression here into the EIA report today. Breakouts or breakdowns are likely but retracement into congestion should follow. I do not see this region as a ‘buy and hold’ space on shorter timeframes. Hedge funds are still bullish but buying has slowed- this is an important reminder of the backdrop. The forward contract is not in contango so they are not adding to positions by rolling contracts in large numbers. The bullets below represent the likely shift of trading momentum at the successful or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 67.90

- Selling pressure intraday will strengthen with a bearish retest of 67.26

- Resistance sits near 67.85 to 68.38, with 69.27 and 70.22 above that.

- Support holds near 67.3 to 66.85, with 66.54 and 65.94 below that.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.