Stock Market Futures Considerations For October 10, 2017

The S&P 500 (INDEXSP:.INX) is rebounding this morning after a minor selloff yesterday. The bulls face layered overhead resistance so traders will want to be patient and disciplined here. See key trading levels below.

Check out today’s economic calendar with a full rundown of releases. And note that the charts below are from our premium service and shared exclusively with See It Market readers.

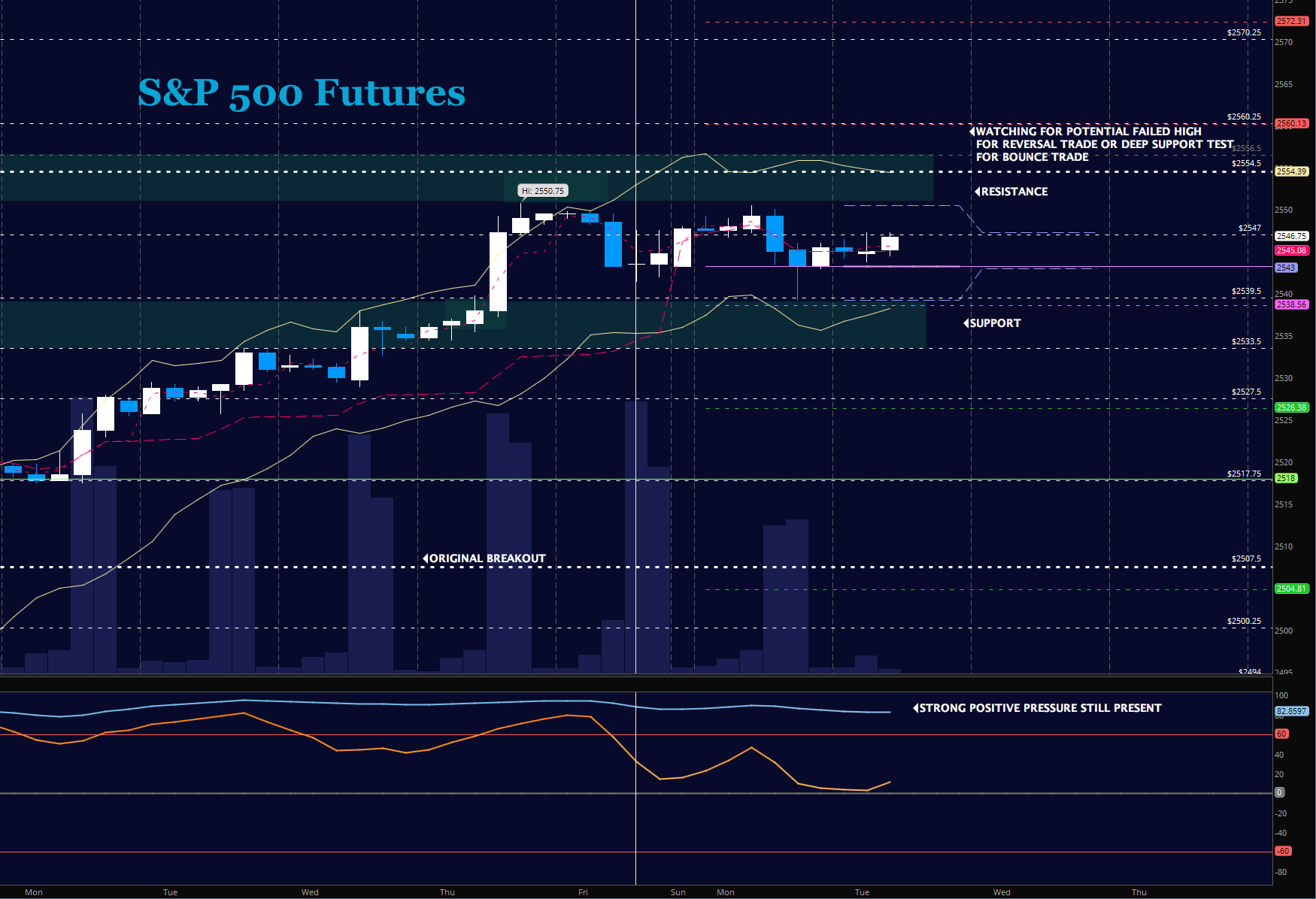

S&P 500 Futures (ES)

Charts hold support steady at 2539.5 for the third day. Resistance holds steady as well as undercurrents upside firm. Buying at support zones seems to be a low risk space for now. The bullets below represent the likely shift of trading momentum at the positive or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen above a positive retest of 2548.5

- Selling pressure intraday will likely strengthen with a failed retest of 2537

- Resistance sits near 2551.75 to 2554.5, with 2560.5 and 2562.25 above that.

- Support holds between 2541 and 2539.5, with 2533.75 and 2527.75 below that.

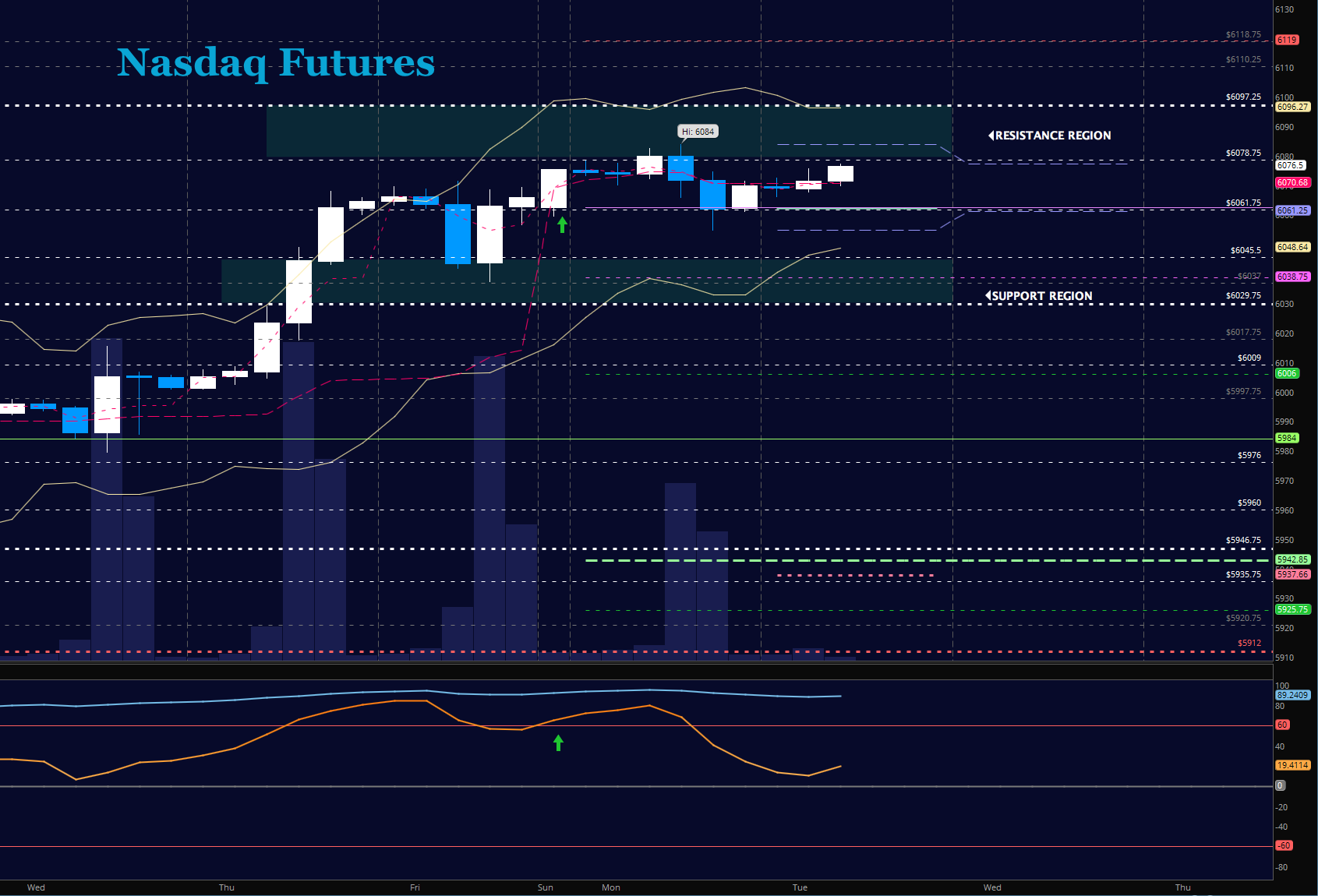

NASDAQ Futures (NQ)

Mid morning highs were retraced but regained steam as the day progressed. New tests of highs will continue to be sold mildly as momentum is not strong enough to carry through on the first pass into these higher spaces. Buyers need to hold 6057 for intraday continuation forward. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 6078.5

- Selling pressure intraday will likely strengthen with a failed retest of 6045.5

- Resistance sits near 6078.5 to 6091.5, with 6097.5 and 6110.75 above that.

- Support holds between 6048.75 and 6029.75, with 6020.5 and 6006.75 below that.

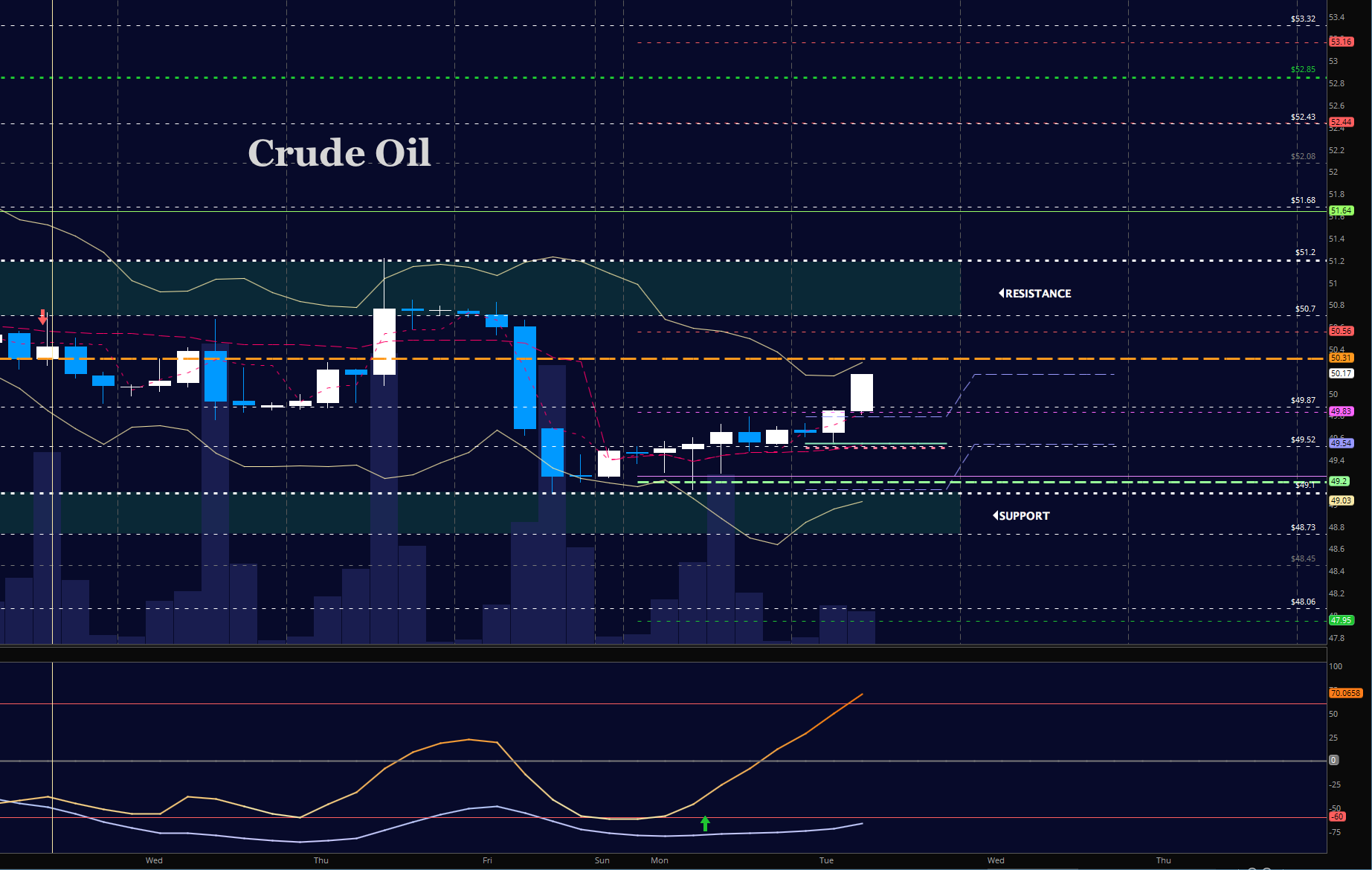

WTI Crude Oil

Oil is bouncing in the premarket into the test of resistance ahead near 50.24 as traders held the bounce from 49.1 quite well. The bullets below represent the likely shift of trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 50.24

- Selling pressure intraday will strengthen with a failed retest of 49.48

- Resistance sits near 50.14 to 50.36, with 50.56 and 50.88 above that.

- Support holds between 49.87 to 49.52, with 49.12 and 48.76 below that.

If you’re interested in watching these trades go live, join us in the live trading room from 9am to 11:30am each trading day. Visit TheTradingBook for more information.

If you’re interested in the live trading room, it is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.