Broad Stock Market Futures Outlook for May 31, 2018

Higher lows edge forward this morning as resistance looms ahead. Some of our indices are tracking inside of the prior days, but the Nasdaq futures (NQ_F) is attempting to break free.

Pullbacks look like buying areas so be patient if choosing long directions. Momentum is still mixed and cross-currents abound. Continue to frame your trades with specific attention to risk exposure.

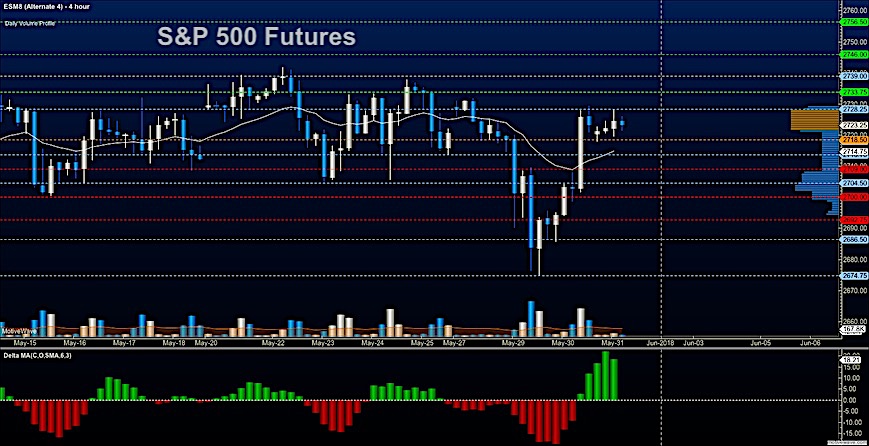

S&P 500 Futures

Higher support holds this morning as traders battle resistance: A breach of 2728.5 may push us higher this morning but formations do not suggest the continuation of upside without a pullback. This means that we take profit at targets when we see them. The bullets below represent the likely shift of trading momentum at the successful or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 2726.

- Selling pressure intraday will likely strengthen with a bearish retest of 2716.50

- Resistance sits near 2728.5. to 2732.75, with 2738.75 and 2742.75 above that.

- Support sits between 2714.75 and 2709.5, with 2707.5 and 2700.50

NASDAQ Futures

Stronger rebound continues to show in this chart as we now drift higher into resistance above our new support level near 6971. Momentum is also mixed here and trading should be level to level. Formations are generally bullish but need retests of breakout levels for continuation. The bullets below represent the likely shift of trading momentum at the successful or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 6996.75

- Selling pressure intraday will likely strengthen with a bearish retest of 6978.5

- Resistance sits near 7002.75 to 7007.25 with 7013.25 and 7027.5 above that.

- Support sits between 6971.5 and 6957.25, with 6948.75 and 6936.5 below that.

WTI Crude Oil

Bounces are fading from yesterday but higher lows are likely to prevail. New support levels sit near 67.1 as prices firm up into the EIA report this morning. Deep fades could be ahead particularly if we lose the levels near 67.44 and fail to recapture. The bullets below represent the likely shift of trading momentum at the successful or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 68.05

- Selling pressure intraday will strengthen with a bearish retest of 66.74

- Resistance sits near 67.97 to 68.24, with 68.47 and 68.74 above that.

- Support holds near 66.64 to 66.4, with 66.27 and 65.86 below that.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.