Broad Stock Market Futures Outlook for April 16, 2018

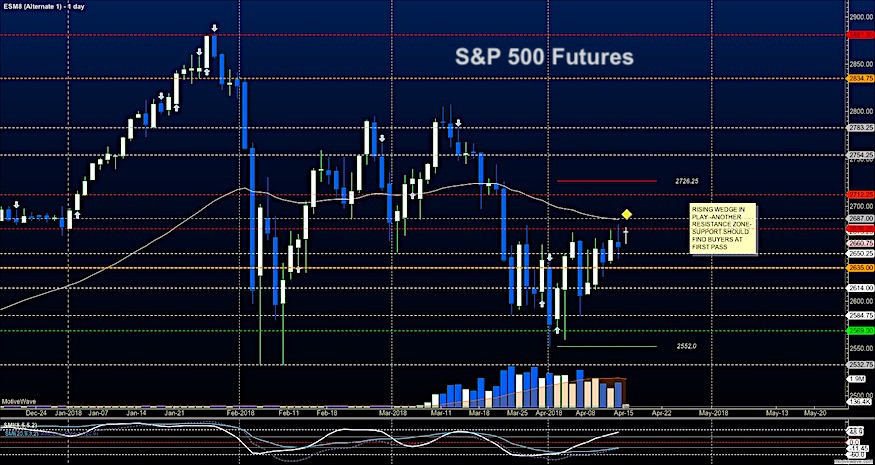

S&P 500 resistance holds from the indexes Friday’s highs. I am watching for a lower high against higher lows. How well we hold higher support levels will determine how the day goes for traders.

Earnings season continues and if momentum projects the actual motion, we should collapse into congestion once expansion exhausts. Pullbacks will continue to be buying zones in the present formation.

S&P 500 Futures

With resistance ahead and higher lows, our intraday drift is bullish but only into resistance. Breakouts are likely to fade to higher lows which will provide good buying regions for traders at the first pass. Sellers still have some control if we fail to hold the region near 2672. The bullets below represent the likely shift of trading momentum at the positive or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 2676.75

- Selling pressure intraday will likely strengthen with a bearish retest of 2661.50

- Resistance sits near 2674.75 to 2686.75, with 2692.25 and 2712.75 above that.

- Support sits between 2667.75 and 2661.5, with 2654.75 and 2646.50

NASDAQ Futures

Momentum is flattening as traders fail to recapture Friday’s high – near 6713. Pullbacks will still be buying zones. Holding 6642 will be important to buyers today. Resistance should fade into higher lows at the first pass but multiple retests of support areas will likely telegraph a fade to deeper support. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 6698.75

- Selling pressure intraday will likely strengthen with a bearish retest of 6648

- Resistance sits near 6698.5 to 6713.5 with 6724.5 and 6767.25 above that.

- Support sits between 6665.5 and 6642, with 6608.75 and 6580.75 below that.

WTI Crude Oil

Bullish traders remain in charge as tested new highs and now drift into higher lows. Bullish pressure is weakening but pullbacks to support on the first pass will be buying zones. The failure to make new highs is the first test of a reversing formation intraday – and we have this. Lower intraday lows will push us into deeper supports with the line in the sand near 66.1 The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 66.93

- Selling pressure intraday will strengthen with a bearish retest of 66.1

- Resistance sits near 66.78 to 67.24, with 67.75 and 68.7 above that.

- Support holds near 66.34 to 66.1, with 65.72 and 65.29 below that.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.