Broad Stock Market Futures Outlook for May 3, 2018

Edges tested repeatedly are likely to break and we are seeing this today. Deeper dips will find buyers because the formation is still a wedge, but they could be quite deep if the levees break.

The first pass breakdowns intraday will likely bounce so look for those first lower highs on tighter time frames after the lower lows.

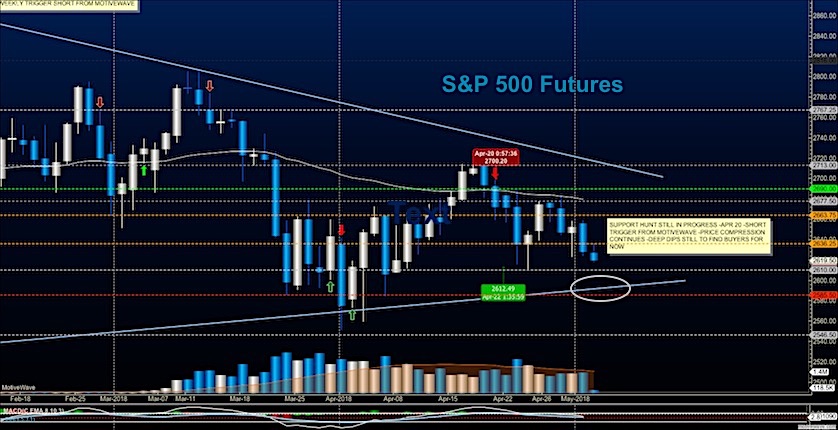

S&P 500 Futures

Support of importance is being tested again in a game of finding the tipping point. Use caution setting up your trades today and realize that hunkering down when grenades are flying is not a bad idea. Pick your spots carefully. The bullets below represent the likely shift of trading momentum at the successful or failed retests at the levels noted.

- Buying pressure intradaywill likely strengthen with a bullish retest of 2636.75

- Selling pressure intradaywill likely strengthen with a bearish retest of 2620.50

- Resistance sits near 2634.75 to 2644.75, with 2657.25 and 2676.75 above that.

- Support sits between 2624.75 and 2617.5, with 2609.5 and 2587.50

NASDAQ Futures

Fades out of the open yesterday never recovered and now support has been moved to deeper levels and breaks below our noted level of 6610. The first dip below will likely bounce to test this but lower highs will send us further south. The bullets below represent the likely shift of trading momentum at the successful or failed retests at the levels noted.

- Buying pressure intradaywill likely strengthen with a bullish retest of 6627.75

- Selling pressure intradaywill likely strengthen with a bearish retest of 6612

- Resistance sits near 6624.5 to 6650.5 with 6674.25 and 6715.5 above that.

- Support sits between 6600.5 and 6580.5, with 6542.5 and 6433.75 below that.

WTI Crude Oil

Significant price compression continues with a bounce off support that holds right into familiar congestion near 67.7. Breakouts or breakdowns are still likely but retracement into congestion should follow. This is a wait state in a tight range. The bullets below represent the likely shift of trading momentum at the successful or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 67.94

- Selling pressure intraday will strengthen with a bearish retest of 67.57

- Resistance sits near 67.89 to 68.32, with 68.87 and 69.52 above that

- Support holds near 67.6 to 67.05, with 66.84 and 65.94 below that

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.