S&P 500 (INDEXSP:.INX) Trading Considerations For March 14, 2017

The charts are showing tightened ranges heading into the Federal Reserve meeting and interest rate decision tomorrow.

See today’s economic calendar with a rundown of releases.

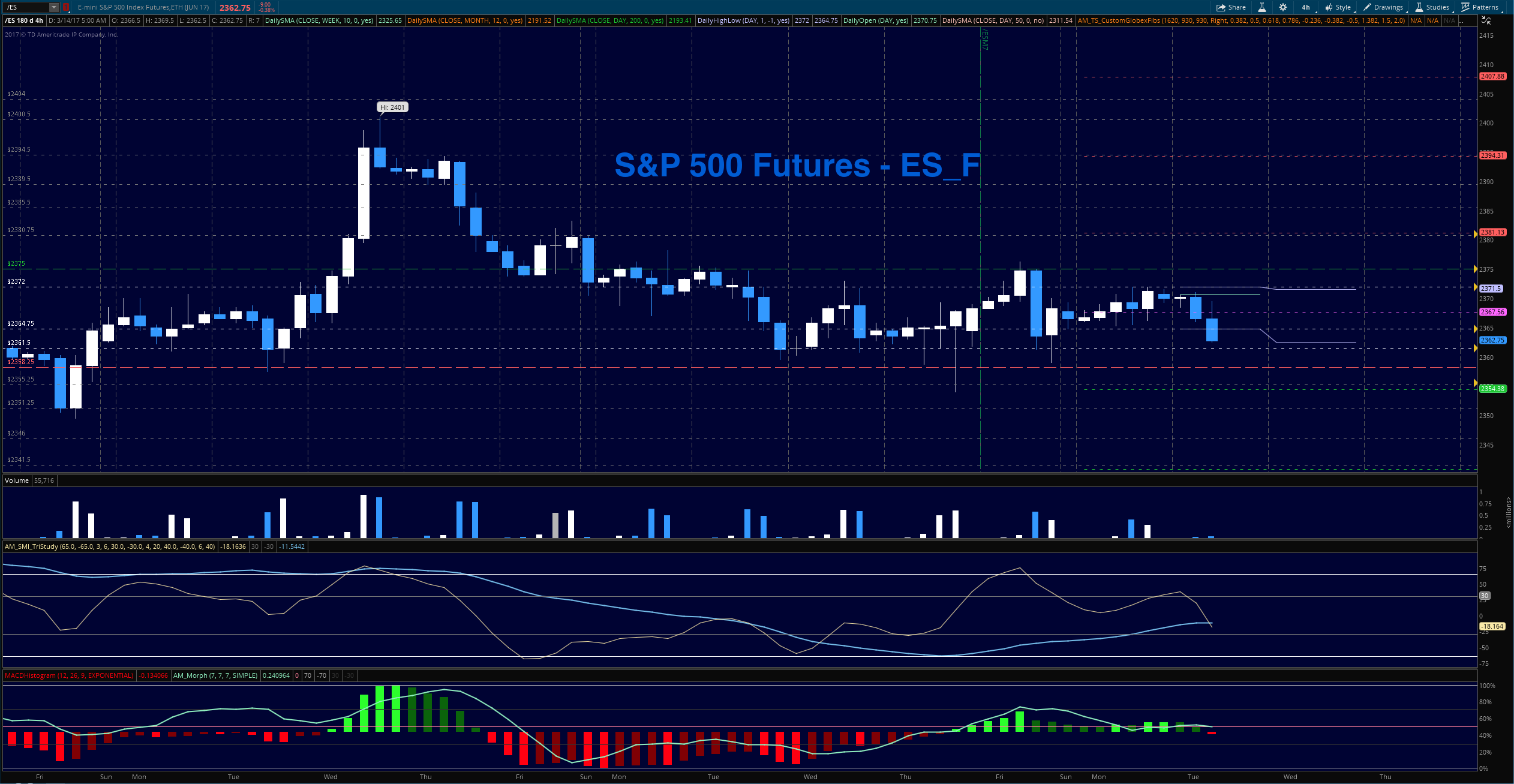

S&P 500 Futures

Price support and resistance remain similar to yesterday. Use caution buying the breakouts or selling breakdowns. Use the retest to take continuation trades – else reversal trades will work at these edges.

- Buying pressure will likely strengthen above a positive retest of 2375.5

- Selling pressure will likely strengthen with a failed retest of 2358.5

- Resistance sits near 2375.5 to 2380.75, with 2389.5 and 2403.75 above that

- Support holds between 2360 and 2357.25, with 2355.5 and 2349.25 below that

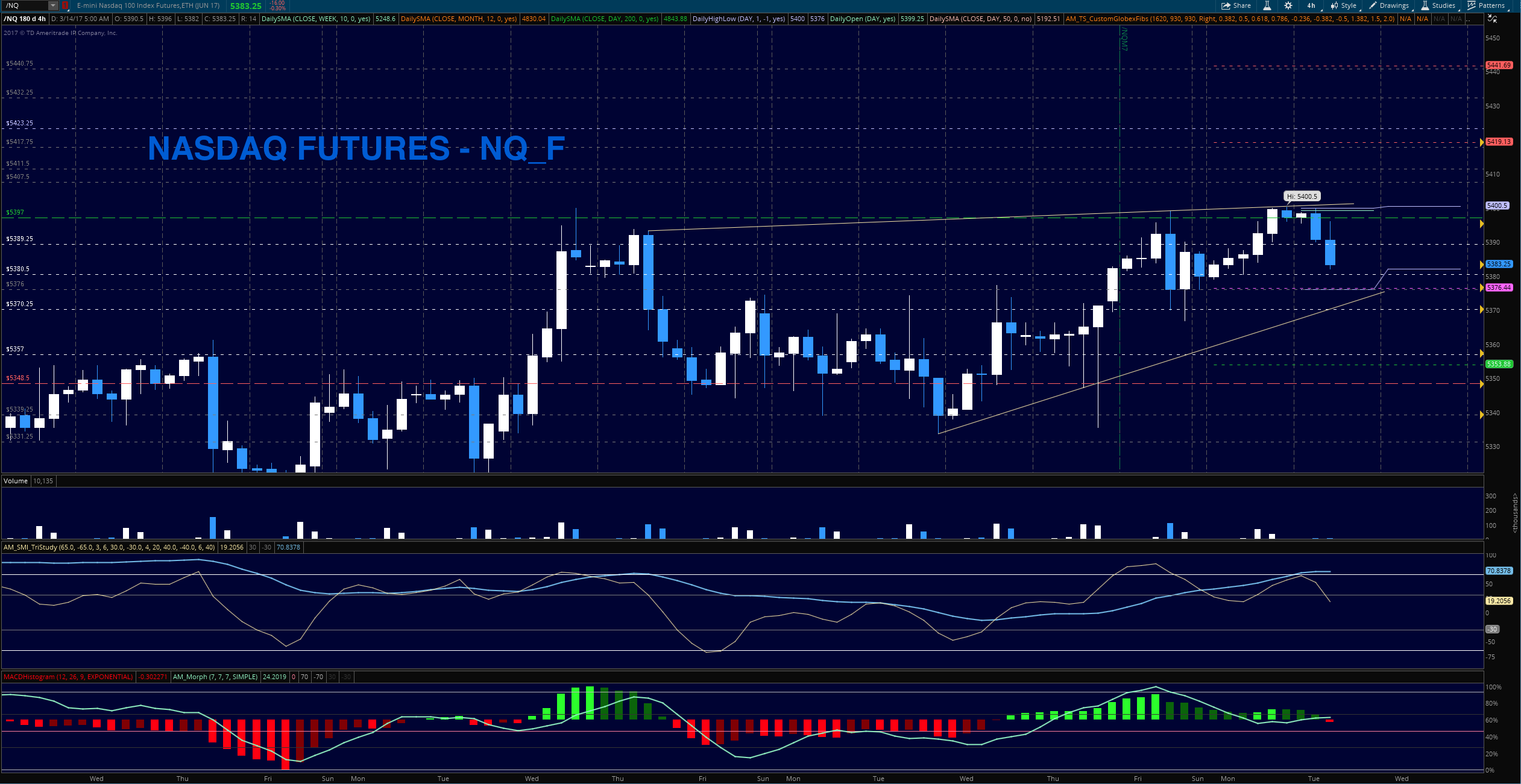

NASDAQ Futures

The NQ_F continued to move out of its range into higher congestion and after breaking higher briefly, it is still holding higher lows as it builds a rising wedge into the Fed meeting tomorrow. holds in this region as we open the week. Momentum is positive but somewhat muted – also suggesting range based trading today. Use caution with trading the breaks – they are more likely to be reversal trades.

- Buying pressure will likely strengthen with a positive retest of 5397

- Selling pressure will likely strengthen with a failed retest of 5366.5

- Resistance sits near 5394.5 to 5398.75, with 5400.5 and 5408.5 above that

- Support holds between 5366.25 and 5357.25, with 5348.5 and 5331.75 below that

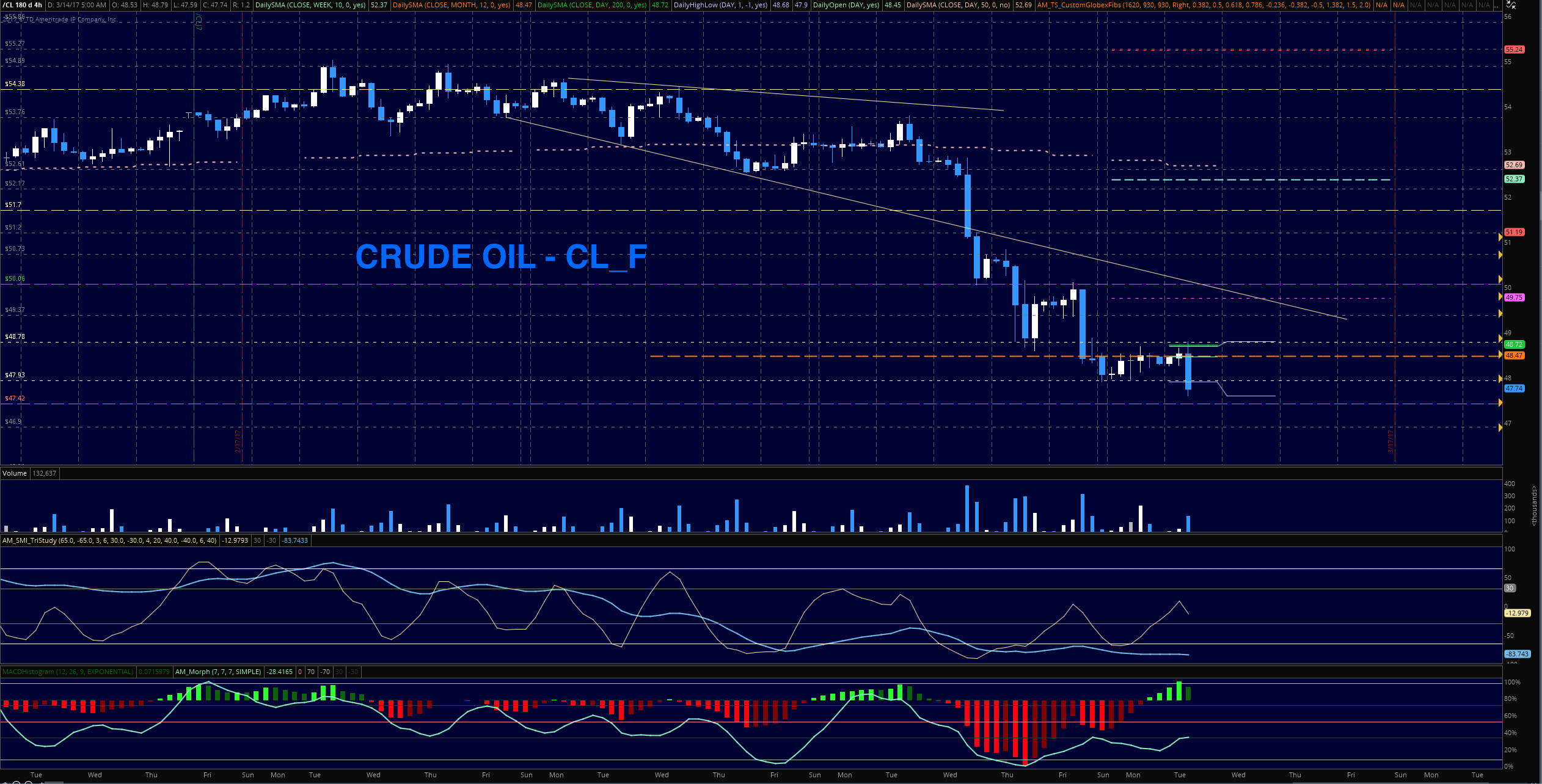

Crude Oil –WTI

As hedge funds were caught on the wrong side of the trade, liquidations continue for a third day- and as short positions decrease, charts are falling more slowly. The charts could drift into 47.3 and 46.8 as buyers continue to liquidate – bounces are still likely to find sellers as they give trapped buyers additional opportunities to exit.

- Buying pressure will likely strengthen with a positive retest of 48.74

- Selling pressure will strengthen with a failed retest of 47.42

- Resistance sits near 48.8 to 50.04, with 50.68 and 51.04 above that.

- Support holds between 47.9 and 47.42, with 46.98 and 45.91 below that.

If you’re interested in the live trading room, it is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.